Key points

- New technologies are driving both rapid growth in electricity demand and innovations in renewable energy supply.

- The electrification of industrial processes is gaining momentum as renewable power becomes cheaper and more reliable.

- Energy security is an important theme as economies seek to diversify beyond fossil fuel dependence.

The ongoing steep decline in the costs of renewable electric power, now in its second decade, promises more abundant, cheaper supplies of electricity in the years to come. Meanwhile, the rapid pace of innovation in storage and electrification is opening up important possibilities for harnessing all that cheap electric power.

Electric vehicles and artificial intelligence (AI) are the poster children for new technologies that have a growing thirst for economical electricity. Less often considered, but arguably just as important, are basic industries—notably cement, chemicals, and steel—for which cheap electric power offers opportunities to significantly reduce both input and processing costs.

We expect some of the most intriguing innovations that appear set to transform heavy industry will present a number of investable opportunities.

For more on major trends we see shaping the future including renewable energy and electrification, please see the Global Insight 2025 Outlook focus article The “Unstoppables”.

Power: satisfying a growing appetite

The rapid proliferation of wind farms, solar collectors, and now storage systems has driven the cost of renewable power (without subsidies) down to levels that already make renewables the least expensive energy sources in many countries, as we detailed in our 2025 Global Outlook focus article The “Unstoppables”. The cost of electricity from renewables has fallen to levels that seemed unimaginable just a decade ago.

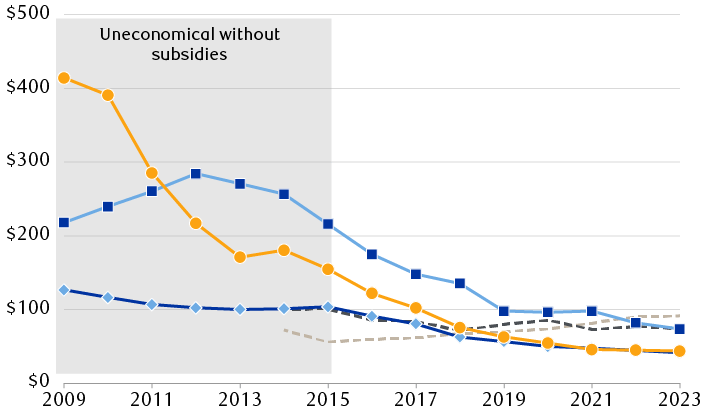

Solar and onshore wind are now the cheapest electricity sources

Global levelized cost of electricity per megawatt-hour

The line chart shows the all-in cost of operating generation assets which use coal, natural gas, onshore wind, and solar, over the period 2009 to 2023. Solar costs decreased from above $400 per megawatt-hour in 2009 to less than $50 in 2023. The cost of offshore wind power rose from roughly $220 in 2009 to $270 in 2013, but then decreased steadily to approximately $75 per megawatt-hour in 2023. Onshore wind costs fell steadily from roughly $125 to $40 per megawatt-hour. The costs of coal and gas power have remained fairly consistent or risen moderately since 2014 (the first year data was available).

The LCOE is the long term breakeven price a power project needs to recoup all costs and meet the required rate of return. LCOEs do not include subsidies.

Source - BloombergNEF; data not available for coal and gas plants prior to 2014

The International Energy Agency (IEA) estimates that the installed power generation capacity of renewables reached a record 666 gigawatts (GW) in 2024, a remarkable 30 percent increase from 2023. By 2030, the IEA estimates global renewable energy capacity could increase 2.7 times. Annual worldwide installation of new solar power generation plants has routinely exceeded the IEA’s forward estimates over the past decade, sometimes by 100 percent or more.

This remarkable growth is being driven not only by cost advantages, but also by the world’s ever-growing appetite for electricity. This demand is likely to accelerate in the future, with a major contributor being electricity consumption by more and larger data centres. Mostly owned by major technology companies, data centres consume vast amounts of energy, particularly when training and deploying AI models. For example, it takes 10 times more power to complete an AI chatbot request than a Google search.

In the U.S., more than one-third of new electricity demand between 2022 and 2026 is expected to come from data centre expansion. According to the IEA, these facilities will likely leap from consuming four percent of all electricity in the U.S. in 2022 to six percent in just four years. That extra two percentage points may not seem like much, but it is equivalent to an average annual growth rate of 10 percent—a rate of expansion that could outpace the development of energy infrastructure, with consequences conceivably including more frequent power outages.

