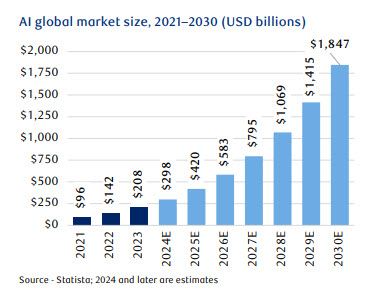

While artificial intelligence (AI) has been around for a number of decades, recent developments in the space have driven a dramatic increase in worldwide AI investment over the last few years. Statista has projected that the size of the global AI market will increase nine times by 2030.15

Investors are drawn by the allure of this cutting-edge technology and the potential benefits it offers to companies: enhanced efficiency, new capabilities and value creation. Historically, a similar influx of funds into innovations was evident during the railroad boom, the dot-com surge and the rise of blockchain technology and cryptocurrency.

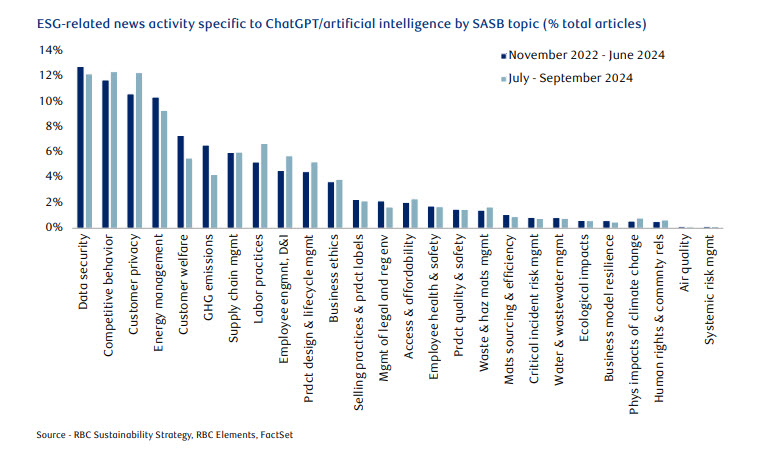

However, much like in the aforementioned historical examples, we believe the AI revolution also poses considerable risks that cannot be overlooked. As AI evolves, it is crucial for investors to be aware of any potential downside. This is where incorporating ESG factors into the analysis may prove beneficial, in our opinion. Such an approach can help to properly identify any ethical or sustainability risks so that mitigating factors can be implemented. As per research conducted by RBC Capital Markets, the growing adoption of AI touches a wide range of ESG topics. It amplifies several existing concerns like data security, competitive behavior, energy management and more.16

Environmental Factors

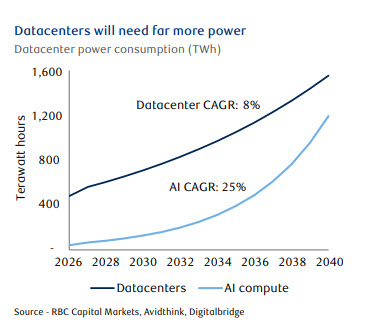

Emissions and electricity use

AI systems are developed and hosted through data centers, which require significant amounts of electricity to process and analyze data. This puts increasing pressure on electrical grids, which, if based on the use of fossil fuels, ultimately leads to an increase of emissions. Top AI companies have already reported more than a 30% increase in emissions in 2023 compared to 2020 values, mostly attributed to data center expansion. According to the IEA, training a single AI model uses more electricity than 100 typical U.S. homes consume in an entire year.17 Demand for AI could reach double the 2022 values by 2026, which is roughly equivalent to the current electricity consumption of Japan.18

Water

The depletion of water in the cooling of data centers and electricity generation has also become a widespread concern. According to a study titled “Making AI less ‘Thirsty’,” AI demand could result in as much as 6.6 billion cubic meters of water withdrawal by 2027.19 To put that into perspective, it is equivalent to six times the annual water withdrawal in Denmark.20

Social

Data security and privacy

AI is powered by data. As we think about the information used, we must consider unique implications on individual privacy and data security. According to a 2024 Stanford University study, new identity-based risks have emerged in relation to inferring personal information about individuals or providing users with the ability to create content that impersonates someone or something else.21 Personal and confidential information can also potentially be targeted through AI’s ability to memorize data and then expose it to other users. Extra caution is also necessary when using AI to ensure discriminatory biases are not inherited through the AI training process.

Human capital management

AI can help reduce human error, improve processes and contribute to making workflows more efficient. However, as with any technological progress, the question of job loss becomes prominent. The CEOs of Big Tech companies have acknowledged that the proliferation of generative AI could lead to job losses in areas such as translation, accounting, entry-level coding and data entry. According to the World Economic Forum, AI is expected to perform 43% of workplace tasks in 2027 compared to 34% in 2022.22 Companies may look to dedicate resources to upskill and train their workforces as priorities shift.

Governance

As companies continue to deploy AI technology, we might see the emergence of AI ethics teams to help ensure proper governance and compliance with regulations. For example, major corporate players have already included information on responsible AI practices in their ESG disclosure reports. According to IBM, responsible AI “is a set of principles that help guide the design, development, deployment and use of AI…that [align] with stakeholder values, legal standards and ethical principles.”23 Common applications of responsible AI include optimization of energy resources used, prediction of extreme weather events and supply chain management. Whether these applications are sufficient to cover the initial energy costs of AI may depend on the scale and the technology’s application.24 AI technology can also decrease the cost of and improve the collection and reporting of ESG data. Natural language processing can assist with reviews of media sentiment, financial releases, news and more. The application of satellite imagery can assist with identifying the effects on biodiversity and track deforestation and water usage. Computing capabilities may contribute toward better calculation of Scope 3 emissions from the supply chain.

Looking for additional insights about responsible investing?

Download our Q3 2024 Insights into responsible investing newsletter