Retirement planning is not what it used to be. The good news: people are living longer and enjoying healthier, more active lives and pursuing new passions in retirement. Yet longevity poses challenges for how you’ll manage the retirement savings you’ve worked hard to accumulate over the decades.

No matter how you picture retirement, living in it will be different from working toward it. You’ll transition from saving and building wealth through a steady paycheck to converting your wealth into a reliable income stream for the rest of your life.

This is a unique challenge for today’s retirees. Previous generations of Americans spent fewer years in retirement and could count on a combination of employer pensions, Social Security and personal savings to provide a reliable retirement paycheck. Now, creating that same paycheck is more complicated given the demise of pensions, volatile financial markets, inflation, taxes and the potential for living 20 years or more in retirement.

Your retirement paycheck begins with a wealth plan

How do you picture retirement? One of the most important, yet sometimes overlooked, steps in preparing for retirement is to visualize what you want your retirement to look like and to prioritize your goals. In short, think about what you are retiring to rather than what you are retiring from.

That can be a daunting task, but here’s another way to approach it: What are your retirement needs, wants and wishes? Obviously, your essential expenses—food, housing, health care, taxes, and insurance—come first, sustaining you over the years. Your wants—travel, entertainment, memberships, and gifts—reflect your desired retirement lifestyle, while wishes—a second home, bequests, and legacy planning—fulfill your legacy.

To start, ask yourself some basic questions about how you want to live in retirement and how you wish to be remembered:

- Life: Where will I live? How will I spend my time?

- Lifestyle: How will I live? Will I travel, volunteer, or start a new business?

- Legacy: How do I want to plan for my legacy? What will I leave to my loved ones and the organizations I care about?

Next, consider questions about retirement income planning:

- What are the various sources of my income in retirement?

- How much income will these sources provide each year?

- When will I need the income?

- How will I coordinate funding payments from different sources to create one retirement paycheck?

Now plan your priorities. What’s most important to you?

- Stay in my house throughout retirement or downsize

- Take that dream trip to Europe with the entire family

- Purchase a home or an apartment in another city to be near family members or to enjoy a different climate

- Fund 529 plans for the grandchildren

- Leave a legacy for family and my favorite charitable organizations

What is the most expensive purchase you will make in your lifetime? Your retirement. Retiring with confidence means managing risk and eliminating as many of the unknowns as possible. A personalized wealth plan simplifies the complexities of retirement income planning and makes it easier for you to see where you stand today, tomorrow and beyond.

A wealth plan addresses all aspects of your financial life and can help you:

- Understand how Social Security, retirement account distribution decisions, Medicare options, and health costs factor into your plan

- Determine your planned expenses in retirement

- Identify your income sources and their specific tax implications

- Distinguish between essential expenses to meet daily living needs and discretionary expenses

- Pinpoint risks that could affect your income and lifestyle expenses

Get in the retirement zone before you retire

If you plan to retire within the next five years, consider taking these steps today to help in your efforts toward having what you need to enjoy a comfortable retirement lifestyle.

Consolidate your accounts to see the big picture

Consolidate your accounts to give you a big picture on how to best position your retirement plan and help prepare for—and manage—retirement income. Asset consolidation gives you more clarity, a streamlined approach, greater control and a deeper understanding of your assets. It may even save you money.

Be smart about your debt

Consider accelerating your higher interest rate payments so that the loan will be paid off before you retire. To curb new credit card debt, try paying cash for major purchases. By limiting new debt and reducing existing debt, you can minimize the amount of retirement income spent on interest payments.

Determine your total cost of retirement

Build a wealth plan that considers the cost of all your needs, wants, and wishes. Your financial advisor can help you project these expenses over time so you can see how much you will need annually to fund your retirement.

Consider your options for claiming Social Security

Retirees often give up tens of thousands or even hundreds of thousands of dollars by taking Social Security benefits too early. If you claim Social Security at age 70 instead of 62, the monthly benefit could be 76 percent higher, adjusted for inflation.

Take advantage of a Health Savings Account

Health Savings Accounts offer a number of benefits beyond spending for the short-term, such as saving for longer-term qualified medical expenses, including those in retirement. Because a Health Savings Account is one of the most tax-efficient savings options available, consider contributing the maximum, then pay for current health care expenses out of pocket and invest the account assets to allow for continued tax-free growth to cover future health care expenses.

