The Fed’s decision to cut interest rates by 25 basis points (bps) on Dec. 18 was hardly a surprise. The move was predicted by almost 90 percent of economists surveyed by Bloomberg and was fully consistent with interest rate futures pricing ahead of the decision.

Slightly more noteworthy, in our view, were the changes to the central bank’s Summary of Economic Projections (SEP)—known colloquially as the “dot plot.” These showed policymakers shifting their projections higher for year-end 2025 GDP growth, inflation, and policy rates. Notably, policymakers now see only two 25 bps cuts in 2025, putting the median projection for the year-end federal funds rate 50 bps higher than it was at the September policy meeting.

But what really got markets to take notice was the hawkish tone to Fed Chair Jerome Powell’s remarks, where he said that it would take further progress on inflation to justify additional rate cuts. Following his comments, U.S. Treasury bond yields rose between eight and 15 bps, depending on maturity, while the S&P 500 fell nearly three percent.

Despite this initial selling pressure following the Fed announcements, we believe a rate-cut pause is both warranted and salutary, and investors should focus on the economic strength driving the policy shifts.

Data dependent, but for real this time

Since before this rate-cut cycle began in September, Powell has claimed the central bank’s moves were “data dependent.” Likely true, but only technically so from our vantage point. Since July, we think rate cuts were largely pre-determined. An outlier reading could have kept rates unchanged, but for all practical purposes, data dependency was purely theoretical.

Based on the Fed’s most recent comments, however, our sense is that the central bank is now shifting into a more natural reading of “data dependency,” where it comes at the decision with a neutral bias, and it will only move if the data justifies it.

Fed projections warrant hawkish shift

| Metric | December meeting | September meeting | Change |

|---|---|---|---|

| Change in real GDP | 2.1% | 2.0% | +0.1% |

| Unemployment rate | 4.3% | 4.4% | -0.1% |

| PCE inflation | 2.5% | 2.1% | +0.4% |

| Core PCE inflation | 2.5% | 2.2% | +0.3% |

| Federal funds rate | 3.9% | 3.4% | +0.5% |

Source - RBC Wealth Management, U.S. Federal Reserve

And as we look at the numbers, we think a pause is clearly warranted.

The Fed’s job is to maximize employment consistent with stable prices. How is it doing? Well, it’s hard to argue there’s an employment problem. The benchmark unemployment rate is nearly one percent below its long-term median, and the broadest measure of labor weakness—which captures discouraged and underemployed workers—looks even stronger; it’s 1.6 percent below the long-term median. These measures have drifted slightly higher, but it’s undeniable that employment is stronger now than it was during prior economic expansions, let alone recessions.

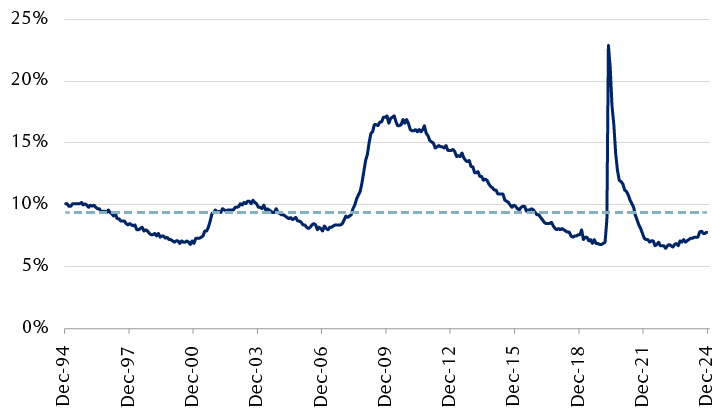

Broadest U.S. labor measure shows little weakness

The line chart shows the U.S. U-6 unemployment rate, the broadest measure of labor availability, with its median of 9.4% for the past 30 years. The U-6 rate was around 6.8% in December 2019, before the COVID-19 pandemic, and then spiked to nearly 23% in April 2020 before falling rapidly back to 6.5% in December 2022. The rate has risen gradually since then, and is now roughly 7.8%.

The U-6 unemployment rate includes the total unemployed, plus all persons marginally attached to the labor force, plus total employed part time for economic reasons.

Source - RBC Wealth Management, Bloomberg; monthly data through 11/30/24

Inflation—and not job creation—is arguably where the Fed should be focused, a stance that Powell’s press conference seemed to finally acknowledge. The core components of the Consumer Price Index (CPI), which excludes food and energy, are up over three percent year-over-year and prices on the broad basket of goods have been rising at an accelerating monthly pace. The Fed’s two percent inflation target is technically based on a different measure of consumer prices, the Personal Consumption Expenditures Price Index (PCE), that was up 2.3 percent year-over-year in October, the last available reading.

Normally, it would be reasonable to say that being within 0.3 percent of the inflation target is close enough. But this is not a normal inflation environment. We’re coming off a bout of near-double-digit inflation and it has left its mark on the U.S. economy. Even as annual inflation levels have moderated, market indicators of longer-term inflation expectations have remained above pre-pandemic levels. Expectations on price moves tend to be self-fulfilling; typically, businesses that expect higher supply costs are quick to raise prices and workers who think costs are going up are more aggressive in looking for wage gains.

Against that backdrop, Powell’s emphasis on inflation progress as a prerequisite for further cuts is reasonable, in our view. A contrary stance could risk losing control of the inflation narrative.

Message of the markets

Although the S&P 500 sold off following the hawkish tone to Powell’s press conference, we think it’s a mistake to conclude that equity prices depend on lower interest rates.

For support, we need to look no further than the market’s response since the Fed initiated its rate-cut cycle in September. Back then, investors were pricing in 2.5 percent of policy easing; today, that number is closer to 1.4 percent. Despite that shift toward higher future interest rates, and even with yesterday’s selling, the S&P 500 gained five percent since the Fed’s meeting in September. With monetary policy being driven by economic strength, we see nothing inconsistent with higher rates and higher stock prices.

We think the bond market is telling a similar story. Going into the Fed’s September meeting, 10-year government bond yields were roughly 1.25 percent below three-month rates. As of Dec. 18, those rates are now essentially the same.

This type of relative move—referred to as curve steepening—can be a worrying sign when it’s driven by the Fed aggressively cutting short-term interest rates to stimulate a slowing economy. That’s not the case today, when the bulk of the steepening has come from rising long-term yields. That type of move is more consistent with a market pricing in solid economic growth and inflation risks than one that is concerned with an incipient recession.

Risks remain

Putting it all together, we think a pause in rate cuts is clearly warranted. After that, policy should—and likely will—boil down to how prices and labor markets are performing. While current indicators are generally positive and could be consistent with little or no additional policy easing, future developments could warrant more aggressive rate cuts than the Fed currently projects.

The most obvious path we see for further easing is slowing inflation and rising unemployment, possibly from global economic softening reaching the U.S. Politics is also a potential factor. There is a growing probability of a U.S. government shutdown, for instance. In addition, the incoming Trump administration has indicated a wide-ranging set of measures that could create unanticipated, negative short-term economic consequences.

All in all, we think investors need to focus not only on what the Fed is doing, but why. And a shift toward slower interest rate cuts based on robust domestic economic performance is nothing to be feared.