What are required minimum distributions?

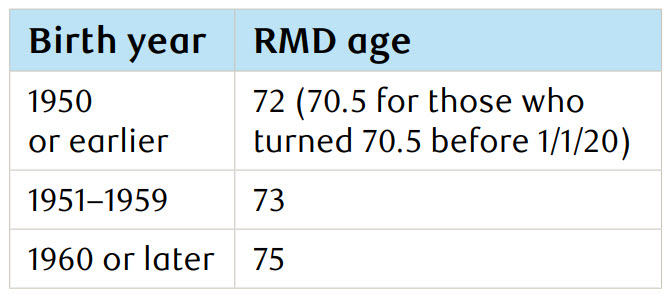

Required minimum distributions or RMDs are withdrawals from your traditional IRAs and most employer-sponsored retirement plans that you must take starting at age 73 (72 if you were born before 1951 or 75 if you were born in 1960 or later). These distributions are taxed as ordinary income, and the amount you must withdraw is calculated based on your account balance and life expectancy factor.

When must RMDs be taken?

Your first RMD must be taken for the year in which you attain the age indicated in the RMD age chart (above). However, you have some flexibility with your distribution in your first year. You can take the distribution during the year you turn this age or delay it until April 1 of the following year, known as your required beginning date (RBD). Subsequent annual distributions must be taken by December 31 of each year.

Don’t need the extra funds?

For those who don’t need the extra income, here are five ways to strategically use your RMD funds.

Keep putting the money to work

• Placing your RMDs into a nonqualified brokerage account may keep your funds invested and potentially growing over time

Move to a Roth IRA

• Converting your traditional IRA to a Roth IRA can provide tax-sheltered growth and lower your distribution amount in future years

Purchase a life insurance policy or variable annuity

• Using your RMDs to purchase a life insurance policy or variable annuity can provide a taxsheltered benefit to your heirs and help maximize your legacy

Fund a 529 plan

• Contributing your RMDs to a 529 savings plan can help fund educational expenses for loved ones while providing tax benefits

Donate to charity

• Donating your RMDs to a qualified charity can help reduce your taxable income and provide a benefit to the charity, with a yearly limit of $108,000 per person

How are RMDs calculated?

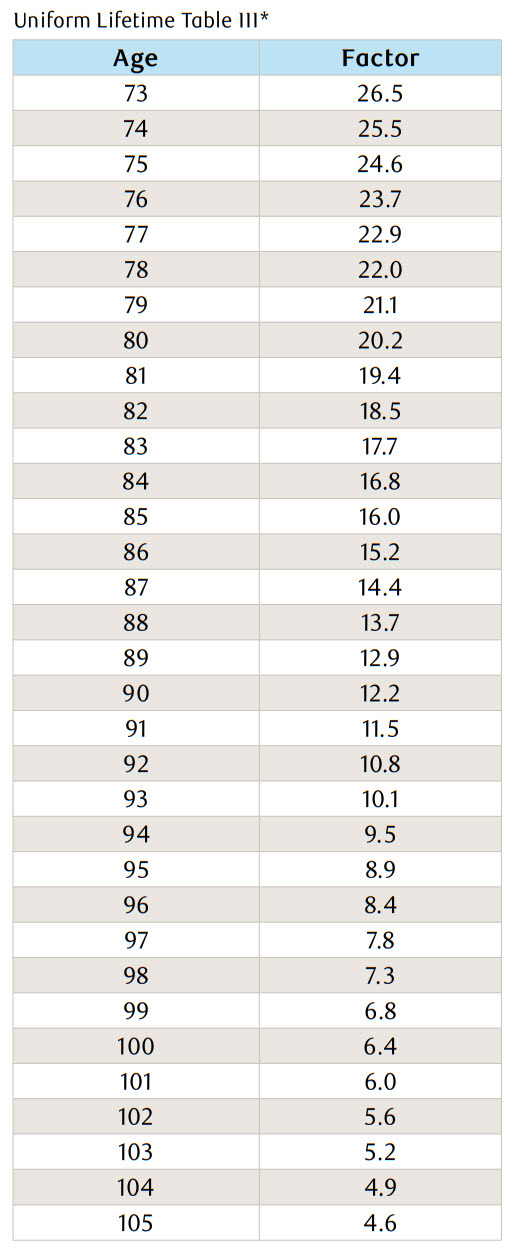

Your required minimum distribution amount is calculated each year by dividing your ending account balance from the previous year with your applicable life expectancy factor. The applicable life expectancy factor is based on the Uniform Lifetime Table III (right), unless your sole beneficiary is your spouse and they are more than 10 years younger than you, in which case the joint life expectancy of you and your spouse is calculated.

Options for taking RMDs

Several options are available for taking your RMDs and your financial advisor can help you with the approach that best suit your needs:

1. Schedule automatic distributions — So you don’t miss a payment.

2. Submit a distribution form — Control the timing and amount of your withdrawals.

3. Set up on-demand distributions — Take your RMDs as needed.

4. Establish IRA check writing — Withdraw your RMD yourself.

5. RMDs can be distributed in either cash or securities — Receive your RMDs in cash or securities from your IRA, with securities valued at the closing price on the day prior to the distribution.

Tax implications and penalties

Taking required minimum distributions from your IRA are generally subject to federal (and possibly state) income tax for the year in which you receive the distribution. However, a portion of the funds distributed to you may not be subject to taxation if you have ever made nondeductible(after-tax) contributions or rolled over after-tax dollars from an employer-sponsored retirement plan to your traditional IRA. Failure to take your RMDs can result in a 25% penalty, which can be reduced to 10% if the missed RMD is corrected between January 1 of the year following the year of the missed RMD and the earliest of the following dates: when the Notice of Deficiency is mailed to you, when the tax is assessed by the IRS or the last day of the second tax year after the tax is imposed.

Qualified charitable deductions

The Internal Revenue Code allows individuals over 70 1/2 to receive a tax benefit for charitable giving using qualified charitable distributions (QCDs). This strategy helps reduce the tax burden by satisfying a portion or all of the RMD obligation once RMDs begin at age 73. It also allows families to set up their philanthropic legacy.

Planning for RMDs

Understanding RMDs is an essential part of your retirement planning and wealth strategy. Your financial advisor can help you develop a well-rounded retirement saving and retirement income plan, effectively manage your assets in retirement and plan appropriately for leaving assets to your beneficiaries. Together, you and your financial advisor can also review this plan periodically and make any necessary adjustments to assist you in achieving your goals.

By understanding your options for taking RMDs and planning accordingly, you can help with a smooth transition into retirement and make the most of your savings. Consult with your financial advisor to determine the best approach for your individual circumstances.

Consult with your financial advisor to determine the best approach for your individual circumstances.