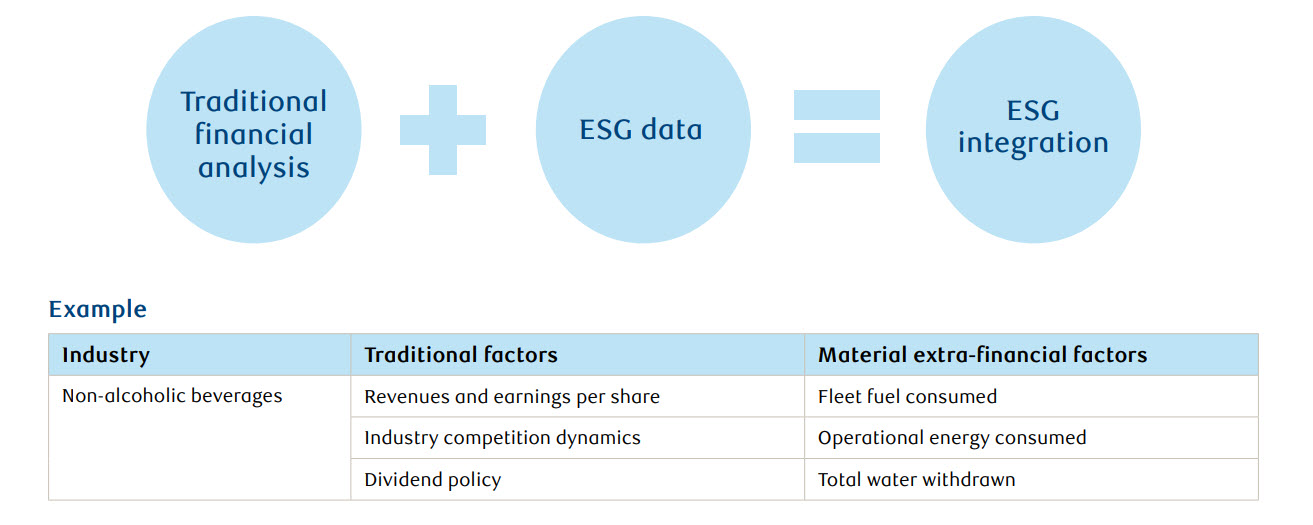

By nature, no sector or company is off limits, which means everything is investible. ESG integration deliberately incorporates and combines ESG data — or material extra-financial factors — alongside traditional financial analysis to identify potential risks and opportunities and improve long-term, risk-adjusted returns.

ESG Data: An additional layer of research

It is not about good versus bad companies or ratings, it’s about data that focuses on the factors that are likely to have an impact on a company’s financial performance, either today or in the future. This additional layer of data is used to check the blind spots when investing in companies or products. Using extra-financial data alongside traditional financial analysis can provide a more complete picture of potential risks and opportunities lurking in those blind spots. While the traditional factors listed in the table above are important in understanding the risk and return potential of an investment opportunity, consideration of material extra financial factors based on environmental features specific to the industry can help investors better understand strengths and weaknesses in the operations of various companies. For example:

- Fleet fuel consumed — Fleet fuel, such as diesel or unleaded gasoline, is needed to move vehicles to transport beverages, and fuel has a monetary cost. All else equal, using less fuel and diversifying fuels and/or fleet vehicles results in lower costs and higher profitability.

- Operational energy consumed — In the production of soft drinks, energy is consumed to light buildings, mix ingredients, bottle beverages, etc. But energy also has a cost, which can vary based on the source of energy. Lowering energy usage and/or investing in a diverse energy mix results in lower costs and higher profitability.

- Total water withdrawn — Water is a critical ingredient in beverages. While water is currently a low-cost input in much of the world, companies that source water from areas with high baseline water stress may be more exposed to risks stemming from droughts and other adverse events that can cause a company to reduce or pause operations.

Note that the set of extra-financial factors listed above are specific to the industry in question and vary from industry to industry. Those listed above may help an investor understand another beverage company, but would be less helpful in understanding an airline, a smartphone producer or a clothing retailer.

Divestment is not always the solution

It is important to look at business models and their future path forward. Companies can work to improve and enhance their specialization. For example, many leading companies investing in renewable energy or direct air capture capabilities are oil and gas firms.

Integrated extra-financial factors can provide insights to understand a more complete picture of a business or industry and position investors to make more informed investment decisions.

Notable investment considerations

- Time horizon of an investment — How will a company be impacted in five, 10, 15 and 20 years? Is it leading in market share? Improving its operations? Will parts of the business become absolute or stranded assets? Has the company experienced regulatory issues resulting in fines or workplace safety issues?

- Supply and demand — Today, fossil fuels are used to make almost everything. Turning off oil would dramatically impact lives. Consider consumer trends and how alternative sources will impact the future supply and demand levels as they are brought to market and scaled.

- Capital expenditures — Is a company investing in innovative technologies like direct air capture or carbon sequestration to help lower its carbon footprint? Is it preparing for future policies, regulations and/or potential carbon taxes?

Know what you own inside your portfolio. Is ESG data utilized or integrated? If so, understand how the data is being used. By integrating ESG data, it provides a more complete view of companies and can lead to fewer blind spots to worry about when making investment decisions. Material ESG factors vary according to industry. See the chart below for examples.

Examples of material factors

| Industry | Sub-industry | Some ESG factors material to the sub-industry as per SASB |

|---|---|---|

| Consumer Goods | Apparel, Accessories, & Footwear |

|

| Extractives & Minerals Processing | Oil & Gas |

|

| Financials | Insurance |

|

| Food & Beverage | Processed Foods |

|

| Health Care | Drug Retailers |

|

| Infrastructure | Electric Utilities & Power Generators |

|

| Renewable Resources & Alternative Energy | Wind Technology & Project Developers |

|

| Resource Transformation | Chemicals |

|

| Services | Hotels & Lodging |

|

| Technology & Communications | Telecommunication Services |

|

| Transportation | Automobiles |

|

Source: Sustainability Accounting Standards Board (SASB)

Looking for additional insights about responsible investing?

Download our Q4 2023 Insights into responsible investing newsletter