The competitiveness emergency

Mario Draghi, the leading European Union (EU) technocrat, recently published a 400-page report which reveals a bold plan to revitalise the EU economy. Draghi had been tasked by the EU Commission to come up with a plan to make Europe more competitive. In the report, he warns that Europe urgently needs to boost growth and productivity, or else it could face an existential crisis.

The review was much needed because, since its creation, Europe and the world around it have changed markedly. In the late 1980s, when the concept of the European single market began to take shape, Italy’s economy was larger than the combined economies of China and India. China’s transition to state-subsidized high-value-added manufacturing over the past 13 years is increasingly putting it in competition with Europe, moving away from its traditional reliance on Europe as a source of inputs. Europe’s geopolitical situation has also shifted, with the U.S., on which Europe relied on for its security, potentially focusing more on Asia and other regions in the future.

Draghi argues that Europe’s lacklustre economic performance not only causes it to fall behind its competitors, but meagre productivity growth also contributes to declining living standards. Without significant policy action, he stresses that these issues—loss of competitiveness and sliding living standards—will worsen and could diminish Europe’s influence in the world.

The picture in Europe is not uniformly bleak. Some industries are dynamic and innovative. Pharmaceuticals, for instance, an industry with a long-established tradition, is competing successfully on the global stage. In Technology, Europe dominates in semiconductor manufacturing equipment, and enjoys a monopoly in extreme ultraviolet (EUV) lithography machines, essential equipment for the manufacturing of the most advanced semiconductor chips. It also leads in enterprise resource planning software. Furthermore, it is home to some of the most prominent consumer goods, luxury goods, and industrial companies globally.

But in frontier technology, such as artificial intelligence (AI), Europe’s innovation pace lags that of the United States. This is concerning, as AI technological advancements have the potential to drive further innovation across various sectors.

In his report, Draghi singles out the need to foster “breakthrough innovation” and to establish a level playing field with the U.S. whose technology companies are spending vast amounts of money, and with China where industrial and technological behemoths are state-backed. Innovation, as he sees it, can boost both economic and productivity growth. Draghi argues the region is generally very good at basic scientific research but fails to turn it into innovation and commercialization.

Ambitious proposals

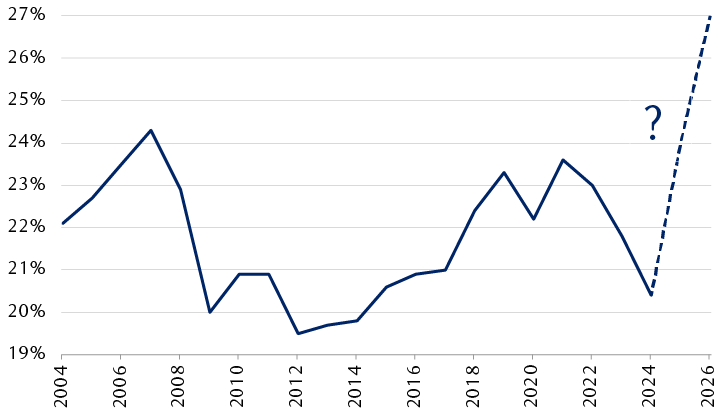

To achieve this, Draghi thinks Europe needs additional investment of up to €800 billion per year for the foreseeable future. This would require a herculean effort as it would increase the share of EU investment to 27 percent of GDP from the current 22 percent, an unprecedented increase after years of decline. To put things in perspective, the recovery fund that the EU put together in 2020 to help member countries recover from the economic impact of the pandemic totalled €750 billion.

Boosting investment to the required level may prove challenging

EU investment as a percentage of EU GDP, and recommended future funding level in the Draghi report

The chart shows EU investment as a percentage of EU GDP over the past 20 years, and the projected future investment need through 2026 based on Mario Draghi’s EU competitiveness report. During the period, the maximum investment percentage was 24.3% in 2007. Investment subsequently trended lower, decreasing to a period minimum of 19.5% in 2012. It then trended generally higher, reaching 23.6% of GDP in 2021, before declining steadily to roughly 20% in 2024. The Draghi report suggests investment should grow to 27% of GDP in 2026, nearly three percentage points higher than has been achieved over the past 20 years.

