- A Trump presidency brings additional challenges to Europe, dimming the outlook for the region’s equities despite undemanding valuations.

- We think markets will continue to price in meaningful monetary policy easing from the European Central Bank until there is further clarity on U.S. tariffs.

European equities

Incoming U.S. president Donald Trump’s proposed 10%–20% blanket tariffs on all European imports bring considerable uncertainties. Tariffs would be a headwind to already meagre economic growth, even if not applied in their entirety. Europe is a very open economy and has a large goods trade surplus with the U.S. Moreover, should Trump proceed with imposing 60% tariffs on China, the latter may redirect its exports to other countries, potentially increasing competition further for Europe in these markets. Overall, European business sentiment is likely to suffer, in our view.

Such challenges could convince the European Central Bank to accelerate its interest rate cutting cycle. Given the tight monetary conditions of late, this could support the European economy, especially due to its high sensitivity to interest rates. Nevertheless, the domestic and geopolitical environments are complex and challenging for 2025, in our view.

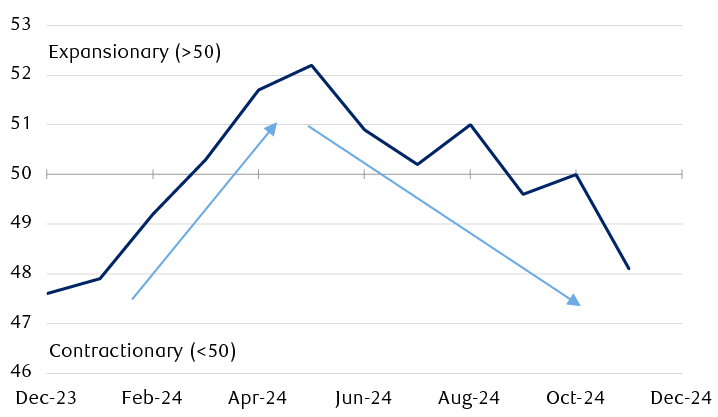

The European recovery seems to have petered out in mid-2024

HCOB Eurozone Composite Purchasing Managers' Index (PMI)

The line chart shows the HCOB Eurozone Composite Purchasing Managers Index (PMI), an economic activity indicator, during 2024. From 47.6 in January, the PMI rose above 50 and entered expansionary territory in March, then peaked at roughly 52 in May. It has since trended lower to a value of 48.1 in November.

Source - RBC Wealth Management, Bloomberg; data as of 11/22/24

The circumstances could prompt the EU to act with a sense of greater urgency to implement reforms to revitalize the economy and boost productivity. Investors hope that German elections in 2025 will result in more functional leadership, and that the newly appointed EU Commission and other national leaders will step up to promote unity. However, there are no quick fixes to the situation, from our vantage point.

Although the challenges seem reflected in modest equity valuations, we believe the notable near-term headwinds warrant holding a modest Underweight allocation in European equities.

Yet we believe Europe is a region primed for active stock picking rather than taking a passive index approach, as its equity market is not representative of its economy. Today, as much as 60% of listed European companies’ revenues derive from outside the region.

We would focus on world-leading companies that benefit from and drive global structural trends, particularly in niches such as semiconductor manufacturing equipment, electrical and mechanical engineering, industrial gases, and health care.

European fixed income

The European Central Bank (ECB) has to contend with diverging national economic growth, as the outlook for northern economies is markedly weaker compared to that of southern economies. The ECB will be weighing the potential 10%–20% U.S. tariff, which would be a significant blow to European exports. According to ECB Vice President Luis de Guindos, the imposition of U.S. tariffs would lead to weaker output and stronger price pressures, and disrupt the established trade flow. The tariff impact, and the response from the European Union, are difficult to gauge at present. We expect tariff negotiations; therefore, the impact will not be immediate, in our view. Against the pre-existing backdrop of weakening growth, we expect a cumulative 100 basis points (bps) of rate cuts from December through H1 2025 and view current market pricing of 125 bps as too aggressive. With output risks tilted to the downside, we think the Governing Council may be more comfortable easing policy at a slower pace should the potential tariffs be watered down.

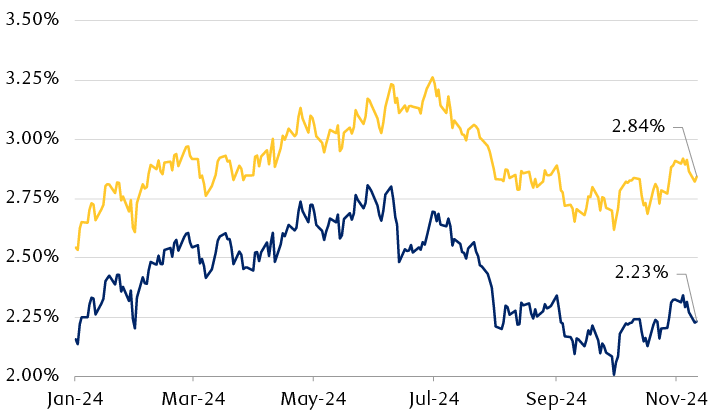

French risk premium remains elevated

Yield differential between French and German bonds remains above year-to-date averages

The line chart shows German and French government bond yields since January 2024. The last data point shows German and French yields are 2.23% and 2.84%, respectively. The yield differential between French and German bonds is wider than it was at the beginning of the year.

Source - RBC Wealth Management, Bloomberg; German and French bond yields represented by the Bloomberg Euro Aggregate Treasury Indexes; data as of 11/13/24

The recent collapse of Germany’s government raises the possibility of the country adopting a more stimulative fiscal policy, and until there is clarity on future government policy, Bund rallies could be limited. We maintain an Underweight position in France and prefer allocations in The Netherlands, Spain, Agencies, and Multi-national debt due to attractive spreads over Bunds, and we continue to favour Greece over Italy among lower-rated nations.

European credit valuations on a one-year basis appear rich, with lower-quality credit spreads tightening the most. Company fundamentals and strong demand will likely support spreads in the near term, but sectors exposed to U.S. exports such as Autos, Industrials, and Materials could drag spreads wider from current levels. Thus, we think it’s prudent to have a cautious and selective approach.