U.S. tariffs: Is the bark worse than the bite?

The tariffs that U.S. President-elect Donald Trump has threatened to impose on the EU could be a significant headwind to a region saddled with meager economic growth. RBC Global Asset Management Inc. Chief Economist Eric Lascelles calculates that two years after the implementation of a 10 percent blanket tariff, eurozone GDP would be one percent smaller than it otherwise would have been.

Reflecting the tariff concerns, 2025 consensus GDP growth forecasts for the eurozone have been downgraded marginally to one percent from 1.2 percent since the U.S. elections in November.

Trump’s transactional approach suggests to us there may be room for negotiations. By giving the U.S. some concessions, such as increased defense spending or purchasing more U.S. oil and liquified natural gas, the EU may be able to avoid the worst-case scenario of an escalating trade war or see only certain sectors affected by tariffs.

Given investors’ anxiety regarding the impact of tariffs on the region, such relatively favorable outcomes—which may only happen after acrimonious negotiations—would likely be a relief for markets, in our view.

German federal elections: A new dawn?

The elections to be held on Feb. 23 are important given the German economy, the EU’s largest, has sputtered since the end of the pandemic. Due to little ideological overlap, the three-party coalition that governed the country since 2021 proved ineffective at redressing the situation.

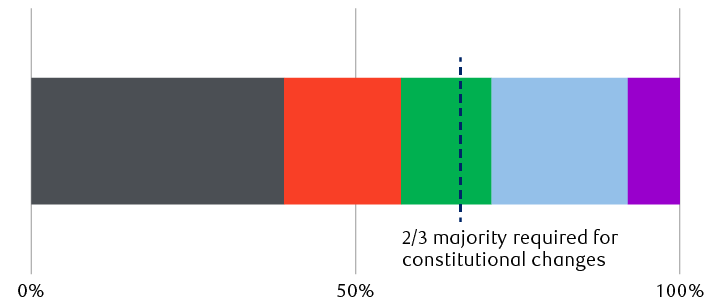

The coalition eventually collapsed, unable to strike an agreement to provide the fiscal stimulus the economy sorely needed. Additional spending has not been possible due to the “debt brake,” the measure enshrined in the German constitution that limits the deficit to a stringent 0.35 percent of GDP per year. Modifying this rule requires a high two-thirds majority in parliament—a threshold unachievable to date.

Polls are indicating change is coming. The center-right conservative alliance of the Christian Democratic Union of Germany (CDU) and the Christian Social Union in Bavaria (CSU) is likely to garner the most votes but fall short of a majority. A coalition with the center-left Social Democratic Party (SDP) as a junior partner is the consensus outcome—such a coalition has governed effectively in the past.

Likely distribution of German parliamentary seats could make amendment of the “debt brake” possible

The bar chart shows the likely seat distribution in the German parliament after the elections. According to recent polls, the an alliance of the CDU/CSU, the SPD, and the Greens could have the two-thirds majority required for constitutional changes. The CDU/CSU is projected to take 39% of the seats, the SPD 18%, the Greens 14%, AfD 21%, and BSW 8%.

Source - RBC Capital Markets, wahlrecht.de

RBC Capital Markets expects a CDU/CSU-led government would have little alternative but to modestly loosen its fiscal stance. It also foresees some additional defense and infrastructure spending under this outcome.

Reforming the debt brake may no longer be inconceivable, particularly if the three traditional parties (CDU/CSU, SDP, and the Greens) achieve a two-thirds majority, as predicted by current polls. All three parties seem open to the possibility of reform and politicians increasingly see the constitutional rule as outdated given the ailing economy and the low level of Germany’s indebtedness—which is very low in an international context with a debt-to-GDP ratio below 60 percent.

Failing this, the new government could declare an “emergency” in 2025 to create a special fund for government spending—a measure which would only require a simple majority in parliament.

Beyond a modestly higher level of spending, a CDU/CSU-led government is likely to be more pro-business, in RBC Capital Markets’ view, prioritizing economic policies over environmental ones. The CDU/CSU manifesto calls for a decrease in the business tax to 25 percent from 30 percent, to be at least partly financed by pruning unemployment benefits. RBC Capital Markets also believes some deregulation is possible, along with a potential return to nuclear energy production through reactivation or the establishment of new reactors to alleviate energy cost pressures.

Overall, we believe that an end to the paralysis that characterized the previous coalition government, a more pro-business government, and modestly accommodative fiscal policy would be beneficial to the economy. These policies, if implemented, would likely please equity markets, in our opinion.

Yet investors should be mindful that large-scale fiscal stimulus remains unlikely, as the CDU/CSU is, after all, a conservative party in the European context. Moreover, Germany suffers from structural challenges including its flailing industrial model, which cannot be addressed solely by fiscal policy.

China: A fading headwind?

A healthier Chinese economy would improve Europe’s prospects given China is a key export destination for European goods, and as many European companies have operations there.

While official announcements in China over the past few months have largely underwhelmed, in our view, recent ones have suggested a “more proactive fiscal policy,” the first such indication of that since 2020, and a change in the monetary policy stance to “moderately loose” from “prudent” for the first time in 14 years. In December, following the two-day Central Economic Work Conference, Beijing pledged to stabilize the property market in 2025.

All this suggests to us that investors should remain confident that an expansionary policy is coming. RBC Global Asset Management believes China still has policy space to provide significant economic support. We expect policy announcements at the March 2025 “Two Sessions,” the annual key political confab for major policy decisions.

A large stimulus announcement would boost Europe’s fortunes, in our view.

Where does all this leave investors?

We believe there are notable near-term headwinds to European equity index outperformance. They range from a lack of competitiveness and meager economic growth to geopolitical risks. These headwinds warrant holding a modest Underweight in European equities.

Yet given investor sentiment is downbeat and low valuations already seem to reflect many of these headwinds, a positive outcome from any of these events could provide opportunities for investors. A ceasefire agreement between Russia and Ukraine and a deeper European Central Bank rate-cutting cycle would also be perceived positively, in our view.

We continue to focus on world-leading companies that benefit from and drive global structural trends, particularly in niches such as semiconductor manufacturing equipment, electrical and mechanical engineering, industrial gases, and health care.