The S&P 500 charged ahead in 2024 with the second straight year of 20 percent or better returns, bringing the total gain since the bull market began in October 2022 to 70.1 percent including dividends.

Furthermore, the S&P 500 has posted above-average annual returns in six of the last eight years.

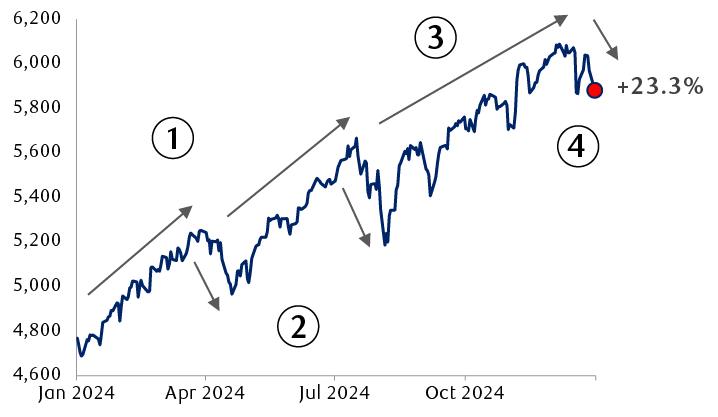

2024 was another strong year for the S&P 500 Index

Line chart showing the path of the S&P 500 Index in 2024 with text labels describing the rallies and declines during the year. The market initially rose from 4,769 when the year began to 5,243 in early April. It then pulled back, but started to rally again toward the end of April. It pushed up to 5,667 by mid-July. The rallies occurred because of better-than-expected economic and corporate earnings data, along with enthusiasm about AI. Then the market pulled back again through early August. This pullback and the one that preceded it coincided with retreats in AI stocks. The market then resumed its rally as AI stocks rebounded and economic and earnings data indicated resiliency, and later advanced following the election, rallying up to about 6,050 by early December. The market pulled back moderately toward year-end following the Fed's hawkish comments and renewed concerns about inflation. For the full year, the S&P 500 gained 23.3% in price terms (not including dividends).

- Stocks climbed in the first half of 2024 on better-than-expected economic and earnings data, along with enthusiasm about AI.

- The S&P 500 pulled back in both instances when AI stocks retreated.

- The rally resumed as AI stocks rebounded and on more economic and earnings resiliency, and later advanced following the election.

- The market pulled back toward yearend on hawkish Fed comments and renewed inflation jitters.

Source - RBC Wealth Management, Bloomberg; daily data through 12/31/24. 23.3% return does not include dividends; return with dividends is 25%

Economic growth much stronger than expected

The strong economy was a key reason why most major U.S. indexes and styles posted above-average gains again.

Wall Street economists started 2024 with a measly 1.2 percent annual GDP growth forecast, which was barely above what is known as “stall speed.” But month after month economic momentum built, and the forecast ended December at 2.7 percent, an above-average rate. (Q4 2024 GDP growth results will be announced in late January.)

Employment was sturdy during the year, wages grew faster than inflation, consumer spending rose at a healthy clip, and the services sector expanded notably. The main laggard was manufacturing, but this represents only a small share of domestic economic activity.

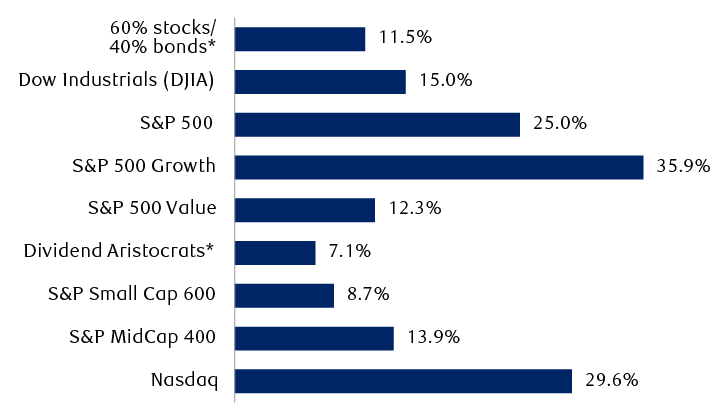

Most major U.S. indexes and styles posted above-average returns in 2024

Full-year total returns of key indexes and styles (includes dividends)

Bar chart representing the 2024 performance of major U.S. equity indexes and investing styles based on total return data including dividends. A 60% stocks/40% bonds portfolio gained 11.5%; the Dow Jones Industrial Average gained 15.0%; the S&P 500 gained 25.0%; the S&P 500 Growth Index gained 35.9%; the S&P 500 Value Index gained 12.3%; Dividend Growth investing proxied by the S&P 500 Dividend Aristocrats Index gained 7.1%; the S&P Small Cap 600 gained 8.7%; the S&P MidCap 400 gained 13.9%; the Nasdaq Composite gained 29.6%.

