The multi-billion-dollar global sports ecosystem is evolving, and the landscape for women athletes, franchises and leagues is positioned for unparalleled expansion.

Historically, professional women’s sports have not had the same access to mainstream platforms and financial resources as their male counterparts. However, attendance, media rights and viewership are building—as seen with the National Women’s Soccer League (NWSL) and Women’s National Basketball Association (WNBA)—and the steady stream of new investments in women’s sports signals a significant shift across the sports ecosystem.

Dedicated to supporting women’s sports across several important areas, RBC launched a research series in partnership with Wasserman and The Collective, Wasserman’s women-focused division. Part 1 of The New Economy in Sports report examined the athlete income gap and the opportunities women athletes present to brands, sponsors and investors.

Part 2 of the report seeks to:

- Highlight the growth trajectory and increasing valuations of women’s sports teams

- Illustrate the impact of audience engagement on league value

- Provide investors with the framework needed to make informed decisions about entering the rapidly expanding women’s sports ecosystem

The impact of audience engagement

Women athletes have a passionate, purpose-driven fanbase that rewards brands, teams and owners. Live gameday attendance for the WNBA increased by 48 percent year over year, and attendance for the NWSL rose 42 percent year over year.

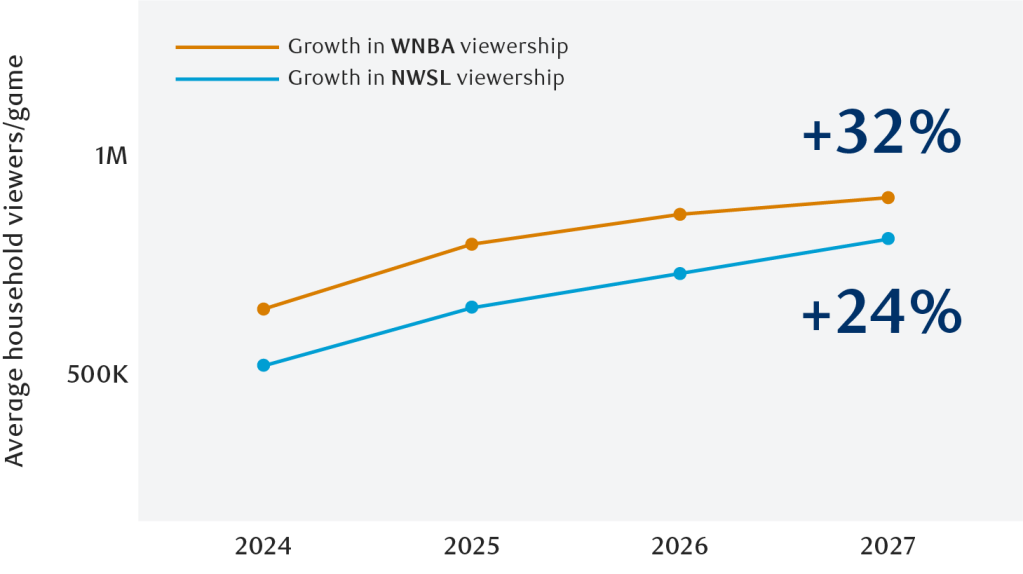

Growth isn’t limited to game attendance. Over the next three years, each league’s broadcast viewership is projected to increase: +32 percent for the WNBA and +24 percent for the NWSL. The organic expansion of live and broadcast audiences will drive over 63 percent of the new value for league teams.

Additionally, shorter cycles for media rights deals are more common in women’s sports, presenting more opportunities for leagues to increase revenue and accelerate value with each renewal, unlike the decade-long commitments typical in men’s league deals.