Diversify your assets by location for tax flexibility

Having a mix of accounts with different tax treatments—tax exempt, tax deferred and taxable—allows for greater flexibility when managing your taxes in retirement. Consider the benefits of allocating some retirement savings to a Roth 401k or IRA. A Roth conversion or partial conversion may also be beneficial, especially in lower income years or down markets. You will have to pay the taxes, but you will benefit from tax free growth, and you can withdraw funds in retirement tax-free when needed.

Review withdrawal strategies

Evaluate withdrawal strategies to take advantage of lower tax years early in retirement. Everyone’s situation is different so make sure to personalize your distribution strategy to provide for the most tax efficient “long term” planning strategy.

Retirement planning isn’t just about numbers and graphs; it is about understanding that no one’s retirement is the same, the importance of having a personalized approach to help minimize the risks in retirement, and revisiting your plan every year to stay on course.

Planning for the unexpected

1 Longtermcare.gov, U.S. Department of Health & Human Services, accessed 2022

The retirement life cycle

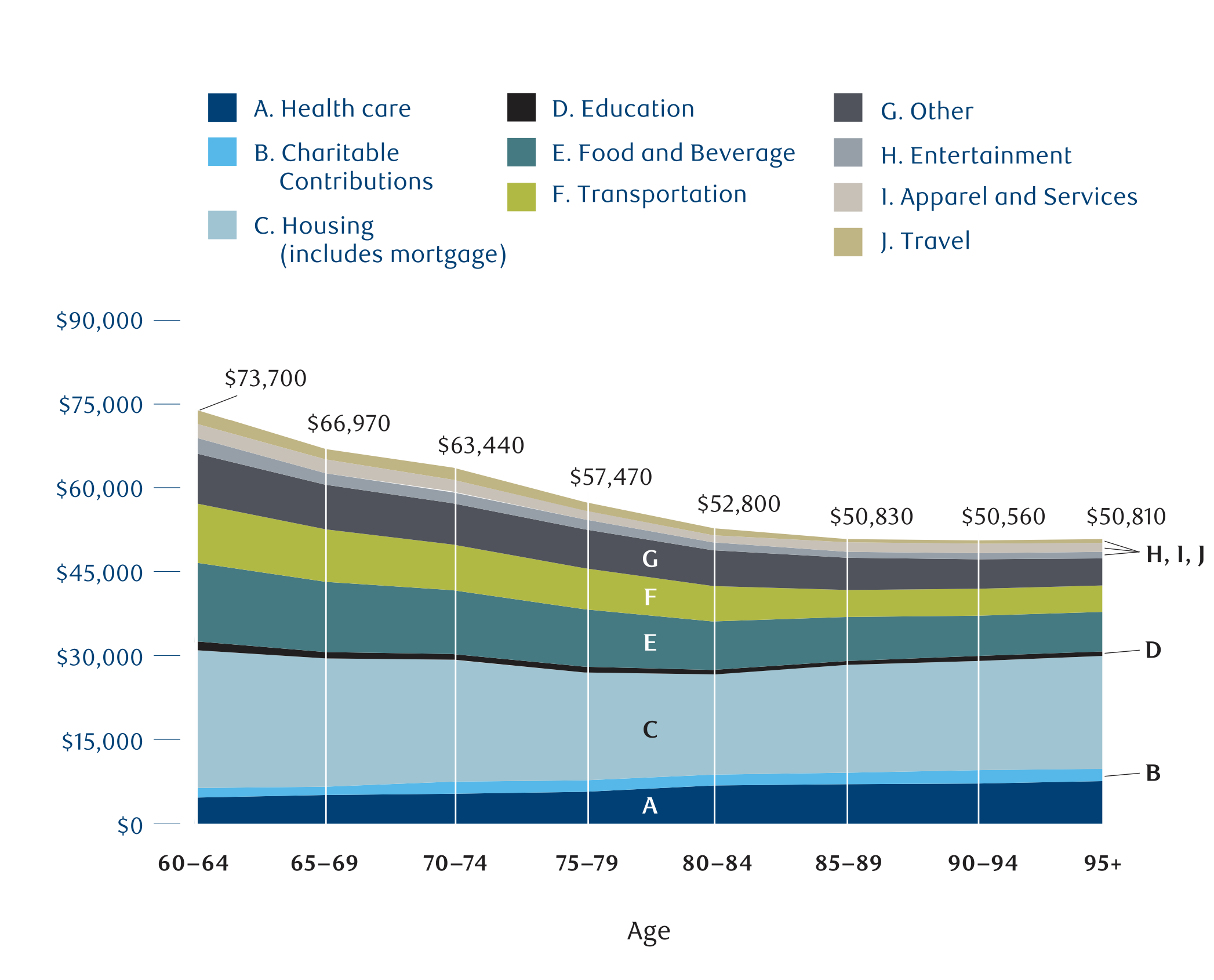

Retirement is not a single, consistent block of time. Many people think about their retirement years in three distinct stages, each with its own unique needs that your wealth plan should be prepared to accommodate:

