My mother dug up my baby book last week when I asked her for a graduation photo to use on LinkedIn. She and my father called me as they tearfully paged through the yellowy-hued photos from the 70s and took turns reading aloud from a letter they wrote when I was 3 and a half. They had sealed it in an envelope and written on the outside, "For Cole on her 21st birthday."

In many ways, their predictions were spot-on. Eerily so. They suggested I might prioritize children over a career and that I would be picky when it came to a life partner. They wrote that I might not like having to report to a boss and that I knew that just by smiling I could open doors. But while my behaviors and psychology may have been written in my DNA, I hope there's still room for variation in the script. It made me want to write a new letter, to my 65-year-old self, like a time capsule set to check in and see if 15 years is long enough to become the person I want to be.

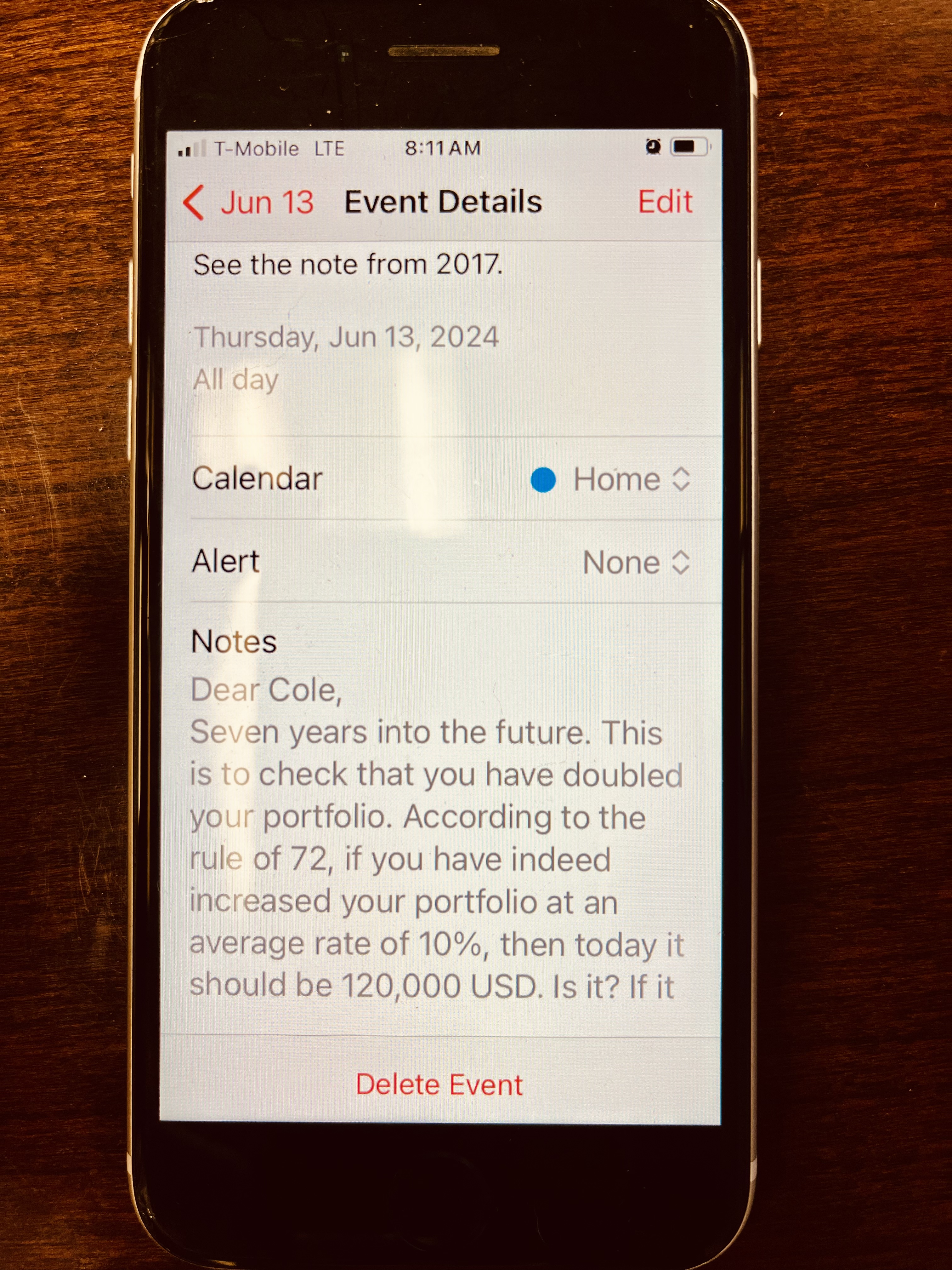

This was not the first blast from the past I received of late. In June I noticed an event on my calendar that read, "Check portfolio: See the note from 2017." I had no recollection of writing this message to myself, but it was an entertaining check-in. I called my husband Greg and told him I would be taking him out to dinner.

This was not the first blast from the past I received of late. In June I noticed an event on my calendar that read, "Check portfolio: See the note from 2017." I had no recollection of writing this message to myself, but it was an entertaining check-in. I called my husband Greg and told him I would be taking him out to dinner.

How often do you check in?

As I grow older, time seems to pass more quickly - hastened partly, I believe, by the pace of modern life and all the many small tasks we have to accomplish in a day. This can make it hard to stop for a moment and check in on ourselves.

I see this with new clients when we sit down for a planning session. The hardest and most time-consuming step is gathering all the information - the statement from that old TIAA account you had when you were a substitute teacher in your first year out of college; the life insurance policy you bought during your first marriage that might still have your ex as beneficiary; social security statements; the lingering balance in an old 529 account.

As hard as it is to dig it all up, I have yet to meet someone who did not feel that it helped them get a clearer picture. After that's done, it's my job as a planner and advisor to set the course for your goals - and then to make sure you check in.

A meeting a year will get you from here to there

There's research that shows how weighing yourself daily tends to lead to weight loss, while semi-weekly weigh-ins, not so much. For everything, there is a balance. Common wisdom tells us that we should not check our investments ever day, but is there an ideal frequency - a recommended schedule for financial health? As advisors, we are required to check in with our clients at least annually. At the very least, this helps us confirm that your heart's still beating!

When I told a prospective advisor that she would talk to some clients monthly, she was surprised. "What could possibly change in a month?" I listed off a few things that had happened in the lives of my clients recently: a death in the family that led to an inheritance created a domino effect of complex planning decisions that took a year to enact. A couple who wanted to change their will and the heirs on their retirement accounts. Divorces are always multi-stage processes that require planning and action before, during and after. It's never done.

You may find this surprising, but while I used to check my portfolio every morning, since I became an advisor, I have barely looked at it. I check my client's portfolios and I check the market, but I have my own on cruise control. I did set another reminder, however, for June 2031. If all goes well, I'll be doing a little more than taking Greg for a nice dinner out.

PS

If you're a client of ours, and you want to check in on your plan, did you know you can log into the portal and click "planning"? From there you can view prior plan reports, and even click on The Play Zone to adjust your savings or retirement age and see the impact on your plan.