Projected growth of broadcast audience

The anticipated growth of women’s sports franchises

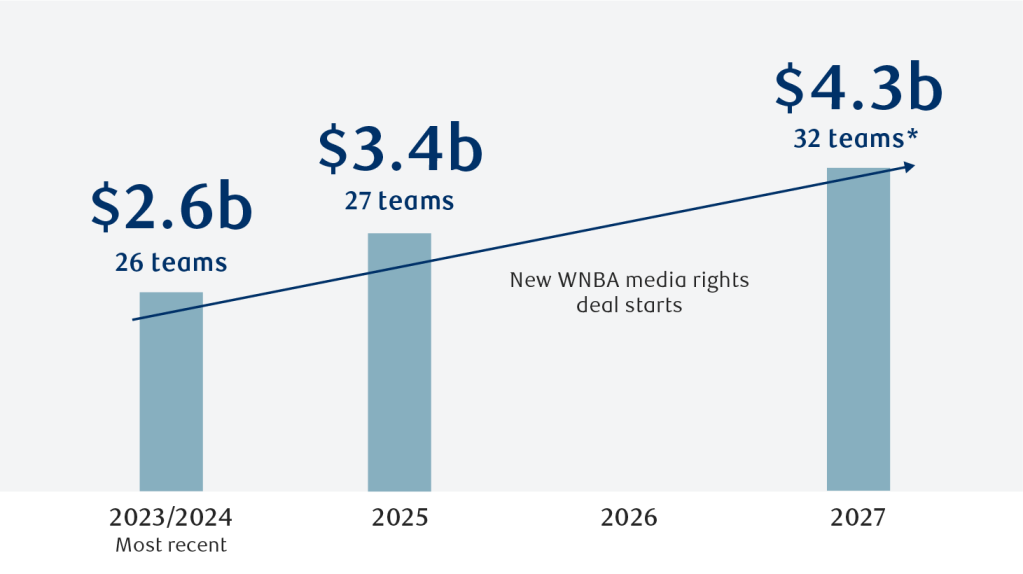

Over 40 characteristics, from market dynamics to team performance, were used to analyze two of the most established women’s sports properties: the NWSL and the WNBA. Based on this analysis, total team valuations are predicted to increase from $2.6 billion in 2023/2024 to $4.3 billion in 2027—a gain of over $1.6 billion in new value over the next three years.

Another driver in these valuations is high-value sponsorship. For example, a jersey patch sponsorship for a high-value NSWL or WNBA team can sell from $1.7 to $2.1 million annually.

There is further room for growth, as the estimated $4.3 billion in team valuations does not include infrastructure development or the new WNBA media rights deals starting in 2026.

Valuation projections for NWSL and WNBA

Badenhausen, K. (2024, September 25). NWSL Franchise Valuations Ranking List: From Angel City FC to Chicago Red Stars. Sportico.com. *Projected expansion.

New ownership models fuel investment

Brands, owners and investors have an opportunity to champion women athletes and make a lasting impact in women’s sports.

While individuals or families with majority stakes are the most common form of ownership in men’s and women’s professional sports (over half of the teams in the WNBA and NWSL), this legacy model is becoming less common with new leagues and teams. In fact, independent women’s teams—teams owned and operated without affiliation or shared ownership with a men’s team—are more likely to feature diverse ownership groups and corporate ownership through equity or investment firms.

“To fully understand the full picture of women’s team sport ownership, we complement quantitative analysis with an overview of innovative investment models and stakeholder perspectives on the biggest opportunity in sport today,” says Thayer Lavielle, executive vice president of The Collective.

Evolving investment structures in the women’s sports ecosystem

Professional women’s sports present a strong growth opportunity, with new investment vehicles available to help investors tap into this potential.

First-mover advantage

Many new teams and leagues are adopting a new investment model known as Simple Agreements for Future Equity (SAFEs) to attract early-stage investors with discounted equity upon achieving key milestones, such as successful subsequent funding rounds.1

For example, World Elite Rugby recently raised $500,000 through a SAFE before launching a broader seed round.2

Infrastructure-based investment

Women’s pro sports leagues have clear development needs, such as dedicated game and practice facilities, media creation and production capabilities, and player salaries and benefits. Some teams are creating a unique asset class linked to infrastructure projects, offering investors a defined exit timeline based on revenue growth.

In May 2024, the ownership group of Chelsea’s Women’s Soccer League team sold a minority stake to fund team promotion and infrastructure development, increasing the team’s valuation to £200 million.

Elevating the game

Women’s sports represent a rapidly growing sector and a compelling catalyst for change. The combination of high growth, a rapidly increasing audience, projected league expansions and additional leagues in development present a compelling case for investing in an industry focused on equality, diversity and sustainability. “Whether through team ownership or strategic partnerships, professional women’s sports are good business and good for business,” says Luana Harris, managing director of RBC Sports Advisory at RBC Wealth Management.

Read the full report

Learn more about the positive momentum of women’s sports, including additional insights on its ecosystem and the opportunities it presents to investors, in “The New Economy of Sports – Part 2: New Investment and Growing Valuations in Professional Women’s Sports.”