This isn’t the first time the Federal Reserve has faced a conundrum. Former Fed Chair Alan Greenspan famously used the term in reference to monetary policy at a point in time when the Fed had raised overnight interest rates by 150 basis points (bps) without any material increase in longer-term Treasury yields, such as the benchmark 10-year Treasury note, off which many economic lending rates are priced.

In theory, the Fed’s adjustments to its overnight lending rate should reverberate through all interest rates. In practice, well, sometimes theory doesn’t hold. That lack of reverberation was just one factor that kept borrowing rates, including mortgage rates, low despite the Fed’s efforts to raise rates. And we know how that ended—with low mortgage rates contributing to a broad housing bubble.

Now Fed Chair Jerome Powell may be staring down his own conundrum—but in reverse.

The upside of down

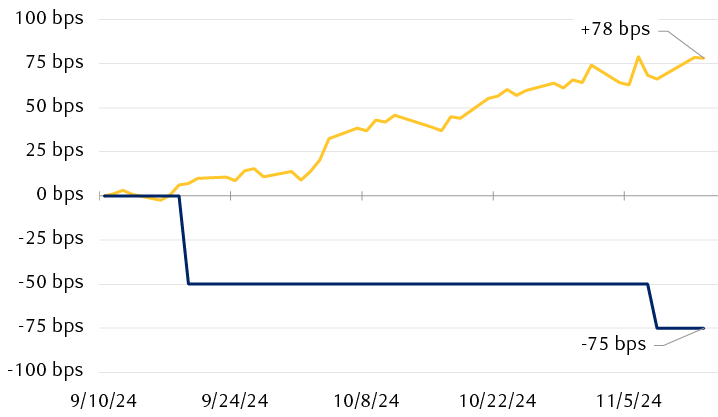

After an outsized 50 bps rate cut in September, the Fed followed through with a 25 bps reduction last week to bring its policy rate target to a range of 4.50 percent to 4.75 percent. But markets have not taken notice. The 10-year Treasury yield has been on a one-way trip higher, up nearly 80 bps to around 4.50 percent this week, with few signs of slowing down.

The Fed’s 75 basis points of rate cuts have been completely offset by rising Treasury yields

Net changes since Sept. 10, 2024

The line chart shows the net changes in the Federal Reserve's overnight federal funds rate and the 10-year U.S. Treasury yield from September 10 to November 13, 2024. The Federal Reserve has cut its policy rate by 75 basis points over this period, but the longer-term 10-year Treasury yield has moved in the opposite direction, climbing by 78 basis points.

Source - RBC Wealth Management, Bloomberg

While much of the rise in yields has been attributed to better economic data after a labor market scare in August, the potential policies of the incoming administration, amplified by the Republican Party officially retaining control of the House this week for a trifecta of control, has been no small factor.

Naturally, Powell wanted no part in entertaining the implications of potential policy proposals, stating last week, “Here, we don’t know what the timing and substance of any policy changes will be. We therefore don’t know what the effects on the economy would be, specifically, whether and to what extent those policies would matter for the achievement of our goal variables, maximum employment and price stability. We don’t guess, we don’t speculate, and we don’t assume.”

But markets do all those things. And guess, speculate, and assume they have.

So, let’s explore what we think markets might be telling us.

The good, and the bad, of rising yields

1. Better economic data, fewer rate cuts

We maintain that the bulk of the rise in Treasury yields despite Fed rate cuts is due to fundamentals. Various economic surprise indexes have been trending higher for months now and have been closely correlated with Treasury yields. After a surprisingly weak payrolls report for July, markets priced in entirely too many rate cuts from the Fed. The recent rise in Treasury yields is simply a repricing of a better-than-initially-feared economic reality, in our view.

We can break the 10-year Treasury yield into two simplified components: expectations for the Fed’s policy rate, and for inflation. We note that better economic data has been reflected in fewer Fed rate cuts ahead. Of the roughly 80 bps rise in the 10-year Treasury yield since September, we believe about 50 bps can be explained by fewer rate cuts priced over the next year.

2. Inflation expectations

The other component embedded in 10-year Treasury yields, inflation, explains the balance. The Treasury Inflation-Protected Securities (TIPS) market tells us the market’s inflation expectations, which have risen by about 30 bps since September. Markets now expect inflation to average 2.35 percent over the next decade, compared to a low of 2.05 percent in September.

While Donald Trump’s return to office may have been a modest surprise to some, we think it was simply the latest outcome in a long list of global referendums on inflation this year that saw multiple incumbent governments around the world dismissed in favor of new ones. Seemingly above and beyond anything else, people simply dislike inflation, and incumbent governments finally paid the price for it this year, in our opinion.

The irony, of course, may ultimately be that those who voted against inflation may actually face more of it as a result, based on current market expectations.

Is “income” in fixed income here to stay?

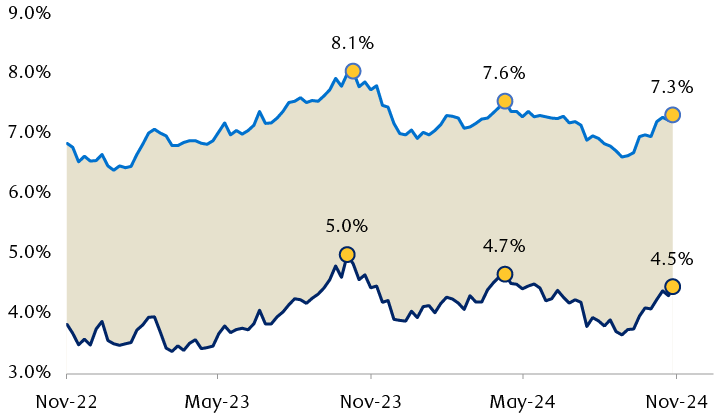

All of which is to say nothing of even greater deficit risks under proposed policy plans, which would be amplified by greater interest costs on the federal debt if those policy plans mean that interest rates will have to remain higher, and for longer. For consumers, mortgage rates are again rising on the back of higher Treasury yields, which could further stress housing affordability.

Rising Treasury yields risk pushing borrowing rates back toward multiyear highs

The line chart shows the relationship between the 10-year U.S. Treasury yield and 30-year fixed mortgage rates from November 2022 through November 2024. Over the past two years, the two rates have moved roughly in parallel, and the spread between them has averaged approximately 3%. The recent rise in the 10-year yield to 4.5% has pushed mortgage rates up to 7.3%. Both are approaching previous peaks in October 2023 (5.0% Treasury yield, 8.1% mortgage rate) and April 2024 (4.7% Treasury yield, 7.6% mortgage rate).

Source - RBC Wealth Management, Bloomberg, Bankrate.com (U.S. home mortgage 30-year fixed national average)

Perhaps the only good news, in our opinion, is that while it may be getting more expensive to borrow money, that can only mean it’s getting more attractive to lend it. For investors, ourselves included, who worried that Fed rate cuts could end a stretch of historically attractive yields, the fixed income landscape may remain fertile land for some time longer. The sugar rush of pro-growth policies and bigger deficits, at least over the near term, will likely keep interest rates elevated for an extended stretch.

As for the Fed, we think there’s probably little policymakers can do to stem the rise in yields. Cutting rates further would likely have little impact and might only add to inflationary fears. Should the animal spirits run too free, and the economy too strong, policymakers could pivot back to rate hikes later in 2025. If markets see rate hikes back on the table, we would expect to see yield curves reinvert.

As always, there is no such thing as a free lunch. While markets remain optimistic about growth and deregulation, fixed income markets are sending warning signs that there is still likely to be a price to pay for it.