| The go-go years (age 65 to 75) | The slow-go years (age 76 to 85) | The no-go years (age 86 to 100) |

| The go-go years are a time to focus on family, friends, travel, hobbies, and anything else on your bucket list requiring an active lifestyle. Of course, this means your spending could be equal to, or in some instances higher than, what it was when you were working. | The slow-go years may be different. You may still be on the go, but you will likely be going slower in many respects and stay closer to home. Here retirees start to downsize their lifestyle and spend less—less on cars, less on homes, less on travel, less on just about everything. This doesn’t mean this group does nothing, but it does mean they are living a simpler, and thus a less expensive, lifestyle. | The no-go years are a time when it may be more difficult to sustain an active lifestyle than the prior two decades. The challenge with the no-go years isn’t about normal expenses but planning for health care, including the possibility of moving to a continuous care community or nursing home. |

8,000 days

Are you prepared for the long haul? With today’s rising lifespans, you could be facing 20 plus years in retirement, which translates into 8,000 days.

When you look at it that way, it becomes clearer that retirement is not an end, but rather a new phase of life that you’ll want to plan thoughtfully.

In retirement, taxes matter

In real estate, it’s location, location, location. In retirement, location matters too.

Tax diversification in retirement can make a major difference in how much you pay in taxes—and when those taxes are due. That’s because different investments are subject to different tax rules, and different types of accounts have different tax treatment. Diversifying your investments into different accounts—a strategy often called asset location—has the potential to help lower your overall tax bill. Tax-considerate income strategies start by understanding the differences between taxable, tax-deferred, and tax-free accounts.

Taxable accounts

Taxable accounts include brokerage accounts and income on certain types of investments, including dividend interest and distributions from mutual funds, even if the fund is not sold. If you sell your investments like stocks, bonds, and mutual funds, you’ll pay taxes on the gains. Investments held for less than a year are typically taxed at the higher rates, while investments held for more than one year are taxed at lower rates.

Tax-deferred accounts

Tax-deferred accounts allow you to delay paying taxes on investment gains, and potentially accumulate more over time through tax-deferred compounded growth. Deferred accounts allow you to contribute pre-tax income, reducing your current tax bill.

For example:

- IRAs, or individual retirement accounts, are tax-deferred and withdrawals in retirement are taxed as ordinary income. Contributions may be tax-deductible, but the amount of your deduction may be reduced or eliminated if you, or your spouse, are covered by a workplace retirement plan.

- 401(k)s and 403(b)s are tax-deferred employer-sponsored plans subject to annual contribution limits, and your employer may match a portion of your contributions. Your contributions are excluded from your income, and withdrawals are taxed as ordinary income.

Tax-free accounts

Tax-free accounts are funded with after-tax dollars. You pay taxes when you contribute, but your investment will benefit from years of tax-free compounded growth and withdrawals in retirement are also tax-free.

For example:

- Roth IRAs or 401(k)s are tax-free, allowing you to contribute after-tax income now, with tax-free withdrawals in retirement. If you’re a high earner, your contribution levels may be reduced or eliminated based on IRS income limits. In addition, your contributions are not tax-deductible.

- Health savings accounts offer triple tax advantages: Contributions are tax-deductible, any growth is tax-free and you can spend your money on eligible health care expenses tax free. Plus, you can keep your health savings account if you move or change employers.

Balancing act

Balancing the need for income against investment risk, taxes and longevity is a dynamic process, and it’s wise to revisit your plan on an annual basis.

RBC WealthPlan creates a clear path toward your financial future

Get a clear snapshot of your retirement income plan. RBC WealthPlan helps clients prioritize their goals and address their concerns.

Gain valuable insights

RBC WealthPlan’s Retirement Paycheck is an advanced, interactive technology that helps you and your financial advisor understand your current situation, the possibilities available and the tradeoffs that may be necessary to achieve various outcomes.

