Following a 38 percent surge from the April low through the all-time high in late October, the S&P 500 has been consolidating its gains, and leadership within the index has been rotating.

It’s useful to step back from the market’s recent movements and evaluate the unique contours that have sparked this year’s rally and the longer bull market run that began in October 2022.

- The largest stocks—often referred to as “mega caps”—have outperformed significantly.

- Earnings growth for technology-related stocks has far outpaced the rest of the market.

- In fact, the second phenomenon has impacted the first.

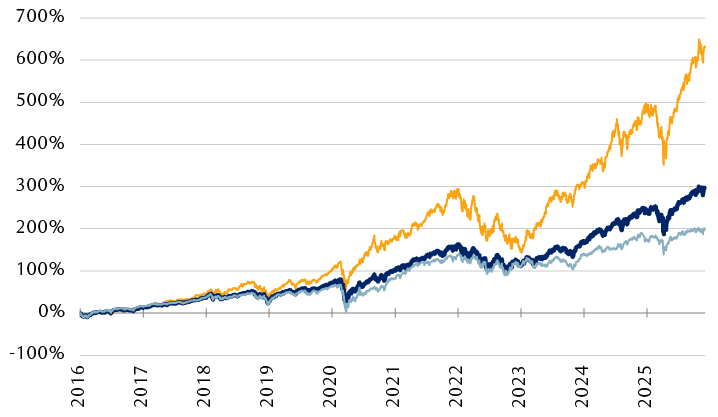

10 biggest stocks far in the lead

As the chart shows, in early 2023, soon after the bull market began, an interesting pattern reasserted itself. The performance gap widened notably between the 10 largest U.S. stocks and S&P 500 Index, along with its equal-weighted counterpart.

The largest stocks have dominated returns lately

Total return indexes in U.S. dollars (includes dividends)

* S&P 500 Top 10 Index represents the 10 largest companies within the S&P 500 weighted by float-adjusted market capitalization, rebalanced quarterly.

Source - RBC Wealth Management, Bloomberg, S&P Dow Jones Indexes; data through 12/2/25

The line chart shows the percentage gain of the S&P 500 Top 10 Index, the S&P 500 Index, and S&P 500 Equal Weighted Index from January 1, 2016 through December 2, 2025. After being in negative territory during Q1 2016, all three rose off the lows and continued in positive territory through much of 2019. By the middle of 2019, the three indexes were up about 73%, 55%, and 50%, respectively. Then in the latter part of 2019, the S&P 500 Top 10 started to noticeably outperform the other two. However, all of them lost ground in the early part of 2020. By March 2020, the three indexes were up 58%, 19%, and 2%, respectively; this was the low point during this period. Following that low in March 2020, the S&P 500 Top 10 began to outperform the other two by a meaningful rate. By the end of 2021, the S&P Top 10 had risen 287%, whereas the S&P 500 was up 161% and the S&P 500 Equal Weighted was up 138%. From that point, all three indexes climbed further, then pulled back in the latter part of 2022, then climbed to new highs, only to pull back again in the spring of 2025. Since then, all three indexes have risen to new highs, but the S&P 500 Top 10 has increased its lead by a wide margin in 2025. By December 2, 2025, the S&P 500 Top 10 had risen more than 600% in total, whereas the S&P 500 had risen almost 300% and S&P 500 Equal Weight had risen almost 200%.

Except for the brief period during the tariff scare last April when the S&P 500 pulled back by almost 19 percent and the largest 10 stocks declined even more, the pattern of a rising tide lifting the largest stocks more than others has defined this bull market cycle.

Since the bull run began on Oct. 12, 2022, on a total-return basis:

- S&P 500 Top 10 has surged 175 percent

- S&P 500 has rallied 100 percent

- S&P 500 Equal Weighted has risen 58 percent

It’s about fundamentals, not just AI hype

The AI boom has contributed to the big rally in the biggest stocks.

Among the 10 stocks that currently represent the largest S&P 500 stocks by market capitalization—NVIDIA, Apple, Microsoft, Alphabet, Amazon.com, Broadcom, Meta Platforms, Tesla, Berkshire Hathaway, and JPMorgan Chase—the first eight are heavily involved with developing the emerging AI technology, and even the last two have AI exposure.

While the largest stocks within the S&P 500 Top 10 Index are rebalanced each quarter—the list can and often does change at least somewhat—AI-related stocks have dominated this group in the past two years.

During this period, these stocks have grown earnings much faster than the rest of the market and have generated free cash flow at a pace that’s well above the “average” S&P 500 stock. In other words, their stock moves have not been driven solely by AI hype; there has also been meat on the bones in terms of company fundamentals.