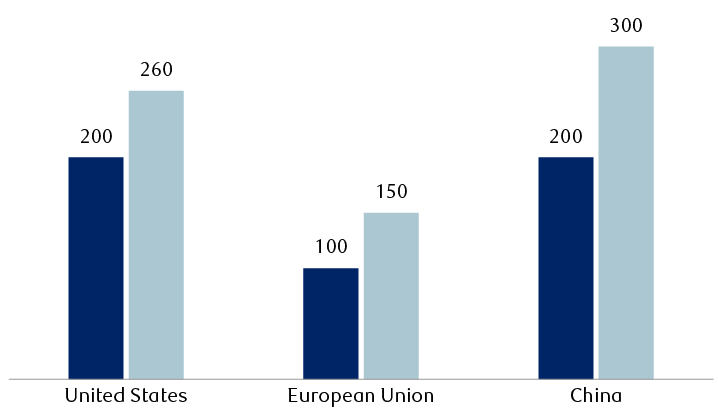

Data centre electricity consumption is rising rapidly

Estimated data centre electricity consumption (terawatt-hours)

The column chart compares estimated energy consumption of data centres in 2022 and 2026 for the United States, the European Union, and China. U.S. data centre energy use is projected to rise from 200 terawatt-hours in 2022 to 260 in 2026. In the EU, consumption is projected to rise from 100 terawatt-hours in 2022 to 150 terawatt-hours in 2026. In China, consumption is projected to rise from 200 terawatt-hours in 2022 to 300 terawatt-hours in 2026.

A terawatt is 1 trillion watts.

Source - RBC Wealth Management, Statista

The U.S. government’s decision to abandon federal climate goals has weakened corporate commitments to green initiatives. Many technology companies are reverting or trying to revert to fossil fuels, but remain committed to renewables owing to their low costs as energy demand rises. Some companies are also exploring nuclear power as an additional source of reliable energy over the long term.

At first glance, nuclear appears well suited to the needs of data centres as it provides highly reliable, clean energy 24 hours a day. However, building new nuclear plants not only involves substantial investment but also typically entails long delays and cost overruns, exacerbated by the dearth of nuclear expertise after the industry fell out of favour for security reasons at the turn of the century.

One emerging approach that aims to overcome these challenges is the Small Modular Reactor (SMR). These advanced reactor designs, which generate a fraction of the power produced by traditional nuclear power plants, are intended to be built in factories and assembled on site to meet customers’ specific needs.

Companies are seeking to diversify their energy sources

Microsoft is a case in point. The company now anticipates that by 2030 it will need over five times more electricity than it had projected in 2020. It has signed a multi-billion-dollar deal with Brookfield Renewable Partners that will facilitate more than 10.5 gigawatts of power generation starting in 2026, largely derived from solar and wind. It will also purchase power from Constellation Energy, which plans to restart the Three Mile Island nuclear plant in the U.S. Moreover, the company created the role of Director of Nuclear Technologies in 2024 to oversee the development of Small Modular Reactor systems for data centres.

Storage: solving the variability problem

If lower costs have been behind the proliferation of renewable capacity, equally important to the overall energy picture have been technological advancements that address the intermittent nature of wind and solar power.

Technical, managerial, and systems-engineering changes have improved traditional grids to accommodate renewable sources. In particular, the rapid expansion of facilities capable of storing enough electricity to compensate for the natural variability in renewable energy production has become a game changer. These so-called grid-scale batteries are electrochemical devices that collect energy from the grid, store it, and release it later to provide power when it is needed.

Beyond the obvious need to harness intermittent renewable energy sources, rapidly decreasing battery prices are contributing to this growth. The price of stationary lithium-ion batteries per kilowatt-hour of storage dropped by some 40 percent between 2020 and 2023 according to BloombergNEF.

The IEA has identified grid-scale storage as the fastest-growing energy technology. It estimates some 80 GW of new capacity will have been added in the three years to 2025, or eight times the capacity expansion in the decade to 2020.

Like electricity generation, the electricity storage category is being broadened by innovation. Sodium-ion batteries in particular have shown promise. Because sodium is a very abundant element, these batteries pose fewer supply chain risks and are also less susceptible to geopolitical tensions than lithium, an element derived from minerals concentrated in a few politically volatile regions.

For more on the supply chain risks associated with minerals that have key roles in the energy transition, please see the Global Insight special report “Mission critical: Securing supply of critical minerals”.

Besides being cheaper to produce than lithium-ion batteries, another potential advantage of sodium-ion batteries is that they are less flammable, which reduces fire risks and results in lower insurance premiums for users. This benefit should not be underestimated; in 2021 and 2023, fires damaged two grid-scale battery facilities operated by Tesla in Australia. More recently, in January 2025, a fire at the world’s largest battery storage plant in California destroyed 300 megawatts of lithium battery storage, clipping two percent off the state’s total energy storage capacity.

Sodium-ion battery technology is now under active development around the world. Chinese battery manufacturer Contemporary Amperex Technology Limited (CATL) recently announced a sodium-ion battery capable of functioning at -40°C, an important attribute for colder climates. In the U.S., private company Natron Energy, backed by oil giant Chevron, is investing $1.4 billion to establish a sodium-ion battery factory in North Carolina.

The IEA estimates sodium ion batteries will make up 10 percent of all energy storage installed in five years’ time.

Electrification of industry: heating things up

The electrification of basic industries has long been deemed unfeasible based on the belief that electrical furnaces couldn’t produce heat high enough for many industrial processes to take place. However, recent innovations have overcome many of these limitations, enabling the electrification of processes that were previously the sole remit of fossil fuels, such as the calcination process in cement production.

