The $64,000 question facing the U.S. equity market is whether S&P 500 performance will finally broaden out beyond the mega-cap artificial intelligence (AI) stocks.

There have been fits and starts since this leg of the rally began in late October 2023, with the “other” part of the market—the bulk of the market—leading for brief intervals, but lagging AI-related stocks notably in total and unable to grab the leadership baton.

However, in recent trading sessions performance has flipped. A diverse group of eight S&P 500 sectors has outperformed the three most AI-leveraged sectors. Also, the Dow Jones Industrial Average and small-capitalization indexes have outpaced the more AI-exposed S&P 500.

This trend accelerated on Wednesday following press reports that the Biden administration is seeking to impose even tougher trade restrictions on companies based in the U.S. and allied countries that sell semiconductors and semiconductor capital equipment to China, many of which are leveraged to the AI theme.

The Q2 earnings season, which began recently, may provide clues about whether the rotation away from AI-related stocks, into other areas of the market, will stick.

The economy will dictate the pace

S&P 500 earnings are expected to grow this year and expand further next year, according to the consensus forecast.

Whether this outcome transpires could largely depend on economic momentum.

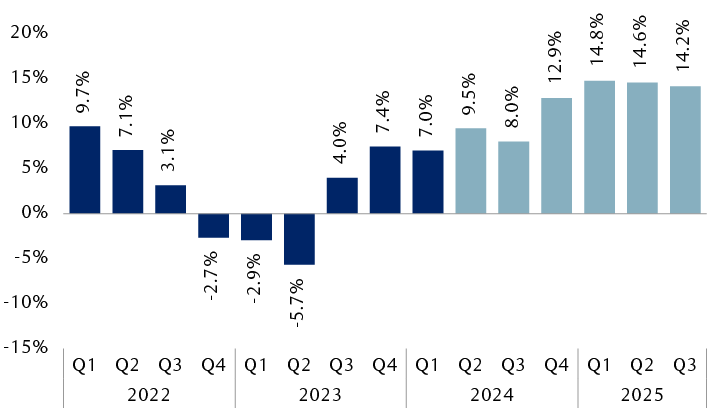

Higher earnings growth forecasts this year and next

S&P 500 year-over-year earnings growth: actual (dark blue) and consensus forecast (light blue)

The bar chart shows quarterly S&P 500 earnings growth in year-over-year percentage terms. Actual data is shown from Q1 2022 through Q1 2024, and consensus forecasts are shown for Q2 2024 through Q3 2025, as follows: 2022 Q1, 9.7%; 2022 Q2, 7.1%; 2022 Q3, 3.1%; 2022 Q4, -2.7%; 2023 Q1, -2.9%; 2023 Q2, -5.7%; 2023 Q3, 4.0%; 2023 Q4, 7.4%; 2024 Q1, 7.0%; 2024 Q2, 9.5%; 2024 Q3, 8.0%; 2024 Q4, 12.9%; 2025 Q1, 14.8%; 2025 Q2, 14.6%; 2025 Q3, 14.2%.

Source - RBC Wealth Management, Bloomberg Intelligence; data as of 7/12/24

If the economy can resume average or above-average growth in coming quarters, potentially helped along by Fed interest rate cuts, then we think this S&P 500 earnings growth trajectory would be plausible.

However, if economic growth remains below average like it was in Q1, slows to “stall speed” (between zero and one percent), or finally succumbs to recession, the current consensus earnings growth forecasts would be unachievable, in our view.

Cracks in employment and manufacturing raise questions about economic momentum, but recent improvements in retail sales, lower interest rates on mortgages and other loans, and bond market signals that the Fed could start cutting rates in September provide reasons for cautious optimism.