- Get clear on your retirement funding sources and create a personal income strategy to cover your projected expenses and estimated taxes

- Evaluate and make important decisions related to your income sources, such as: Social Security, Roth conversions, income options, required minimum distributions and charitable estate planning opportunities

- Understand the impact of different withdrawal strategies and their associated tax impacts on your retirement income

- Predict how your plan may be affected by events beyond your control, such as changes to taxes, inflation or life expectancy

- Identify any need for additional portfolio income and more easily navigate those years where you anticipate a gap in income, as well as years where you have a surplus

Where will your retirement paycheck come from?

RBC WealthPlan identifies your sources of retirement income using powerful visualizing tools. The Total Income Analysis below shows a 30-year projection of how one person will meet their spending goals throughout retirement.

Create your retirement paycheck

A personal income plan identifies available sources of income and assets to fund your expenses in retirement in a tax-considerate manner to create a reliable paycheck. The plan must also anticipate the effects of longevity and usually incorporates four broad categories of income sources.

Start by identifying your income sources

| Income source #1 | Income source #2 | Income source #3 | Income source #4 |

| Reliable income Predictable sources of income, such as Social Security, pensions, annuities and required minimum distributions. | Earnings and income Sources such as dividends, interest, income, and earnings from part-time work. | Asset draw down Build a strategy to draw down assets, including investments, retirement savings and health savings accounts. | Legacy assets Additional assets that you don’t need to fund your retirement— including real estate, tax-favored assets and trusts—and wish to set aside for future generations or favorite charities. |

Then earmark these income sources for expenses

| Income source #1 | Income source #2 | Income source #3 | Income source #4 |

| Essential expenses Food, housing, transportation, utilities, health care and taxes. | Non-essential and unforeseen expenses Ongoing and one-time expenses such as a vacation, purchasing a car, helping out an elderly parent or a healthcare event. | Gifting Beneficiaries of your assets, or support of heirs. | |

Next, understand the tax implications

From a tax perspective, in general, it’s wise to withdraw from your taxable accounts first, then tax-deferred, then tax-free. That’s because the money you take from a taxable account (such as a brokerage account) may be taxed as capital gains at a lower rate than what you’d owe on distributions from traditional 401(k) plan accounts, traditional IRAs and certain other tax-deferred savings, which are taxable as ordinary income. Have your tax professional review your accounts for specific guidance.

Unlike your working years where your employer withheld and pre-paid your taxes, in retirement you have to fund your full tax bill. Your RBC Retirement Paycheck will help estimate the taxes that may be due. Consider having taxes withheld from taxable distributions, making quarterly payments or setting aside funds specifically for your tax bill to take the sting out of tax day.

Finally, don’t overlook these taxes

Social Security

Approximately 56 percent of people who get benefits pay income taxes on them, according to the Social Security Administration. That’s because their income in retirement exceeds limits set by tax rules and regulations.

- Individuals with combined income between $25,000 and $34,000 will pay income tax on up to 50 percent of their benefits. That also goes for couples with incomes between $32,000 and $44,000.

- Individuals with combined income of more than $34,000, as well as couples with more than $44,000, may pay tax on up to 85 percent of their benefits.

- Don’t forget that several states tax Social Security at various rates.

Ordinary income tax rate

The level of income you have in retirement affects your tax liability. If you meet certain income thresholds or receive capital gains from taxable investment, you may face other taxes.

Alternative Minimum Tax (AMT)

Individuals who reach certain income levels may be subject to AMT. This tax is calculated by eliminating certain deductions that are typically allowed under standard tax calculations.

3.8 percent Medicare surtax on net investment income

Married individuals filing a joint return with income above $250,000 and single filers with income of $200,000 or more may be subject to a 3.8 percent tax on net investment income. The tax can be applied to interest, dividends, capital gains, rental and royalty income, and non-qualified annuities that exceed the threshold amounts.

Tax-preferred treatment: Long-term capital gains/qualified dividends tax rate

A more favorable rate applies on long-term capital gains and qualified dividends, generally, from U.S.-based stocks.

- Those in the lowest tax brackets may be able to qualify for a 0 percent tax rate on long-term capital gains and qualified dividends. For most, these gains or dividends will be taxed at a 15 percent rate.

