- Domestic policies and improved external relations could support the uptrends of Chinese and Japanese equities.

- Asian credit markets are remarkably resilient, but given historically low credit spreads, quality will matter more than yield in 2026.

Asia-Pacific equities

China and the U.S. have reached a one-year trade truce, which should support the Chinese economy and market sentiment in 2026, in our view. We recall that the major corrections in Chinese equities in 2025 were largely due to U.S.-China trade tensions. The latest deal reached in October appears more durable and is likely to set the stage for a more sustainable rally, in our view.

Stable global trade relationships should support Chinese exports, which have seen volumes growing but prices dropping. An increase in shipments to the U.S. could help ease price pressures. Beijing’s macroeconomic policy is likely to become more supportive of domestic demand in 2026, given the government’s ambition to boost domestic consumption over the next five years. However, we think the initial steps may be small and experimental.

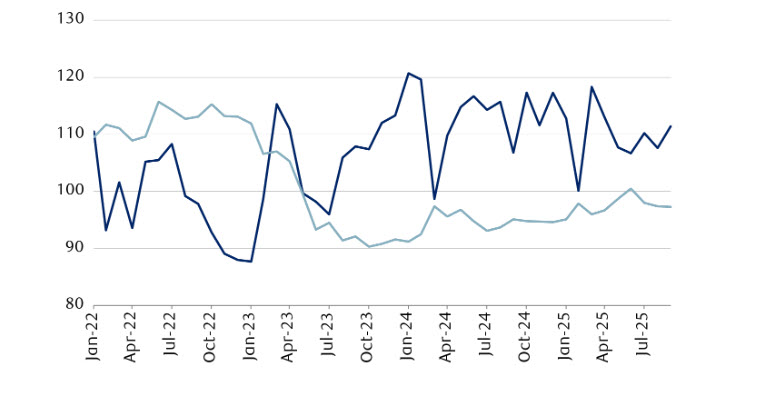

A U.S.-China trade truce could be supportive to the Chinese export sector

Chinese export volumes have shown resilience, but export prices are falling

Source - RBC Wealth Management, Bloomberg; monthly data through September 2025

The Chinese government continues to prioritize technology development, with a focus on high-end manufacturing. As a result, we expect capital expenditure in related sectors to continue growing. We believe Chinese companies are well-positioned to benefit from the global AI spending boom, as they supply many key components. The primary risk, in our view, is a potential reversal in global AI spending, which could have a ripple effect in China.

The Japanese equity market rose sharply in October, and while short-term volatility is likely, we expect further upside in the new year. Japan welcomed its first female prime minister, Sanae Takaichi, and her government is enjoying an unusually high approval rating. Since becoming prime minister in October, Takaichi has announced measures to counter inflation, accelerated the timeline for defense spending increases, and unveiled growth strategies for cutting-edge industries. In her very short time in office, we also witnessed a strengthening of the U.S.-Japan alliance.

We see “Sanaenomics” as a catalyst for Japanese equities, and we view her fiscal measures to be sufficient to help counter inflation and boost sluggish middle-class consumption.

We reiterate our long-term constructive view on Japanese equities given a sustainable two percent inflation target seems in sight; renewed investment from friendshoring and onshoring; improving returns on equity and shareholder returns; resilient domestic demand supported by high household savings and wage hikes; inbound tourism; and elevated domestic inflows from individual investors under the revamped Nippon Individual Savings Account scheme.

Asia-Pacific fixed income

Asian credit markets head into 2026 on firm footing after a resilient 2025. Asian investment-grade credit spreads remain anchored by steady economic growth, contained inflation, and ample domestic liquidity. Corporate credit fundamentals are sound, leverage has moderated, and supply remains disciplined. Even high-yield segments have weathered global rate volatility for most of 2025, underscoring Asia’s resilient credit markets.

Regional policymakers are likely to stay proactive in balancing growth and fiscal prudence. Governments of export-oriented economies – such as China, South Korea, Japan, and Thailand – are expected by most investors to sustain targeted fiscal support to offset the drag from U.S. tariffs and subdued global demand. This should help anchor long-term yields and contain funding volatility. Yet, we believe elevated valuations and thinning fiscal buffers across several economies mean returns will hinge on credit selection and structural themes rather than broad market rallies.

China’s credit cycle should move toward stabilization in 2026. Systemic risks appear to be easing as real estate developers deleverage, and policy remains geared toward steady, productivity-driven expansion. Domestic investors will continue to be a key stabilizing force, in our view, while sectors linked to consumption and technology provide selective upside. Within China, we prefer investment-grade bonds issued by central state-owned entities and high-quality private companies.

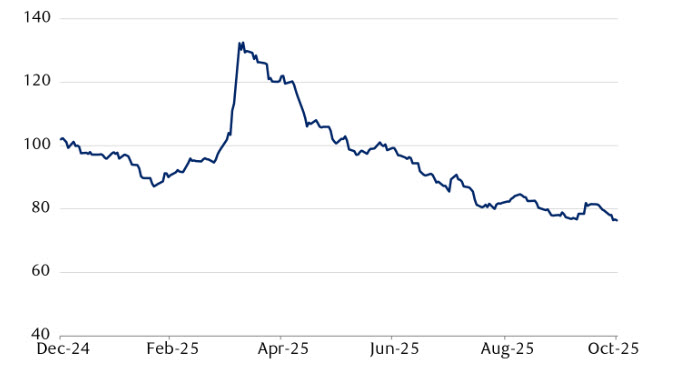

Asia ex Japan USD corporate IG credit spread

Source - RBC Wealth Management, Bloomberg; data as of 10/31/25

Japan’s policy shift is set to be a defining force in regional markets, in our opinion. The Bank of Japan’s (BoJ) gradual normalization of monetary policy and a more expansionary fiscal stance by the new Takaichi administration have caused Japanese government bond (JGB) yields to rise, and not without credit implications. Higher JGB yields are prompting more Japanese corporates to issue U.S. dollar-denominated bonds, increasing Japan’s role in Asian credit markets. Although this may potentially widen credit spreads at the longer end of the yield curve, we think strong domestic demand driven by lower U.S. dollar hedging costs should support positive returns and provide attractive relative valuations for global investors.

Looking ahead, we believe the Asian credit outlook for 2026 points to more moderate returns, driven by stable fundamentals, net negative new supply – whereby more bonds are being paid back than newly issued – and selective value in higher-quality issuers.