Earnings convergence is key

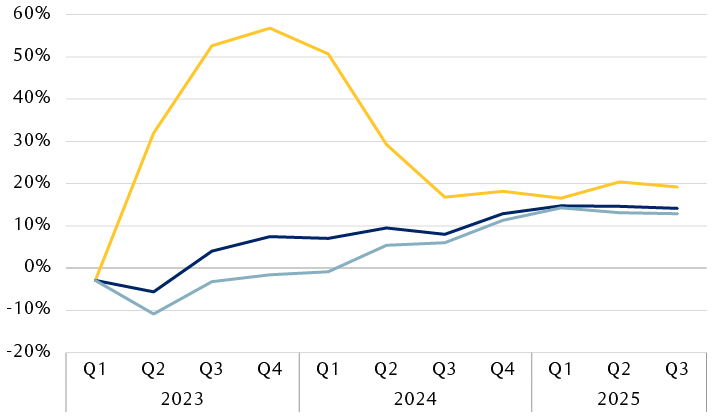

The profit trajectory of two important S&P 500 segments will likely be another major determining factor in whether non-AI parts of the market, particularly economically-sensitive sectors (aka cyclicals), can assert leadership over a sustained period.

As things stand now, the year-over-year earnings growth rates for AI-leveraged Magnificent 7 stocks and the rest of the market (the “excluding Magnificent 7” category) are set to nearly converge around 15 percent in Q1 2025. The consensus forecast projects Mag 7 earnings growth to slow meaningfully by Q3 of this year and then level off, whereas growth for the rest of the market is expected to steadily improve by Q1 of next year, before flattening out.

Growth rates for key segments expected to nearly converge in Q1 2025

Year-over-year earnings growth and consensus estimates

The line chart shows earnings growth in year-over-year percentage terms for the Magnificent 7 stocks (Alphabet, Amazon.com, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla), the S&P 500, and S&P 500 excluding the Magnificent 7 stocks. Actual data is shown from Q1 2022 through Q1 2024, and consensus forecasts are shown for Q2 2024 through Q3 2025. These data show that the growth forecasts for the three categories almost converge in Q1 2025. Magnificent 7 growth began in slightly negative territory and then shot up to a peak of 56.8% in Q4 2023, then declined slightly the following quarter. The consensus forecast declines rapidly to 16.8% by Q3 2024, increases slightly in Q4 2024, reaches a low of 16.5% in Q1 2025, and is modestly higher in the following two quarters. The S&P 500 growth rate was slightly negative in Q1 2023, dipped to -5.7% the next quarter, and then rose, leveling off around 7% in Q4 2023 and Q1 2024. The consensus forecast increases to 9.5% growth in Q2 2024, followed by a slight decline to 8.0% in Q3, and then an increase to between 14.8% and 14.2% for the next three quarters. The growth rate for the S&P 500 excluding Magnificent 7 stocks was also slightly negative in Q1 2023, dipped to -10.9% the next quarter, and then rose to -0.9% in Q1 2024. The consensus forecast calls for growth of 5.4% in Q2 2024 (the first positive growth rate) and continued increases to 14.3% in Q1 2025, followed by slight declines to 13.1% growth in Q2 2025 and 12.9% in Q3 2025.

Note: The Magnificent 7 stocks are Alphabet, Amazon.com, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla. For all three categories, actual data is shown for Q1 2023 to Q1 2024; Q2 2024 and later are consensus forecasts.

Source - RBC Wealth Management, Bloomberg Intelligence; data as of 7/12/24

If institutional investors become increasingly confident this earnings convergence story could play out, we think many would favor sectors and industries outside of the Magnificent 7 and AI-focused areas of the market in the coming weeks and months. This could result in a broader group of sectors taking the performance baton.

Management teams’ earnings guidance and commentary during the Q2 reporting season should provide hints about whether the consensus forecasts for both segments are feasible or need adjusting. It’s notable that the convergence story has already been pushed out; three months ago, it was expected to transpire in Q4 2024.

Where we go from here

We think U.S. equity market volatility could increase during the second half of this year as economic and earnings growth uncertainties get resolved. Also, volatility typically perks up at some point during election years.

The S&P 500’s 12-month forward price-to-earnings ratio of 18.6x excluding Magnificent 7 stocks is above average, but not extreme from our vantage point—so long as consensus earnings estimates and GDP growth hold up.

We recommend tilting U.S. equity holdings toward quality dividend-paying stocks and areas of the market that have lagged this year given that the baton could finally shift to such sectors for longer than just a brief stint. Specifically, we favor Financials, Health Care, and Utilities.