- Those in the 39.6 percent tax bracket may be required to pay a 20 percent capital gains/qualified dividend tax rate. Most states also apply taxes.

Income sources

To fund retirement, first start by defining income sources that are predictable and certain. These income sources may include:

- Social Security

- Required minimum distributions (RMDs) from workplace savings plans, such as 401(k) or 403(b) plans, and traditional IRAs

- Annuity payments

- Pension payments

Determining the timing and distribution amount related to these retirement benefits is a critical next step. There are several factors to consider, and key considerations for each reliable income source.

Social Security: Timing is everything

The decision of when to begin collecting Social Security is different for everyone. Most people qualify to begin taking Social Security benefits on their 62nd birthday but have the option to delay taking benefits as late as their 70th birthday.

The main advantage of delaying the start date is that each year of delay increases annual benefits between 6–8 percent. In contrast, for individuals with limited assets or health risks, it may make sense to take Social Security benefits early.

Most importantly, do not look at Social Security filing in isolation. Consider coordinating your spouse’s benefits filing decision with your own to optimize your combined income for your joint lifetime. And always consider your filing decision in the context of your personal goals, taxes, and overall plan cash flow needs.

Required minimum distributions (RMDs) in retirement

Planning ahead for your required minimum distributions, or RMDs, can lower your tax bill during the distribution phase of life. Any money in a 401(k) or traditional IRA will be subject to RMDs, which now begin at age 73 following the passage of the SECURE 2.0 Act.

Fortunately, there are methods to choose from when it comes time to take your required minimum distributions. You can choose whichever approach works best for you.

Remember: You can begin to withdraw money from your 401(k) when you turn 59 ½, but that doesn’t mean you should. Think strategically about how you use your qualified assets.

Delay your RMD

You must take your first required minimum distribution for the year in which you reach age 73. However, with this first RMD, you can choose to delay distributions until April 1 of the following year.

If you wait until April to take your first RMD, however, know that you still must take your second RMD by December—saddling you with two taxable distributions in one year.

Consolidate RMD withdrawals

If you have multiple IRAs, one of the best strategies to avoid liquidation when an investment’s value has dropped significantly, or when an investment is projected for long-term growth, is to combine your RMD amounts for all your IRAs and take the total amount due from the IRA(s) with the most cash available or least volatile investments.

Tax laws require that an RMD be calculated separately for each IRA, but you may withdraw that amount from any of your IRAs, except a Roth IRA. If you have multiple IRAs, you may want to designate at least one as having short-term, low-risk investments or significant cash reserves to cover the RMD payments each year.

Make a qualified charitable distribution (QCD)

IRA owners age 70½ and older may take a tax-free distribution of up to $100,000 per year if it is paid directly from their traditional IRA to a qualifying charity. This qualified charitable distribution (QCD) can be used to satisfy your RMD for the year. This tax advantage is lost if you take receipt of the funds first, so be sure to instruct your IRA custodian to pay the distribution directly to the charity.

Annuities and pension plans: Income you can’t outlive

The risk of outliving assets in retirement has increased, given the longer life expectancies Americans now enjoy. One strategy for addressing this concern is to purchase an annuity that can provide a regular stream of income throughout your life— and the life of your spouse. Annuities may produce a guaranteed stream of income that you can’t outlive and are often used to supplement retirement income. You can fund an annuity with a single lump sum and/or a series of payments. In return, you can have the insurance company make scheduled payments to you. The payment amount depends on the type of annuity, contract terms, and factors such as age, variable or fixed payments, and single or joint income needs. Annuities aren’t for everyone. But they’re uniquely designed to help accumulate money on a tax-sheltered basis or provide guaranteed lifetime income, or both.

Annuity payment guarantees are based on the claims paying ability of the issuer.

Consider an annuity to meet these needs:

- Essential expenses: To provide supplemental, guaranteed income

- Health event: To cover unexpected health care costs

- Income gap: To bridge an income gap before you begin taking Social Security payments

- Longevity insurance: To protect you and/or your spouse from outliving assets

- Market volatility: To maintain a consistent income level or provide a minimum death benefit via market volatility protection features

After tapping the available reliable resources for your retirement needs, the next source of income that should be used is earnings and income. Resources may include:

- Interest from bonds

- Dividends from stocks

- Capital gain distributions from mutual funds

- Income from part-time work, a business or rental properties.