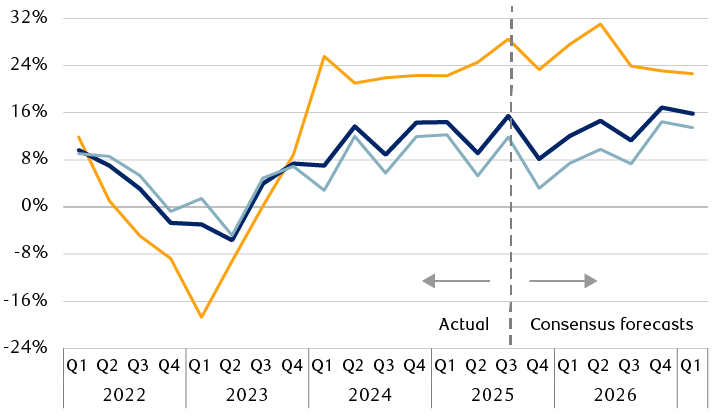

The Information Technology sector’s ability to outgrow earnings of the broader market is an illustration of meat on the bones.

Just as the bull market was starting to gain steam, Tech sector profit growth rapidly flipped from deeply negative territory in Q1 2023 to lofty levels, reaching almost 26 percent in Q1 2024 and hasn’t really looked back since. In the past two years, the Tech sector’s profits have risen much faster than the broader market quarter after quarter.

Tech earnings growth expected to keep outpacing the rest of the market

S&P 500 actual net income growth and consensus forecasts

Source - RBC Wealth Management, Bloomberg; data as of 12/2/25

The line chart shows actual earnings growth rates from Q1 2022 through Q3 2025 and consensus earnings growth forecasts from Q4 2025 through Q1 2027 for three segments of the U.S. market: Information Technology sector, the S&P 500, and the S&P 500 excluding the Information Technology sector. Growth for all three started out between 9.1% and 11.9% and then declined into negative territory with the lowest levels occurring in the first half of 2023; the Tech sector reached -18.7% in Q1 2023 and the others bottomed between -4.8% and -5.6% in Q2 2023. All three rose into positive territory thereafter, reaching between 6.9% and 8.9% in Q4 2023. Then growth for the Tech sector became stronger, and from Q1 2024 through Q3 2025 was between 21% and 28.5%. During that same period, growth for the S&P 500 bounced between 7% to 15.5% and S&P 500 excluding the Tech sector bounced between 2.9% to 12.3%, and growth for the S&P 500 was slightly higher than the S&P 500 ex-Tech the whole time. The consensus forecast is for all three indexes to grow earnings by roughly similar rates from Q4 2025 through Q1 2027 as they did compared to the previous period with the Information Technology sector leading the other two indexes again. The consensus forecast for Q1 2027 is 22.6% for the Tech sector, 15.9% for the S&P 500, and 13.5% for the S&P 500 excluding Information Technology.

Adages exist for a reason

The old investment adage “past performance is not necessarily indicative of future results” applies in this case.

Just because the largest 10 stocks within the S&P 500 have outperformed significantly so far during this bull market cycle doesn’t mean this pattern will automatically continue for the duration of the bull run.

We think much will depend on whether earnings growth of technology-related stocks continues to exceed other areas of the market to a meaningful degree—and whether the prospects for this will extend beyond 2026. This is a high hurdle, but at least for now, the consensus forecast of industry analysts anticipates this will persist through at least Q1 2027.

Another factor that could influence the performance of the largest stocks versus the rest could be the AI development cycle itself.

Thus far, the phenomenon has been dominated by “AI 1.0,” which has been mostly a capital-spending story to build infrastructure and train and run AI models. The bulk of stocks within the S&P 500 Top 10 Index have benefitted from this over the past two years.

We think the focus of the AI development cycle probably needs to start shifting to “AI 2.0,” where signs of productivity and financial benefits start accruing to companies not just inside, but also outside of the technology industry. This could ultimately boost financials of certain industries and companies that aren’t necessarily in the center of the AI radar right now.

Given the very strong run that the largest S&P 500 stocks have had, we think now is a good time to check portfolio allocations.

When single stock positions drift well above their normal bounds—as often happens following strong rallies—we think it’s prudent to double check their fundamental prospects and valuations, and if warranted, bring them back closer into balance. This is one of the key investment recommendations in our recently published 2026 U.S. equity outlook.

For more information about RBC’s thoughts for 2026 and multi-year themes, please see the articles posted here.