The divergence in policy paths probably shouldn’t come as much of a surprise amid the global crosscurrents that have developed in recent months.

And nor did the Fed’s decision come as much of a surprise. The Fed’s pause was expected by all analysts surveyed by Bloomberg, and the muted market reaction this week confirms just that.

Though we didn’t learn much from the Fed this week, questions about what the Fed does next will undoubtedly continue to hang over markets, even if the Fed has taken a back seat to politics, policies, and headlines for the time being.

Certainty of uncertainty

It perhaps goes without saying that Fed uncertainty remains high. RBC Capital Markets has maintained its call that the Fed is likely done cutting rates at 4.50%, and is on hold for at least all of 2025.

A wide range of views amid elevated uncertainty still exist as consensus expectations as of Jan. 25—which should at least partly reflect the potential impact of policy changes from the new administration—still show further rate cuts could be forthcoming.

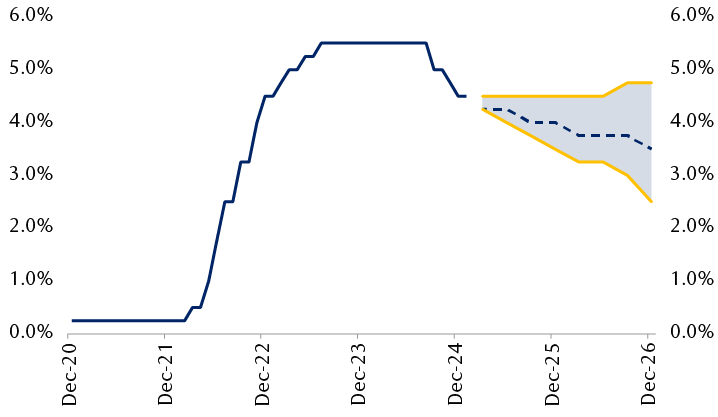

Despite pause, analysts still see Fed rate cuts in the pipeline

Federal funds rate consensus estimates

The chart shows the path of the upper bound of the federal funds rate, and the range of forecasts, along with the median consensus estimate through the end of 2026. The high end of estimates sees a rate hike back to 4.75% by the end of 2026, while the low end sees cuts down to just 2.50%. The median forecasts see rate cuts to 3.50%, from a current level of 4.50%.

Source - RBC Wealth Management, U.S. Federal Reserve, Bloomberg Consensus Analyst Survey conducted Jan. 16–25

As it stands, analysts still see the Fed cutting rates at its next meeting in March, though current market pricing suggests the chances of such a move are remote at barely 20%. As Fed Chair Jerome Powell was keen to point out during his press conference—policymakers are in no rush to cut rates at the moment. In our view, we still think the bias at the Fed remains toward further rate cuts this year.

The Fed didn’t cut rates, but markets have

As we discussed last November, the Fed’s rate cuts haven’t done much to actually lower interest rates. The Fed lowered its policy rate by 1.00% over the September through December period, only to see the benchmark 10-year Treasury yield, which feeds more broadly into borrowing rates for consumers, rise by over 1%. Mortgage rates, for example, rose more than 0.50% over that stretch.

Put simply, while the Fed certainly has control over interest rates, it doesn’t have complete control and is still at the whim of market forces. Better economic data, lingering inflation risks, and fewer rate cuts priced by markets have all worked to drive longer-term rates higher in recent months despite the Fed’s efforts.

Though the Fed skipped a 0.25% rate cut this week, there has been a reprieve on the rate front as the 10-year Treasury yield has now fallen by over 0.30% from the Jan. 14 high of nearly 4.80%. Whether it’s just pullback amid what has been an ongoing trend higher remains to be seen, but we are starting to wonder if the recent drop in longer-term yields may be reflecting the idea that tariff and trade threats pose a greater threat to the growth outlook than to the inflation backdrop.

Clues from the past

Though Powell was explicit this week that he would not comment on anything related to proposed policy plans up to and including tariffs, the tariff and trade threats of 2019 can perhaps provide a playbook of how the Fed may weigh the risks this time around. D

uring the previous episode of tariff threats in 2019, policymakers at the Fed grew increasingly concerned about growth risks, and less so about the upside risks to inflation. Concerns peaked around June 2019 as steel tariffs were expanded to Canada, Mexico, and Europe, but began to fade by the end of the year as the U.S. suspended parts of later stages of tariff plans.

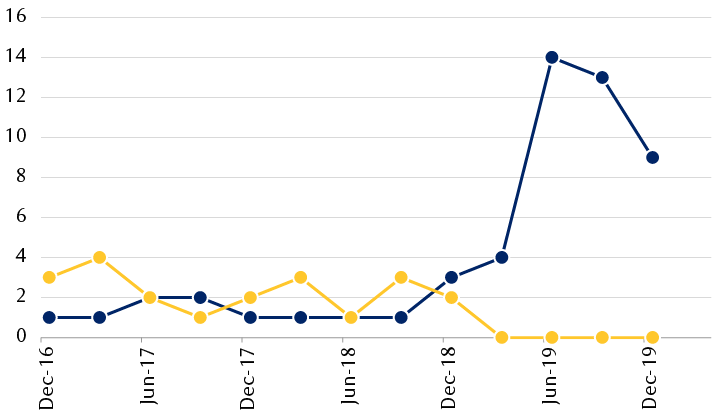

Fed policymakers saw more risks to growth than to inflation during the tariff episode of 2019

Number of Federal Open Market Committee members holding each view

The chart shows the number of Fed policymakers who saw downside risks to economic growth and upside risks to inflation at various policy meetings from 2016 through 2019. For example, amid trade and tariff threats in 2019, 14 of 17 policymakers saw downside risks to growth, while zero saw upside risks to inflation.

Source - RBC Wealth Management, Bloomberg

Therefore, we think that the ongoing discourse—and market pricing of higher inflation, higher rates, and fewer future Fed rate cuts—around the issue of tariffs and trade may be misplaced.

While it could take months for tariff plans to be put in place—if they are at all—the uncertainty alone could weigh on business investment decisions and new order activity in the meantime. The economic slowdown seen in 2019, particularly in the manufacturing sector, partly contributed to the Fed’s decision to deliver a series of “insurance” rate cuts.

Much of the focus has seemingly been on the inflationary risks of tariffs—which are certainly material—but those upside risks may be more than offset by the downside risks to growth, in our view.

For those reasons, we think the recent pullback in Treasury yields should be sustained. The 10-year Treasury yield should hold a near-term 4.25%–4.75% range. And while the Fed paused rate cuts this week, we don’t think it’s the end of rate cuts just yet.