1. Election

Is it too early to start this discussion? Always. However, we think it’s important to understand how investors typically react well before the year of a presidential election. In overlaying every presidential election year since 1932, the S&P 500 usually has the weakest point of the year 5-6 months before the election. 2016 & 2020 were no exception (Chart 1). This is when the average investor becomes cautious and decides to sit on the sidelines until a winner is declared.

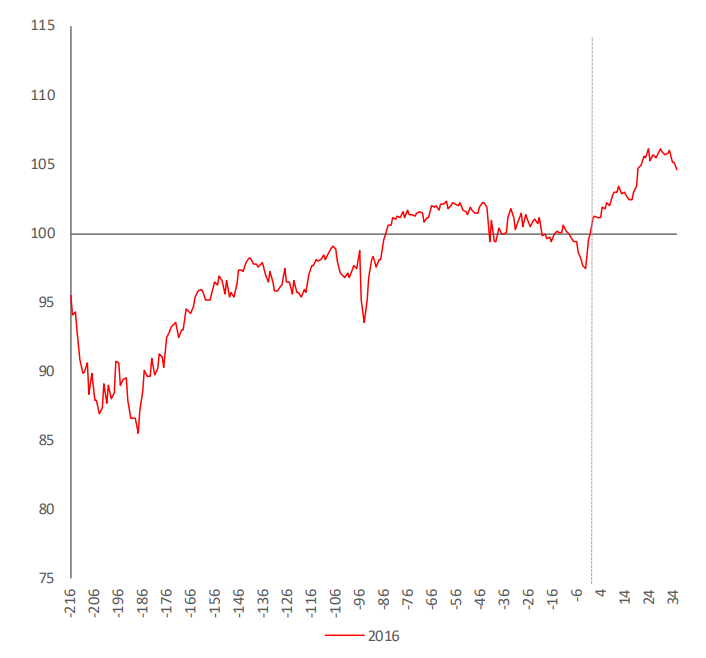

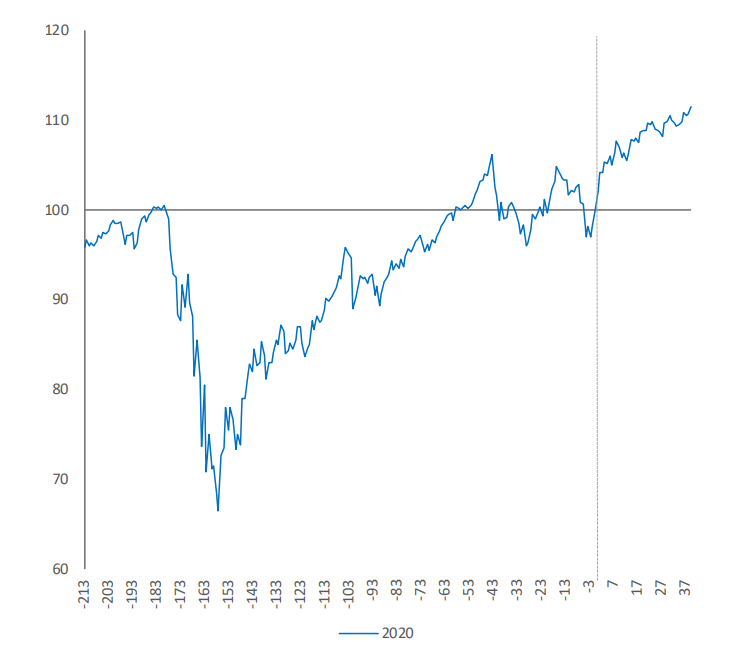

Chart 1

Last Two Presidential Years Similar to the Historical Playbook, With Post Election Rallies

2016 (Clinton vs. Trump): S&P 500 Performance Indexed to the Closing Price the Day Before Election Day

2020 (Biden vs. Trump): S&P 500 Performance Indexed to the Closing Price the Day Before Election Day

Source: RBC US Equity Strategy, Bloomberg

2. Yields

The 10-year Treasury just hit its highest yield in 16 years and the Prime lending rate just topped a staggering 8.50%. While the market thought Powell’s speech was hawkish, our chief rate strategist felt that Powell “threw an entire bathtub of ice water on some recent inflation talk.”

3. Turning Cautious On Growth

Growth valuations have only corrected modestly relative to Value and remain well above their long-term average. Until we see the 10-year Treasury fall below 4%, we are favoring value names with new capital.