* 60/40 portfolio based on the MSCI World Index and Bloomberg U.S. Aggregate Index. Dividend Aristocrats based on S&P 500 Dividend Aristocrats Index.

Source - RBC Wealth Management, Bloomberg; data through 12/31/24

There was a wrinkle toward year end, however, and this has spilled over into 2025. Following the hawkish comments from the U.S. Federal Reserve in early December, equity market participants have kept a close eye on rising Treasury yields.

Even though RBC economists and most others expect GDP growth to persist in 2025, there is now a vigorous debate about how high Treasury yields can rise before they dent the economy and equity market. There is no line in the sand, but we think if the 10-year Treasury yield pushes closer to five percent or above, the S&P 500 and other major U.S. equity indexes could retreat further.

Enthusiasm about AI’s prospects

While seven of 11 S&P 500 sectors delivered handsome double-digit returns in 2024, the market was once again led by stocks leveraged to the artificial intelligence theme, otherwise known as the “Magnificent 7” (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla) and Broadcom, another AI-oriented stock.

NVIDIA, which produces the most powerful AI chips in the world, surged 171 percent for the year and contributed by far and away more to S&P 500 returns than any other stock, representing 22 percent of the index’s gains.

Six other stocks represented another 33 percent of the S&P 500’s return for the year. That left the other 511 stocks in the index making up the rest.

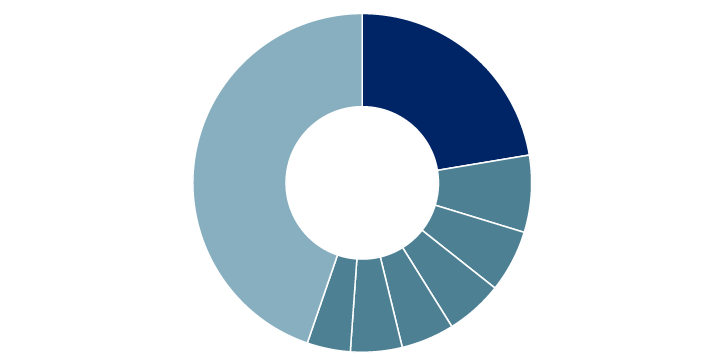

A small group of stocks represented a big portion of the annual gains

Contribution to the S&P 500 25% total return in 2024

The pie chart shows contributions to the S&P 500’s total return in 2024. 22% of the gains were from NVIDIA. 33% of the gains were from six other stocks, listed in order from largest to smallest contribution: Apple (7.35%), Amazon.com (5.94%), Meta Platforms (5.46%), Alphabet in both share classes (5.08%), Broadcom (4.93%), and Microsoft (4.14%). The other 511 stocks that were in the index during the year contributed 45% of the gains.

* The six stocks, from largest to smallest contribution to the S&P 500 total return, were: Apple, Amazon.com, Meta Platforms, Alphabet (both share classes), Broadcom, and Microsoft.

** 518 stocks were in the S&P 500 during 2024 (Alphabet counted once); a small number of stocks were included in the index for only part of the year.

Source - RBC Wealth Management, FactSet; annual total return data (includes dividends) through 12/31/24

Six of the biggest AI firms are estimated to have plunked down more than $165 billion in capital expenditures on the technology in 2024, a 50 percent jump from the very elevated 2023 level, according to Bloomberg Intelligence. This spending fueled optimism about future revenue and earnings growth.

We view AI as a foundational leap in technology and believe that multiple industries can benefit from it. But Wall Street often gets ahead of itself when pricing in groundbreaking technologies, and long-term winners can differ from those that initially lead the pack.

Also, a “show me the money” attitude started to develop in 2024 on company conference calls about the future potential revenue and earnings payback for the enormous amount of capital already spent. When analysts pressed management teams for answers, there were mostly vague responses. We think there will be a greater focus on AI return on investment in 2025 and beyond.

