Coming in “thick and fast”

A key pillar of the euro area growth recovery over the next few years is Germany’s renewed fiscal drive. According to RBC Capital Markets, recent announcements point to not only very sizeable, but also front-loaded, spending, in its words, “thick and fast.”

In a radical shift from many years of fiscal prudence, the German government announced in March that it would:

- Create a 10-year €500 billion infrastructure fund which would not count towards the government’s borrowing limit and

- Stop counting any defence spending above one percent of GDP towards that limit.

The Federal Ministry of Finance announced concrete figures behind these pledges in late June.

The German government is front-loading its special infrastructure fund, with around €58 billion by 2026, alongside some €25 billion in annual defence spending. Peak stimulus and the deepest fiscal deficit are penciled in for 2026.

Moreover, the details released by the Finance Ministry show that a high share of the spending is going to areas which should boost economic growth. In 2025 alone, €22 billion, or about 0.5 percent of German GDP, is going to rail sector improvements. Furthermore, there is €4 billion per year for housing projections, €4 billion for digitalization, and €6.5 billion for education and childcare.

RBC Capital Markets expects this spending to be a substantial stimulus for German and, therefore, euro area growth in 2025 and 2026, though the stimulus should fade beyond that point. This increases RBC Capital Markets’ confidence in its slightly above-consensus growth estimates of 1.3 percent and 1.5 percent, respectively, for this year and next for the bloc as a whole.

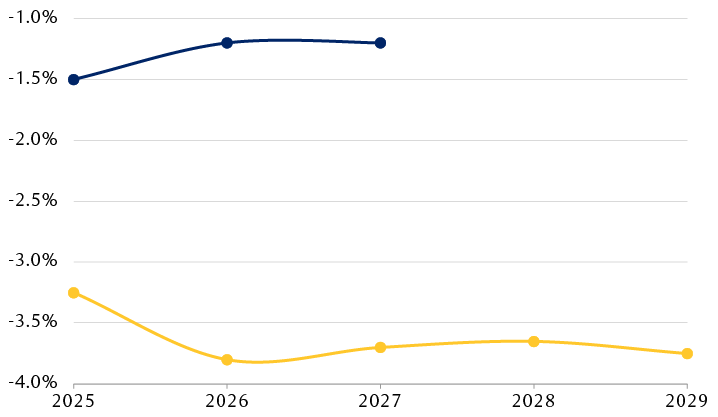

Front-loaded spending will deepen Germany’s deficit

German Finance Ministry’s deficit expectations (% GDP)

The graph shows the German Finance Ministry’s expectations for the country’s deficit as a percentage of GDP at the beginning of the year and after the spending announcement. While the ministry previously expected the deficit to be 1.5% of GDP for 2025 and 1.2% for 2026 and 2027, it now expects the deficit to hover between 3% and 4% of GDP for the next five years.

Source - German Finance Ministry, Bundesbank, RBC Capital Markets, RBC Wealth Management

The trade deal beyond the headlines

The U.S. and the European Union (EU) reached a deal in late July that introduces 15 percent tariffs on most EU exports, including automobiles, pharmaceuticals, and semiconductors. Tariffs on steel and aluminium remain subject to global tariffs of 50 percent, though discussions are ongoing regarding possible reductions.

Furthermore, the European Commission, which negotiated the terms of the deal on behalf of member states, committed to the EU investing $600 billion in the U.S. economy and purchasing $750 billion in U.S. energy exports over the next three years.

Initially, the deal was poorly received in Europe. The 15 percent tariffs were higher than the 10 percent tariffs which had been in place since April 2025, so it seemed the EU had capitulated. This disappointed many observers given the EU market of 450 million people with high per-capita spending power is a geo-economic force.

We note, however, that the agreed-upon tariff is lower than the 30 percent U.S. President Donald Trump threatened in June. And while the 15 percent rate doesn’t compare as favourably with the UK’s 10 percent tariff, the torrent of trade deals with other trading partners announced since then feature tariffs that are at or above 15 percent, suggesting to us that the EU is not in a weaker competitive position after all.

The concessions made—the promise of higher European investment and energy purchases—cannot be fulfilled by the European Commission. While it has the authority to negotiate trade deals, it has no power over private investment, nor does it have the authority to tell companies where to buy energy. The RBC Capital Markets Commodity Strategy team is skeptical that $750 billion in U.S. energy can be delivered to the EU in the next three years.

Finally, the EU has not given up regulating U.S. multinationals on European soil, nor its power to impose a digital services tax (it still holds those valuable cards).

Meanwhile, it appears that Trump has abandoned the idea of treating the value-added tax—a sales tax typically over 20 percent—levied by EU member states as an unfair tax barrier to U.S. exports.

Overall, we believe this deal is not as disadvantageous to Europe as early reactions have suggested.

Buoyed sentiment?

After a strong start to the year, and a swift recovery from the April 2 reciprocal tariff announcement correction, European equities have stalled this summer, their performance overshadowed by that of the U.S. tech sector and currency moves. But overall, the STOXX Europe ex UK Index has still returned over 13 percent year to date in local currency terms (including dividends), ahead of the S&P 500’s 9.5 percent return in dollar terms. Thanks to the significant U.S. dollar weakening versus the euro this year, returns of the STOXX Europe ex UK are around 28 percent in U.S. dollar terms.

Performance has been driven by value stocks including banks (up almost 60 percent in local currency), with construction and materials, insurance, and utilities all gaining more than 20 percent. Most quality stocks have underperformed, partly reflecting the market rotation into value but also a range of idiosyncratic factors resulting in earnings downgrades.

Looking forward, we believe a diplomatic resolution to the Ukraine conflict could act as a positive catalyst for European equities. Hope of reconstruction efforts could arise though this would require hostilities to come to a sustainable end. If that were to be the case, banks, particularly those with Central and Eastern Europe exposure, would likely benefit, in our opinion, as would construction and aggregate firms. Lower energy prices, thanks to reduced transport and insurance costs, could also benefit the region but the price improvement is likely to be marginal as EU sanctions on Russia will likely persist, even with an eventual ceasefire.

Overall, while sentiment could improve in the short term for European risk assets on the back of seemingly successful diplomatic efforts, we caution against being overly optimistic about an immediate, lasting end to the hostilities as the issues associated with this are complex.

Regardless, in our view, the investment case for Europe remains, based on an economic recovery thanks to lower interest rates, the German fiscal programme, and the EU’s commitment to investing in its defence industry. The STOXX Europe ex UK Index trades at 16.2x the next-12-months consensus earnings forecast, slightly above its long-term average, a premium we believe is warranted given the region’s improved medium-term growth outlook.

We continue to prefer sectors we think are likely to benefit from the fiscal stimulus, such as select industrials, including defense, and materials. In our view, banks should benefit from the region’s improved medium-term growth outlook, while continuing to offer attractive dividends and share buybacks opportunities.

With contributions from Thomas McGarrity, CFA