In the world of finance and economics, few topics generate as much debate and concern as the issue of the debt ceiling. The debt ceiling refers to the legal limit imposed on the amount of money the government can borrow to fund its operations and meet its financial obligations. When this limit is reached, a series of complex and potentially damaging consequences can unfold.

Understanding the Debt Ceiling:

The debt ceiling is a mechanism designed to control government borrowing and prevent excessive debt accumulation. It sets a cap on the total amount of money the government can borrow by issuing Treasury securities. When the debt approaches or reaches this limit, the Treasury Department must take measures to avoid defaulting on its financial obligations.

Challenges and Consequences:

Political Gridlock: Raising or suspending the debt ceiling requires the approval of Congress, often leading to partisan battles and political gridlock. Debates surrounding the debt ceiling become opportunities for lawmakers to push their own agendas, which can delay or complicate the decision-making process. This uncertainty and political brinkmanship can have severe consequences on financial markets and economic stability.

Credit Rating Risk: Failure to raise the debt ceiling in a timely manner can significantly impact the government's creditworthiness. Credit rating agencies may downgrade the government's credit rating, making it more expensive for the government to borrow in the future. Moreover, a credit rating downgrade can have a ripple effect on other financial markets, increasing borrowing costs for businesses and individuals alike.

Market Volatility: The uncertainty surrounding the debt ceiling can trigger market volatility. Investors become wary of the potential consequences of a U.S. default, leading to increased market turbulence, plummeting stock prices, and higher borrowing costs. This volatility can reverberate globally, affecting economies and financial systems worldwide.

Economic Fallout: Failing to raise the debt ceiling can have dire economic consequences. The government may be forced to implement drastic spending cuts, reducing funding for essential programs and services. Social security payments, military salaries, and other critical obligations may be jeopardized. Moreover, a default on U.S. debt would shake global confidence in the stability of the U.S. dollar, potentially triggering economic crises on a global scale.

Potential Solutions:

Raising the Debt Ceiling: The most straightforward solution to the debt ceiling issue is for Congress to raise or suspend the limit, allowing the government to continue borrowing and meeting its financial obligations. However, as mentioned earlier, this often becomes a contentious political battle, with lawmakers using it as an opportunity to negotiate other policy objectives.

Long-term Structural Reforms: Some experts argue for long-term structural reforms to address the underlying issues that contribute to the growth of the national debt. This could include measures such as reducing government spending, implementing tax reforms, and improving fiscal responsibility.

Eliminating the Debt Ceiling: Another perspective suggests eliminating the debt ceiling altogether, arguing that it serves as an unnecessary and potentially harmful constraint on the government's ability to manage its finances effectively. However, this approach raises concerns about the potential for unchecked government borrowing.

The debt ceiling presents a complex and challenging issue that requires careful consideration and responsible action. Failing to address the debt ceiling in a timely and constructive manner can have far-reaching consequences on financial markets, the economy, and the livelihoods of individuals. Finding a sustainable and politically viable solution is crucial to ensuring fiscal stability and protecting the long-term economic health of the nation. Ultimately, a well-informed public and productive bipartisan cooperation are essential in resolving the debt ceiling dilemma and ensuring a financially secure future.

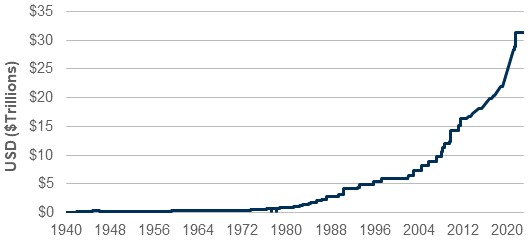

Historical U.S. Debt Limit

Source: U.S. Treasury. Data from 6/25/1940 – 5/15/2023.