Easier money and falling inflation

Fed rate cuts and a further retreat in inflation also helped the equity market in 2024. From September through December, the Fed cut its benchmark rate by one percentage point (100 basis points). The Consumer Price Index declined from 3.4 percent at the start of the year to 2.7 percent by November. On this score, equity market participants largely declared “victory” over inflation. Both factors contributed to a broad group of sectors rallying during the year.

However, in recent weeks, there are signs market participants are having second thoughts. There are concerns that inflation might at the very least remain elevated above the Fed’s two percent target for longer or the inflation rate could increase, especially if the incoming Trump administration’s tariff policies are aggressive.

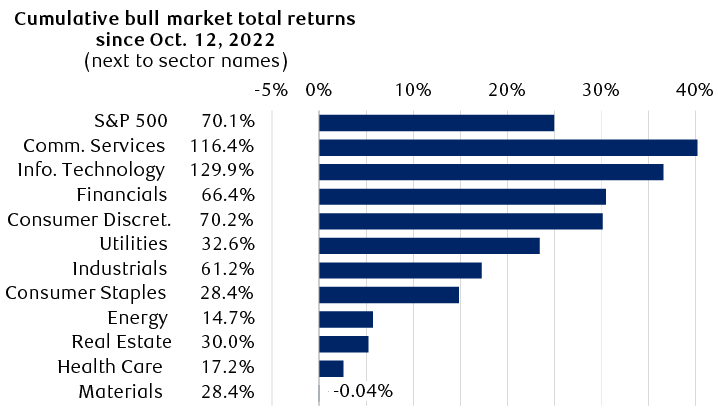

All but one sector rose in 2024, extending their bull market gains

S&P 500 and sector total returns (including dividends)

Bar chart showing S&P 500 and sector total returns in two ways: Cumulative return since the bull market began on October 12, 2022 and full-year 2024 returns. All data include dividends. The returns are as follows in this order: Cumulative bull market and 2024 annual. S&P 500: +70.1%, +25.0%. Communication Services +116.4%, +40.2%. Information Technology +129.9%, +36.6%. Financials +66.4%, +30.5%. Consumer Discretionary +70.2%, +30.1%. Utilities +32.6%, +23.4%. Industrials +61.2%, +17.3%. Consumer Staples +28.4%, +14.9%. Energy +14.7%, +5.72%. Real Estate +30.0%, +5.2%. Health Care +17.2%, +2.6%. Materials +28.4%, -0.04%.

Source - RBC Wealth Management, Bloomberg; data through 12/31/24

Earnings growth estimates flipped the script

Normally, S&P 500 consensus earnings growth estimates decline somewhat throughout the year, but in 2024 they increased, and this occurred despite the fact that most strategists viewed earnings expectations as elevated or even overly optimistic when the year began.

But here again, the AI stocks played an outsized role.

2024 earnings growth estimates for the six biggest AI stocks increased almost 33 percent from June 2023 through year-end 2024, while estimates for the rest of the S&P 500 declined 5.7 percent during the same period.

We think the earnings estimate trends for three large-cap categories—the biggest AI stocks, other technology stocks, and the rest of the S&P 500—will play a key role in shaping overall S&P 500 and sector returns in 2025.

As things stand now, the consensus forecast is for other technology stocks to grow earnings slightly faster than the biggest AI stocks, and for both of those categories to exceed the earnings growth of the rest of the market. However, as has been the case before, estimates can change a lot between categories as the year progresses.

Election-related optimism

The S&P 500 and other major indexes extended their gains following Donald Trump’s election victory and the Republican sweep of Congress. Investors embraced the notion that low tax rates on individuals could be extended and rates could be cut a bit more in some areas, and that corporate tax rates could at least remain low or be cut further for domestic manufacturers. Optimism about deregulation also fueled the move.

Last year, the equity market largely ignored Trump’s other major policy proposals such as tariff hikes and deportations, although both of these topics started to be considered and debated more toward year end.

While Washington policy rarely is the main factor in determining economic outcomes and equity market returns, we think market participants will be much more focused on this topic in 2025 than usual.

A considered approach

At this stage, RBC Capital Markets anticipates mid-single-digit gains for the S&P 500 in 2025. Already-premium valuations and frothy investor sentiment readings argue to us that the appropriate positioning for the year ahead in a global balanced portfolio would have equities at, but not above, the long-term target exposure. We recommend an approach that is “watchful, cautious, but invested.”

For more thoughts about this year, see our complete Global Insight 2025 Outlook, read the individual articles online, or review our Technical Strategist’s analysis.