Keen interest

Japanese stock indexes have risen dramatically for the past 18 months. The Nikkei 225, a traditional index which ranks 225 stocks in the Tokyo Stock Exchange by price, recently breached its 34-year high. The TOPIX, a more modern index based on market capitalization, had already broken out of its long-held trading range in June 2023.

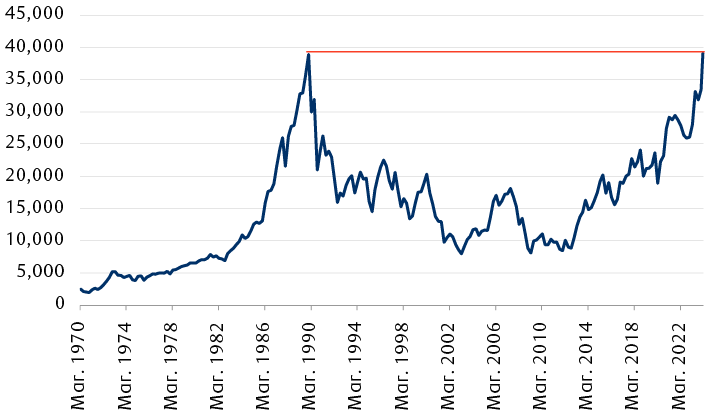

Nikkei 225 Index breaches 34-year high

Line chart showing the Nikkei 225 Index from Mar. 31, 1970, through Feb. 22, 2024. The index level was 2,523 on Mar. 31, 1970, and reached a peak of 38,915 on Dec. 29, 1989, then declining to 8,109 on Mar. 31, 2009. Since then, it has slowly clawed back its losses and due to much better performance since 2023, it recently breached its 1989 peak. As of Feb. 22, 2024, the index level was 39,099.

Source - RBC Wealth Management, Bloomberg; quarterly data through 2/22/24

Several factors conspired to attract investors’ attention to Japanese equities.

- The return of inflation: Having endured bouts of deflation in the past two decades, inflation made a welcome return after the COVID-19 pandemic. This heralded a sea change in corporate behaviour, enabling companies to increase prices and suggesting profitability could improve.

- Corporate governance reforms: The Tokyo Stock Exchange introduced important corporate reforms last year, a follow-up to reforms introduced under former Prime Minister Shinzo Abe in 2012. The government shamed the corporate sector for its notoriously low returns and demanded change. As a result, many companies adopted more shareholder-friendly measures, improving disclosures, growing dividends, and announcing share buyback programmes. Many companies are dismantling old cross shareholdings structures (when companies own shares of other companies), freeing up capital that can be used to improve returns: Toyota Motor reduced its stake in telecom company KDDI, Fujitsu sold its chip packaging subsidiary Shinko Electric, while Nippon Steel and Hitachi have announced similar restructuring plans. Much more appears to be in the offing.

- According to a Tokyo Stock Exchange list issued last month, only about one-third of the companies trading on the exchange have announced plans to improve shareholder returns. By divulging company names and using peer pressure, we expect the Tokyo Stock Exchange will encourage more companies to announce plans improve shareholder returns.

- The results of the reform are already apparent, in our view. According to Bloomberg, 60 percent of companies trading on the TOPIX now trade above book value, up from 50 percent a year ago.

- Savings reforms: The Japanese government recently revamped the Nippon Individual Savings Account (NISA), a tax-free stock investment program for individuals, by expanding annual investment limits and granting indefinite tax-exemption periods. Given that as of September 2023, 52.5 percent of Japanese households’ financial assets were held in cash, or almost twice the size of the Japan GDP, the new NISA could drive domestic retail demand for stocks.

- Chinese stocks proxy: In a world of increased geopolitical tensions, Japan may be seen as a proxy for investing in China.

Stabilization ahead

The Tokyo Stock Exchange reforms are an attempt to shake up a corporate sector suffering from a disappointing domestic economy, in our opinion. After a promising H1 2023, Japan’s economy finished 2023 on a subdued note. Q4 2023 GDP numbers pointed to a 0.1 percent quarter-over-quarter contraction, on the heels of Q3’s more severe 0.8 percent contraction. We believe the main culprit was weak domestic demand, as inflation kept shoppers at bay.

Yet, we think there are reasons to believe the outlook will stabilize. Monthly trade data and economic indicators such as the Tankan Business conditions, both manufacturing and non-manufacturing, suggest that business conditions across all industries were the strongest in five years.

Meanwhile, Japan also benefits from the friendshoring and reshoring trends. Companies aiming to extract themselves from Chinese supply chains and build capability in strategic industries on its allies’ terrain see Japan as a stable environment. The trend is particularly apparent in the semiconductor industry with both a joint venture between Taiwan’s TSMC and Japan’s Sony, and government support of its own local semiconductor industry.

Positive real wage growth should also help consumption recover. Already at 3.6 percent last year, wage growth will likely accelerate as labour shortages and high corporate profits entice companies to increase wages and secure the necessary labour force. A Nikkei survey of CEOs suggests that 80 percent of them expect wage growth between four and nine percent. This spring’s Shuntō annual wage negotiations, during which thousands of unions will simultaneously negotiate wage agreements with employers, are key to watch, in our opinion.

Treading a fine line

The Bank of Japan (BoJ) has been hesitant to tame above-target inflation by ending its long-held negative interest rate policy for fear of knocking its already subdued economy further off course. Yet, maintaining a loose monetary policy is markedly weakening the yen, contributing to inflation.

Inflation above the two percent target for close to two years, as is the case in Japan, would have spurred most western central banks into a tightening cycle. But the BoJ is moving very carefully. Memories of tenacious deflation are still fresh, and consumption is brittle, given Japan’s mature population (average 49 years old vs. 39 in the U.S.). Hiking rates too quickly could risk crashing the economy.

But loose monetary policy, with 10-year yields on JGBs, Japan sovereign bonds, below one percent compared to 4.2 percent in the U.S., has markedly weakened the yen, close to 40 percent against the U.S. dollar, since 2021.

A weak yen has been a boon for exporters but a headache for importers, and it is fueling inflation.

The BoJ is mulling over its first rate hike in 16 years. Markets are priced for a 0.10 percent rate hike by June and a full 0.25 percent by year end. Such careful moves are unlikely to throw the economy off course. And with other central banks cutting rates this year, the interest rate differential with Japan will diminish, in our opinion, alleviating the pressure on the yen. RBC Capital Markets’ forecast is that the yen, as weak as 150 to the U.S. dollar recently, could reach 145 to the U.S. dollar at year end 2024.

Overall, the Bloomberg consensus expectation is for Japan’s GDP growth to reach 0.8 percent this year, suggesting Japan will emerge from its technical recession.

More to go for

We continue to suggest an Overweight position in Japanese equities. A period of consolidation is possible given the recent strong rally, but TOPIX earnings growth could increase by a strong 10 percent in 2024, according to Bloomberg consensus, largely thanks to the corporate governance reforms and the return of inflation as consensus expects. Moreover, valuations remain in line with the 20-year median, at 15.9x this year’s earnings. This is in contrast to several other equity markets such as the U.S. and emerging markets which trade much above their long-term median valuations.

We prefer consumer sectors as higher real wages should encourage consumption, selective stocks in the financial sector as slightly higher interest rates should help profitability, and high dividend stocks that could benefit by retail fund flows under the new tax-efficient investment scheme.

With contributions from Jasmine Duan