Remember that earnings from taxable accounts may increase the possibility of reaching a higher income threshold, resulting in more significant tax liability. In contrast, the earnings from tax-deferred accounts can be reinvested without triggering current tax implications. Therefore, you typically want to place income-generating assets in retirement accounts, such as 401(k)s or IRAs, and place lower-tax investments, such as index funds and exchange-traded funds (ETFs), in taxable accounts. The taxes you owe on investment earnings can vary, depending on the type of asset held or the source of earnings. Some income is subject to tax at ordinary income tax rates, while other income is subject to the more favorable long-term capital gains/qualified dividends rate.

Which assets should you draw from first? There are several approaches you can take. Traditionally, tax professionals suggest withdrawing first from taxable accounts, then tax-deferred accounts, and finally Roth accounts where withdrawals are tax free. The goal is to allow tax-deferred and tax-free assets the opportunity to grow over more time.

Tax impacts of retirement income

When crafting your retirement paycheck, identify the funding sources that may be used to determine income taxes, Social Security benefits subject to taxation, and additional required Medicare premiums.

Qualified withdrawals from Roth IRAs and health savings accounts generate tax-free funds that won’t trigger increases to Medicare premiums if your income is above a certain level.

| Included when calculating whether: | ||||

|---|---|---|---|---|

| Account Type | Investment earnings/ withdrawals | Income tax owed | Social Security Benefits taxed/ Medicare surcharges | |

| Pre-tax 401(k) Traditional IRA | Arrow Right | Taxable withdrawals (ordinary income) | Yes | Yes |

| Taxable Accounts | Arrow Right | Tax-exempt Interest | Yes | |

| Ordinary dividends Taxable interest | Yes | Yes | ||

| Qualified dividends | Yes | Yes | ||

| Realized capital gains | Yes | Yes | ||

| Roth 401(k) and IRA | Arrow Right | Tax-free withdrawals | ||

| Health Savings Account | Arrow Right | Tax-free withdrawals (for qualified health care expense) | ||

RBC Wealth Management does not provide tax or legal advice. All decisions regarding the tax or legal implications of your investments should be made in connection with your independent tax or legal advisor. No information, including but not limited to written materials, provided by RBC WM should be construed as legal, accounting or tax advice. Chart courtesy of J.P. Morgan Asset Management.

Boost your retirement income with a health savings account

You may think about your health savings account (HSA) solely as a way to pay for current-year eligible medical expenses. But are you aware it can also be used as a long-term investment vehicle that can play an even greater role in your overall retirement income strategy?

You can use your HSA with other retirement accounts to maximize your after-tax retirement income. Saving in an HSA for retirement gives you a tax-advantaged account dedicated to future medical expenses—allowing you the opportunity to avoid dipping into retirement accounts intended for cost-of living expenses. Also, HSAs are a great way to pay for qualified medical expenses in retirement.

A triple tax benefit

- HSAs offer a tax-considerate method to build reserves by delivering a rare triple tax benefit:

- Interest earnings and investment growth from deposits are income tax-free

- All contributions to an HSA are made income tax-free

- Withdrawals for qualified medical expenses are made tax-free

Estate planning

It is important to tackle basic estate planning as part of your overall plan. No matter your age or wealth, key legal documents, proper titling of assets and maintaining beneficiary designations are important first steps.

Estate essentials

Your estate includes everything you own: your home, personal possessions, savings, investments, retirement accounts, real estate, business and digital assets.

Regardless of your age or estate value, protecting these assets requires a set of estate planning documents, including a current health care directive, will and power of attorney. Without them, transferring your estate, which may include gifting while you’re alive, can be complicated by taxes, probate and family emotions.

It is also vital that your assets are properly titled and your beneficiary designations are accurate. This is especially important if your plans for transfer differ from a traditional linear family transfer, or you are single or have a blended family.

Trust considerations

Many people think estate planning is about their death. But it’s really about your control over your assets—control while you’re living, and control after your death. One of the most basic ways to gain control is through a simple will. But for people with more complex estates or concerns, a trust can provide a legal structure to facilitate control and see your wishes are carried out. A trust is often used to minimize estate taxes and can offer other benefits as part of a well-crafted estate plan.

There are many reasons for implementing estate planning strategies, including:

- Providing protection, confidentiality and privacy

- Promoting family harmony and trust

- Funding the care of minors and family members with disabilities or health care needs

- Creating legacy plans for stewardship and funding of charitable causes

- Handling or avoiding probate or state estate tax considerations

- Passing on values to the next generation by controlling the timing and terms of the transfer

Taxes matter

Increases in the federal estate and gift tax exemption presents additional planning opportunities and may also have unintended consequences for existing estate plans.

