The Federal Reserve’s July 30–31 meeting took place approximately one year since the most recent rate hike of the cycle. Historically, though, it is usually the approximate point at which the Fed has delivered the first rate cut of the next cycle.

But, as widely expected, policymakers left rates on hold once again as Fed Chair Jerome Powell acknowledged that “The overall sense of the committee [is] that we’re getting closer to the point at which it will be appropriate to begin to dial back restriction.” To us, and certainly in the eyes of the market, that implies the Fed will all but certainly begin to dial back policy rates at its September 17–18 meeting.

Is patience really a virtue?

We think the Fed should be applauded for its patience and stability in recent months and quarters, standing firm in the face of market expectations which have been both volatile and, at times, quite extreme. But the market reaction in just the 24 hours since the meeting’s conclusion has us wondering whether that virtue is now at risk of becoming a failure.

Treasury yields had already been in a state of a steady decline since the 2024 highs in April, but the drop has gathered steam this week, to say the least. Both the five- and 10-year Treasury yields traded below the four percent level for the first time since the beginning of the year.

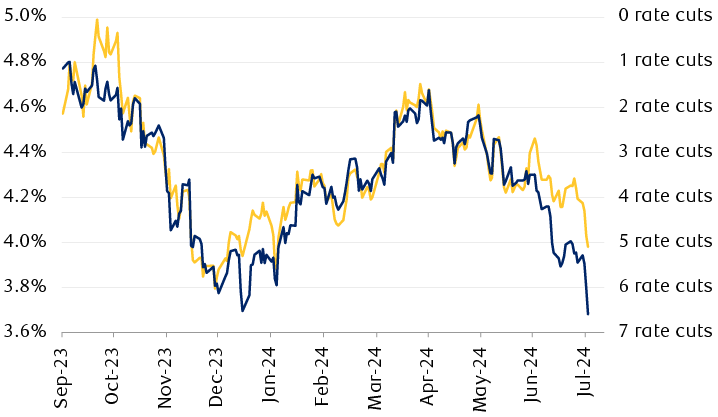

As the first chart shows, the 10-year yield has closely tracked the evolution of Fed rate cut expectations over the past year, and those expectations have swelled to nearly seven rate cuts over the next year. With only eight Fed meetings each calendar year, that is teetering rather close to an implied 25 basis point cut at every meeting, a much faster cadence than the quarterly cut pace policymakers had projected as recently as June.

Markets again pricing an aggressive Fed rate cut campaign that could drag Treasury yields even lower

The line chart shows the 10-year U.S. Treasury yield and the implied number of 0.25% rate cuts over next 12 months, based on 1-year interest rate forward contracts, from September 2023 through July 2024. The number of expected rate cuts has closely tracked the Treasury yield. At the end of July, the Treasury yield was 5.28% and the market had priced in 6.6 rate cuts.

Source - RBC Wealth Management, Bloomberg; implied rate cuts over next 12 months based on 1-year interest rate forward contracts

As Powell also discussed, when deciding to begin cutting rates the Fed is always attempting to balance the risks of doing so too soon which risks reigniting inflation, and moving too late, which risks a recession and likely a greater degree of rate cuts as a response.

With the Bank of Canada having already cut rates twice, the European Central Bank once, and the Bank of England joining the rate cut fray just this week, our growing sense is that the Fed may be tempting fate given a favorable run of inflation data amidst a labor market that increasingly appears at risk of deterioration.

Data dependence and decaying data

To be sure, nothing the Fed did or said this week surprised markets. Teasing a September rate cut did little to move a market that has already been priced for it. Instead, economic data released this week, and ahead of Friday’s key nonfarm payrolls report, has suggested that not only is the labor market cooling—as the Fed has aimed to achieve—it may be getting cold. The decline in Treasury yields this week may be more attributable to the data than to the Fed, in our view.

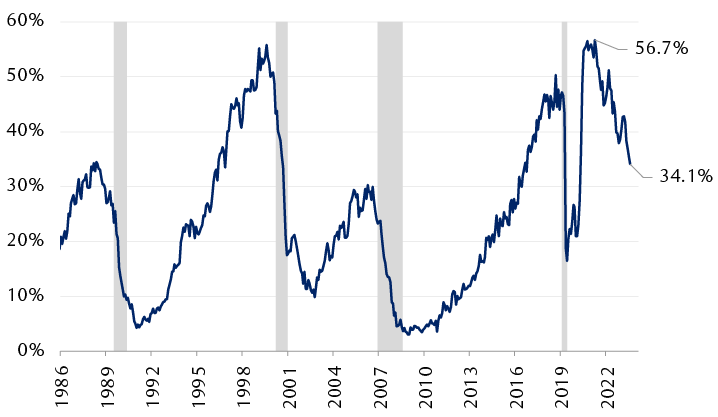

The Conference Board’s Consumer Confidence Survey showed that just 34 percent of those surveyed found jobs to be “plentiful,” while those viewing jobs as “hard to get” rose to 16 percent; the lowest and highest, respectively, since the pandemic. While Powell characterized the labor market as still strong and in a nearly ideal state of balance, similar to 2019, the second chart shows that the availability of jobs is not only notably lower than in 2019, but dropping at a pace on par with past recessions.

Cooling? Or simply cold?

Consumers sense a sharply tightening U.S. labor market

The line chart shows the percentage of respondents to the Conference Board’s monthly U.S. Consumer Confidence Survey who said that jobs are “plentiful” from December 1986 through July 2024. The percentage rose rapidly following the 2019 U.S. recession, but has declined from 56.7 in March 2022 to 34.1 in July 2024.

Percentage of respondents to the Conference Board’s monthly Consumer Confidence Survey (through July 2024) who say jobs are “plentiful.”

Source - RBC Wealth Management, Bloomberg

On top of that, the Institute for Supply Management’s survey of purchasing managers this week showed an employment index of just 43.4 percent, down from 49.3 percent in June; levels below 50 percent indicate contraction, greater than 50 percent expansion. The 43.4 percent reading is the lowest since the pandemic, and prior to that hadn’t been registered since the 2008–2009 recession.

Powell noted that policymakers will continue to assess the “totality” of the data before making a decision in September. But while there remains a lot of data to be released before then, we can’t ignore the risk that by then it may be too late.

Penalty box

All told, the market may be giving the Fed a pace-of-play penalty by pushing a rate cut to September, even as Powell acknowledged that there was a “real discussion back and forth of what the case would be for [cutting at] this meeting.” The market is now fully priced for three rate cuts this year with three meetings remaining; however, there remains a non-zero chance that if the Fed does decide to cut in September, it could be with a larger 50 basis point cut, which markets are now assigning a 20 percent possibility.

While the market moves this week and certainly signs from some of the data perhaps paint a somewhat gloomy economic outlook, we can’t ignore geopolitical developments this week out of the Middle East which are also weighing on risk sentiment and driving investors toward the presumed safety of sovereign bonds.

The U.S. economy and the labor market remain on rather solid footing, but there are risks—as is almost always the case. Following the Fed taking steps to extend duration in July, we continue to recommend that fixed income investors move to rotate out of cash and short-term securities to lock in current yields in longer-dated maturities. We are somewhat cautious on a 10-year Treasury yield below four percent, but would be buyers at any levels north of that in the coming weeks, and ahead of the Fed soon joining the global central bank easing cycle.