Source - RBC Wealth Management, Bloomberg

Draghi expects most of the funds will come in the form of private investment, although some additional public investment will be needed. But such large amounts represent a real challenge. The traditional European model relies on bank funding which may not be adequate for this purpose. Banks may be reluctant to fund firms developing risky, disruptive technologies with uncertain prospects. And Europe’s capital markets lack depth and liquidity. His report does not address how to overcome these issues, though the question of coordinated EU investment has again resurfaced.

Draghi also suggests that the EU should leverage its scale in sectors like defence, telecoms, energy, and finance which currently operate in fragmented markets. Given the new geopolitical reality, his view is that these sectors should now be considered as strategic at the EU level and operate seamlessly across countries. Integration is currently hindered by varying national regulations and concerns over loss of national sovereignty. We believe deep structural reforms are necessary to address these challenges.

Reserved reaction

The reaction to the report in Europe has been muted. That may be due to the current lack of leadership in Europe’s two big members. France and Germany have succumbed to political turmoil and don’t seem to be able to focus on this subject. This is disappointing as both countries should be taking this report as the blueprint for their own economic and industrial revival, in our view.

According to Draghi, unless measures are taken to improve productivity, Europe is likely to experience a slow but inexorable decline. And herein lies the problem. In the past, it has required acute crises for Europe to unite, overcome the status quo, and take bold action. In response to the pandemic, the EU engaged in large-scale joint-borrowing to fund the €750 billion recovery fund, a first for the union. Russia’s invasion of Ukraine prompted greater solidarity and cooperation among EU member states to address security concerns.

The trouble is that a gradual loss of competitiveness is not a seismic shock. Urgency and immediate severity may not spur national governments into taking the radical, ambitious measures that are needed.

The hope is that the recently re-elected head of the EU Commission, Ursula von der Leyen, and her Commissioners will endorse Draghi’s report as their economic agenda. After all, it is the EU Commission, as the executive branch of the European Union, which requested the report. The Commission’s five-year term could enable the implementation of at least some of the proposed measures. Though Draghi’s proposals might be unappealing to some governments due to potential losses of national sovereignty, many countries accepted ceding some autonomy when the single market was established decades ago, a decision which bore fruit. In this context, we believe Italian bank UniCredit’s recent buildup of a 21 percent stake in Germany’s Commerzbank may signal the beginning of a new era of consolidation in the banking sector.

Investment implications

The European equity market is not representative of the European economy and has markedly evolved over the past decade. Today, a greater proportion of European companies’ revenues are derived from outside the region as opposed to domestically. We believe both these structural changes and its cyclical nature make the European equity market primed for active stock picking rather than a passive approach.

Given the region’s domestic challenges, we have long advocated focusing on Europe’s world-leading companies that benefit from and drive structural global trends. Some examples are companies that are focused on niche areas key to the future of the global economy or those at the forefront of providing innovative solutions to sustainability challenges.

Europe is home to many companies that provide the equipment and solutions needed for what we believe will be a multi-year capex super-cycle associated with the significant amounts of investment related to structural trends such as electrification, reshoring, and digital transformation including AI. We find attractive long-term opportunities in niches such as semiconductor manufacturing equipment, electrical and mechanical engineering, and industrial gases. Moreover, China-exposed cyclicals, that have significantly underperformed of late, would stand to benefit should the recently announced monetary stimulus in China be followed up with additional fiscal support.

Elsewhere, we still believe there are several attractive investment opportunities within Europe’s Health Care sector, as well as selectively within consumer and luxury goods areas, as well as Financials.

With contributions from Thomas McGarrity, CFA