In light of these changes, existing estate plans should be reviewed, including most trusts, especially those that use formulas that reference the standard exemption. There may also be an opportunity to remove limitations or rework trust structures to eliminate unnecessary complexity. These may include moving assets back into the estate to take advantage of the revaluation of assets at death.

Federal estate and gift tax changes

What changed?

The amount of your estate that can be gifted or transferred free of tax, either during your lifetime or via your estate, has risen:

The Tax Cut and Jobs Act estate tax exemption amounts in 2023:

- $12.92 million per individual

- $25.84 million per couple

What did not change?

Gift tax waiver for:

- Transfers for tuition and medical expenses paid directly to the institution

- Annual gifts of $17,000 per person and $34,000 per couple to unlimited beneficiaries

- Unlimited gifts to spouses who are U.S. citizens.

Legacy assets

If you are fortunate enough to have wealth beyond funding your retirement, you can start focusing on your legacy plan. Proper legacy planning includes drafting (and updating) a will or trust to help confirm that all your assets will be distributed exactly as you wish.

When developing your legacy plan, give special consideration to these key questions:

- Who are you responsible for financially?

- Who do you want to benefit from your assets?

- Are there minor children in need of a guardian?

- When and how do you want your heirs to receive the assets—and how will those assets be taxed?

- What are the potential estate costs, including estate taxes, probate costs, and administrative costs?

It’s important to spell out a clear direction about your personal legacy wishes since your choices can affect tax planning strategies in retirement. Tax-advantaged gifting strategies should be considered to confirm the smooth transition of assets to beneficiaries before and after death.

Gifting during your lifetime

Sometimes it’s wise to make gifts during one’s lifetime to decrease the size of an estate and minimize estate taxes after death. Decisions about when to make a gift should factor in the federal estate exemption threshold and state estate tax laws.

If you’d like to benefit a charity and don’t need your RMDs for retirement income, a qualified charitable distribution from your IRA may make sense.

Your next chapter

A wealth plan is uniquely suited to help you navigate your financial life throughout retirement. Created thoughtfully and managed over time, an RBC WealthPlan enables you to set a course, define milestones, track successes and redirect you should your circumstances change.

A personalized retirement income plan can help you:

- Consolidate your holdings to give you a complete picture of your assets

- Document and prioritize your goals

- Stress-test your goals with different scenarios

- Establish proper asset allocation to diversify and minimize investment risk and taxes

- Understand outcomes, avoid unnecessary risks, rebalance and chart your progress • Answer retirement questions with confidence

- Have a plan for funding your tax payments

- Strategically manage your cash flows

- Protect what is important to you and create a legacy

IMPORTANT: The projections or other information generated by RBC WealthPlan regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Results may vary with each use and over time.

Annuities are designed to be long-term investments and frequently involve substantial charges such as administrative fees, annual contract fees, mortality & risk expense charges and surrender charges. Early withdrawals may impact annuity cash values and death benefits. Taxes are payable upon withdrawal of funds. An additional 10 percent IRS penalty may apply to withdrawals prior to age 59-1/2. Annuities are not guaranteed by FDIC or any other governmental agency and are not deposits or other obligations of, or guaranteed or endorsed by any bank or savings association. With fixed annuities, both the money you invest and the interest paid out are guaranteed by the claims-paying ability of the insurer. Investments in variable products will fluctuate and values upon redemption may be less than the original amount invested. Investors should consider the investment objectives, risks, and charges and expenses of an annuity carefully before investing. Prospectuses containing this and other information about the annuity are available by contacting your RBC Wealth Management financial advisor. Please read the prospectus carefully before investing to make sure that the annuity is appropriate for your goals and risk tolerance.

Trust services are provided by third parties. RBC Wealth Management and/or your financial advisor may receive compensation in connection with offering or referring these services. Neither RBC Wealth Management nor its financial advisors are able to serve as trustee. RBC Wealth Management does not provide tax or legal advice. All decisions regarding the tax or legal implications of your investments should be made in connection with your independent tax or legal advisor.

RBC Wealth Management, a division of RBC Capital Markets, LLC, registered investment adviser and Member NYSE/FINRA/SIPC.