Our Process

Our Process

i) Discovery

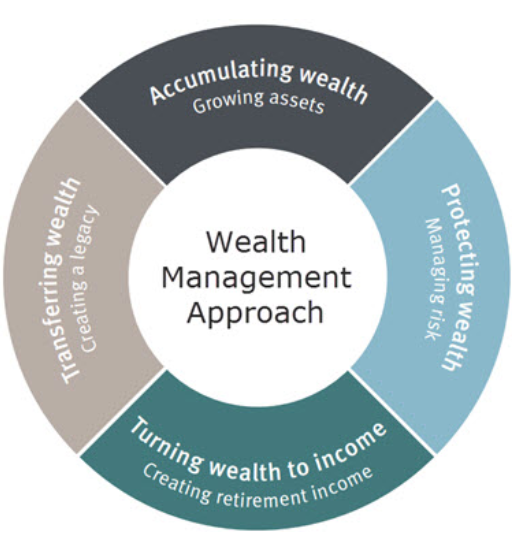

We know that as your estate has grown, so have the complexities of managing your wealth. Our first step is simply to talk with you and discover what is important to you. During our initial conversations, we encourage you to take the lead as we seek to learn your unique goals and priorities. We develop a deep understanding of your concerns, as we know that clients almost always have some financial worries, regardless of their net worth. In these discussions, we also explain the role we play and the value we add through our holistic approach to wealth management.

ii) Plan Development

Armed with an understanding of your priorities, concerns, and risk tolerance, and after analyzing your current portfolio, our team meets with you to present a holistic wealth plan and suggested investment strategies tailored to your unique financial picture. We explain our proposal using familiar language stripped of opaque financial jargon and confirm with you that it reflects your life goals. We then refine the plan based on your feedback.

iii) Plan Implementation

Leveraging our expertise, deep industry knowledge, investment management relationships, and the world-class resources of RBC, we execute your customized plan. To meet our clients’ complex needs beyond implementing investment strategies, we offer specialized services across a range of areas, including estate planning, education planning, insurance, long-term care, business succession, charitable gifts, taxes, and mandatory distributions. When appropriate, we also coordinate with your existing network of professionals.

iv) Continuous Collaboration

Throughout the year, we review your goals and evaluate whether we are on track. We also encourage our clients to recognize that the planning and implementation stages are rarely “one-and-done” steps. Your priorities may evolve and unexpected events may occur, so we work with you to modify your plan and its implementation based on your changing circumstances. Finally, we are passionate about educating future generations on how to steward your wealth, and we welcome the opportunity to meet and work with your children and grandchildren.