In his book Zero-Carbon Industry, Jeffrey Rissman explains that electrification of industrial processes should be viewed in terms of the cost-effective replacement of fuel-based processes with electrified alternatives. In the age of energy security , this objective is particularly important for countries aiming to reduce their dependence on imported fossil fuels.

For more on the growing global importance of energy security, please see the Global Insight special report “Recharging the energy transition?”

Rissman points out that the electrification of industry largely boils down to a question of how to produce heat from electricity, as heat accounts for more than 90 percent of U.S. fuel use for industrial processes (excluding raw materials), according to the U.S. Energy Information Administration.

Moreover, he estimates that less half the heat for industrial processes is for applications below 500°C. For example, the food and pulp & paper industries rely on processes that require temperatures of 200°C or less. Cement kilns, by contrast, need to reach temperatures of 1300–1450°C, and steelmaking blast furnaces operate at 1600–1800°C.

For processes that require less extreme heat, such as those in the food, pulp & paper, or even pharmaceutical and textile industries, heat pumps have emerged as an alternative. Increasingly used for domestic heating, heat pumps act as reverse refrigerators, taking heat from outside and moving it inside. They are energy efficient as they do not produce new heat but merely move it, delivering substantial energy savings.

Industrial heat pumps are in use in Europe and Japan, two regions where electricity prices are low compared to natural gas prices. Japan’s Kobe Steel, for instance, sells industrial heat pumps that produce steam at 165°C. Subsidies and policy incentives have helped the take-up of this new technology.

But even in the energy-rich U.S., heat pumps are garnering more interest. It costs no more to run a heat pump to get temperatures up to 130°C than a gas boiler, according to the Renewable Thermal Collaborative (RTC), an industry consortium. Higher-temperature heat pumps are also being developed. German industrial company SPH Sustainable Process Heat GmbH has developed a heat pump that harnesses waste industrial heat and reaches temperatures of up to 200°C.

For processes that require much more intense heat, thermal batteries have emerged as a potential solution. One version consists of bricks housed in a metal box, heated by electrical conductors to over 1000°C. Thanks to effective insulation, they can retain heat for days and release it when needed at various temperatures.

Many companies are working towards the electrification of industrial processes

Chemicals: A newly formed consortium bringing together German chemical behemoth BASF, Saudi chemical powerhouse SABIC, and global industrial-gases firm Linde aims to develop an electric furnace capable of producing heat sufficiently intense for the chemical reactions required in their manufacturing processes.

Mining: Rio Tinto and BHP, two of the world’s largest mining firms, have launched a collaborative initiative to construct Australia’s first electric smelter for iron ore.

Cement: Holcim, the German cement giant, is exploring the electrification of kilns and already incorporates renewable electricity in various stages of the production process.

Steel: Sweden’s SSAB aims to commercialize green steel by 2026 by replacing coal-powered blast furnaces by hydrogen direct reduction, where hydrogen is produced via electrolysis powered by renewable electricity.

Another technology that has taken on a critical role is electrolysis. Instead of stimulating chemical reactions with heat, electrolysis drives reactions by passing an electric current through a solution. Extensively used for green hydrogen production, electrolysis is being investigated for the smelting of iron ore and potentially to replace the kiln in cement production.

Finally, where the most extreme temperatures are required, a technology that has been around for almost a century is increasingly being used: the electric arc furnace. In the steel industry, these devices use electric arcs to melt scrap metal to be repurposed into new steel. They offer a more energy-efficient and environmentally friendly alternative to traditional blast furnaces, which make steel from iron ore and coking coal in a process known as smelting. Electric arc furnaces are mostly suited to developed markets where scrap is easily available and plentiful.

Though well established, this technology is attracting new converts. In 2024, Tata Steel shut down its blast furnaces in Wales, UK, intending to move to electrified steelmaking.

Innovate, baby, innovate

Will these new technologies work at large scales? Time will tell. But sceptics should remember that other low carbon technologies like wind and solar initially experienced high failure rates and slow rollouts. As engineers and businesses progressed along the learning curve, failure rates declined and adoption accelerated faster than anyone had anticipated.

Even if these new technologies prove scalable and efficient, electrifying industry will take time. Changing processes may involve high upfront costs, including training, and disruptive stoppages.

Yet the march toward electrification, underpinned by the falling cost of renewable electric power and the rising importance of energy security, is progressing. Innovations in power, storage, and electrification of industrial processes continue.

While new technologies and disruptive innovations may present promising opportunities for investors in time, they come with inherent risks. As companies grow and at times merge, market dynamics shift and prices fluctuate; the path forward can be uncertain. Thus, although staying alert to new developments is important, many investors may opt to focus on more established industries and themes. Energy efficiency, for example, is an investment theme that underpins many businesses providing products and services aimed at optimizing consumption and lowering energy costs.

As new innovations emerge to meet the challenges of a changing world, we encourage investors to consider the opportunities and risks in light of their long-term investment goals.