Europe equities

Europe is beginning to tackle its structural issues, possibly paving the way for substantial and lasting change. The introduction of new fiscal measures, with the EU aiming to boost defence spending and Germany spending more on infrastructure, should provide some support to the economy even as U.S. tariffs act as a headwind.

U.S.-EU trade tensions centre on EU food hygiene standards and the region’s digital and value-added tax provisions. The EU’s offer to purchase U.S. LNG and defence equipment or cut its own industrial tariffs on the U.S. to zero may not be sufficient to prompt the U.S. to lower its tariffs on the EU. As it stands, the average U.S. effective tariff rate on EU goods now reaches 11 percent. This is a significant increase from the two percent rate in effect at the beginning of the year and it poses a substantial headwind for exporters. If a trade framework is not agreed to soon and the U.S. does not back down from current tariffs in place, then we believe the EU is very likely to retaliate by raising tariffs on up to €100 billion in U.S. imports. Such an escalation would likely hit European GDP growth this year.

Europe, especially Germany, has resorted to fiscal stimulus amid possible U.S. security and defence support cuts in the region. We expect this stimulus could lift the EU GDP by some 0.3 percentage points in 2026 and 2027, mitigating the impact of tariffs. RBC Capital Markets expects GDP growth for the euro area to reach 1.6 percent in 2026.

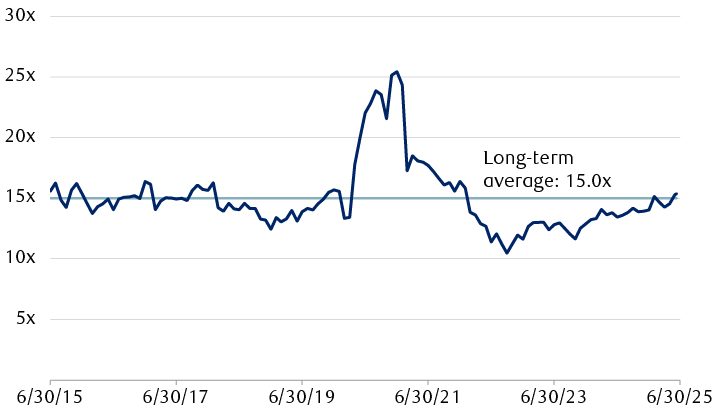

The MSCI EMU (Economic and Monetary Union) Index, a proxy for European equities, trades at a price-to-earnings valuation of 15.4x 12-months forward consensus earnings forecast, roughly in line with its long-term average. It also trades at a discount to U.S. equities even on a sector-adjusted basis. We prefer sectors likely to benefit from the fiscal stimulus, such as select industrials, including defense, and materials. In our view, banks should benefit from the region’s improved medium-term growth outlook and a steeper yield curve, while continuing to offer attractive shareholder returns via dividends and share buybacks. We are mindful that sectors subject to tariffs as well as those exposed to a strong currency are less likely to outperform.

European equities trade roughly in line with the historical average

MSCI EMU (Economic and Monetary Union) Index 12-month forward P/E ratio

The line chart shows the 12-month forward price-to-earnings ratio for the MSCI Economic and Monetary Union Index, a proxy for European equities, from June 2015 through May 2025. The average over this time period is 15.0x forward earnings. The index currently trades at 15.4x.

Source - RBC Wealth Management, Bloomberg; data through 6/10/25

Europe fixed income

We view European Central Bank (ECB) policy rates as “well positioned,” suggesting a pause in July, but not marking an end to the rate-cutting cycle. Should growth surprise to the downside, in our view, the ECB in September would make one additional 25 bps cut with a terminal interest rate of 1.75 percent.

In our opinion, lower wage pressures, lower energy costs, and a stronger euro will continue to support the 2025 disinflation process to meet the ECB’s 2.0 percent inflation target. Economic growth going forward will be impacted by the effective U.S. tariff rate likely remaining above pre-April 2 levels, and we think the surge in Q1 GDP growth is unlikely to persist into Q2–Q4. Despite these challenges, RBC economists expect higher growth of 1.2 percent compared to ECB estimates of 0.9 percent in 2025 given the strength in Q1 GDP.

We believe most eurozone governments are likely to continue running sizeable deficits in the near term, and risks of fiscal sustainability could come to the fore. Germany has the fiscal headroom to borrow, but France and Italy already have fiscal restrictions given their high debt levels. Elsewhere, Spain, Portugal, and Greece’s debt levels are likely to improve, in our view. But euro area sovereign spreads relative to Germany have tightened, especially in the lower-rated nations and are now in richer territory. Therefore, we prefer an Underweight position in the near term. For long-term investors, we think 10-year German Bund yields above 2.60 percent present an opportunity to consider adding to positions.

Despite the trade policy headwinds, corporate fundamentals have remained stable with notable improvements in the technology and basic industrials sectors. High-yield bond default rates have ticked higher and are at levels last seen in 2011, so we prefer investment-grade bonds. Following the tariff-relief rally, credit spreads are now tight, and we expect widening, especially in high-yield bonds to year end. That being said, we think there are still opportunities in short-duration investment-grade bonds with compelling yields and an income cushion to mitigate against potential spread widening.