- We’re constructive about U.S. equities, although the more complex investment environment calls for being nimble and keeping return expectations in check.

- Further Fed rate cuts could be off the table by early 2025, but could rate hikes be back on it later in the year?

United States equities

There are normally multiple uncertainties facing the market at any given time, but for 2025 there are also unusual complexities that could impact performance, potentially generating volatility and opportunities.

There is little doubt in our minds that market participants will pay much closer attention to Washington, D.C. in 2025. This is despite the fact we see little-to-no evidence that Washington policies are key drivers of U.S. equity returns over time.

In addition to the pro-growth tax and regulatory policies likely coming from the Trump administration and Republican-led Congress, the market will potentially need to contend with the most aggressive tariff policies in almost 100 years. This makes the Fed’s job of forecasting inflation and GDP growth, and properly calibrating interest rates, more complex. Tariff unknowns, including how various trading partners will respond, complicate industry and stock selections.

Net-net, RBC Global Asset Management Inc.’s Chief Economist Eric Lascelles anticipates President-elect Donald Trump’s policies will slightly boost economic growth during the year, all else equal. He forecasts 2.3% GDP growth in 2025, which assumes actual tariff rates get watered down compared to Trump’s original proposal for 60% tariffs on Chinese goods and 10% tariffs on other countries’ goods. Lascelles’ GDP forecast is higher than the 1.9% Bloomberg consensus forecast.

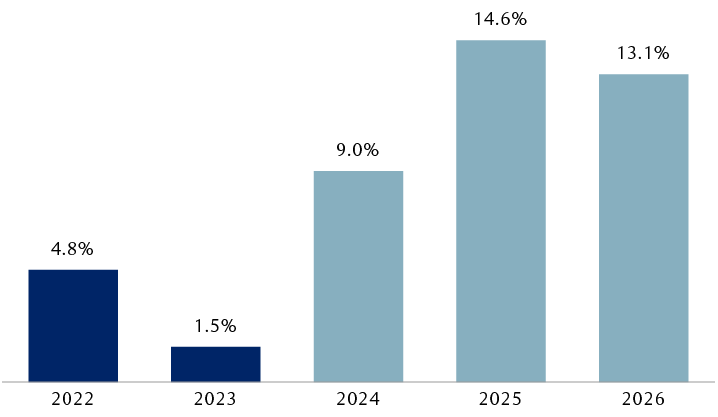

The gap between 2.3% and 1.9% GDP growth matters for S&P 500 profits—the mother’s milk of the market—and impacts whether sector profits and returns broaden out further beyond the Magnificent 7 stocks. Following outsized U.S. equity gains for two years driven largely by resilient economic growth and strong Magnificent 7 profits, the 14.6% year-over-year consensus earnings growth estimate for 2025 seems robust to us. We think it would take 2.3% or better GDP growth to achieve it, and would need more than just tech-oriented stocks to carry the load. The 14.6% earnings growth rate translates into $276 in earnings per share—higher than RBC Capital Markets’ forecast of $271 per share, which implies a roughly 10% S&P 500 price return in 2025.

A 14.6% profit growth forecast for 2025 seems lofty to us, and would require relatively strong GDP growth

S&P 500 year-over-year earnings growth and consensus forecasts (light blue)

The bar chart shows S&P 500 year-over-year earnings growth for 2022 and 2023, and consensus estimates for 2024 through 2026. For 2022, actual earnings growth was 4.8%, and for 2023 it was 1.5%. For 2024, the consensus estimate is for 9% growth, followed by 14.6% in 2025 and 13.1% in 2026.

Source - Refinitiv I/B/E/S; data as of 11/22/24

We’re constructive about U.S. equities yet vigilant due to the complexities. Investors should keep return expectations in check, and we recommend starting the year without major sector Overweights. We think the market will provide opportunities to take advantage of sector and industry dislocations in 2025. Be nimble.

United States fixed income

The Fed could pause rate cuts sooner rather than later. We expect the Fed’s bias to remain toward further rate reductions through Q1 2025 as questions about the true health of the labor market linger. But in our view, the incoming Trump administration’s pro-growth policies risk overheating an already-robust U.S. economy, and with that, fueling concerns about another inflationary episode. We believe the Fed will continue the rate-cut cycle into Q1 before pausing at a policy rate around 4.25%.

The potential for a rate hike in 2025 exists. Though the likelihood of a rate hike may not be great, similar to the late 1990s, the Fed could remain in a relatively constant state of calibration based on how the economy develops. Rising inflation would be the most likely candidate to spur policymakers back into action, though further economic momentum could also cause policymakers to pull back on the reins.

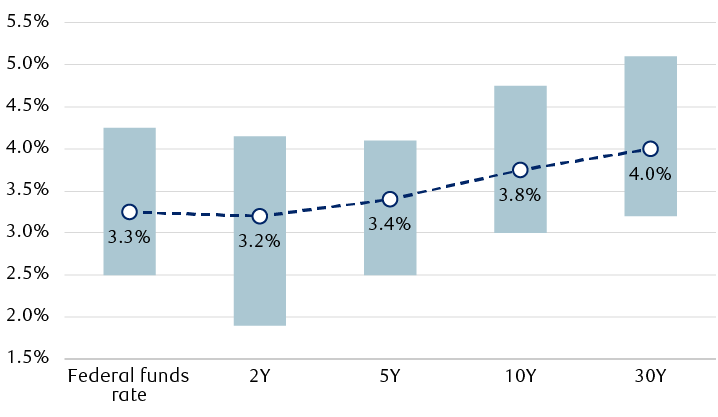

We think the shape of the Treasury yield curve will tell investors all they need to know in 2025. A flat yield curve will be a key gauge of whether the Fed is successfully keeping the economy, inflation, and the labor market in balance. Should the yield curve invert again because short-term yields are rising, it could indicate the market expects the Fed to raise rates to offset growth and inflation pressures. Just as we see the Fed holding rates at 4.25% in 2025, we expect the 10-year Treasury yield to trade around similar levels next year, but the range of outcomes is large.

Yields across the fixed income landscape are likely to remain well above historical averages. Economic optimism has pushed credit market valuations to historically extreme levels while fewer rate cuts in the pipeline mean that cash and short-duration securities should offer attractive income. However, we would remain biased toward increasing duration, and reducing credit risk exposure, throughout 2025.

Yields still expected to fade in 2025, but range of possible outcomes remains large

Consensus U.S. Treasury yield forecasts for year-end 2025

The chart shows average Bloomberg consensus forecasts for U.S. policy interest rate and various Treasury bond maturities at the end of 2025, with bars indicating the range of estimates by analysts surveyed. The federal funds rate: average, 3.3%; minimum, 2.5%; maximum, 4.25%. Two-year Treasury yield: average, 3.2%; minimum, 1.9%; maximum, 4.15%. Five-year Treasury yield: average, 3.4%; minimum, 2.5%; maximum, 4.1%. Ten-year Treasury yield: average, 3.8%; minimum, 3.0%; maximum, 4.75%. Thirty-year Treasury yield: average, 4.0%; minimum, 3.2%; maximum, 5.1%.

Source - RBC Wealth Management, Bloomberg Consensus Analyst Survey for November 2025