I celebrated one year with the Hershey Group in September. This year has been full of growth and gratitude. With this milestone, I have been reflecting on the path that has led me to where I am today and how important it is to anticipate what is ahead while controlling the things that can be controlled.

The time in a person’s twenties and thirties is formative. The trajectory of one’s life can be determined in this time, especially in the post-graduate twenties. Childhood and adolescence are characterized by learning who you are, learning the world, and having a defined educational and extracurricular path. College, or the time from 18-21 years old, on the other hand is characterized by growth as an adult, challenged beliefs, gained perspective, finding who you are and beginning the journey to find your place in the world. Then after attending college, a person is propelled into a world where they are in the driver’s seat, with no set route or path ahead.

I am in my early twenties; I am currently two years removed from college and my world is characterized by rapid change, growth, and excitement for the future. I graduated from the College of William and Mary in the May of 2021 with a degree in finance and on the precipice of a career in law. I had decided that my route in life was to become an estate attorney. I took the LSAT, applied for law school, and worked as an estate administration paralegal. Early into working as a paralegal, I realized that law school was not the career path for me because I was seeking a more relational career

|

When I realized that this was not my path, the opportunity to become a financial advisor with the Hershey Group opened and I was extremely grateful. I had internships with RBC Wealth Management during two summers in Washington, DC and with a local wealth management firm in Williamsburg when I was attending classes. I had an interest in financial advising and when the opportunity came, I knew it was the correct direction for me. As I am at the beginning of my career, I have already learned that change is guaranteed in life and the best practice is to accept that it is guaranteed and maintain who you are and what you believe as the change happens. I am grateful for the redirection from law school to financial advising- I realize now why the twenties are seen as a defining time!

Just as I have worked hard to establish a foundation for beginning a career, I’ve learned it’s important to create a foundation for my long-term investment plan. The fundamentals of savings and investing are crucial to meeting your goals. To create the solid foundation of wealth, it comes down to five ideas below.

1. Build an emergency fund.

This is the bedrock of financial health. You need a savings cushion so that you can weather short-term emergencies- like a job loss, health expense, or a new oven, without having to touch your long-term investments. Generally, we advise saving up 6 months’ worth of income.

2. Use debt wisely.

This means avoiding the creation of new credit card debt, but also prioritizing how you pay down your debt. Focus on paying down the accounts with the highest rates first. Don’t worry so much about your student debt, as it tends to be low interest.

3. Save for the future.

Whether it’s through an employer plan or a Roth IRA, you’ve got a shot at jump-starting your retirement. However, there’s a yearly limit to how much money you can put into these plans, so you can’t out it off. And many employers will match a portion of your contribution which is essentially free money!

4. Watch your spending.

We don’t recommend living a spartan existence. You need to enjoy yourself now. But a simple shift can make a difference.

5. Plan for the unexpected.

You’ve reached the age where you may be taking our student loans, buying or renting a place to live, and having children. These major life events make it important to have a safely net via insurance. These are the basic types of coverage you need.

• Health - Young and healthy people should consider high deductible plans and a Health Savings Account.

• Property and Casualty - Covers your car, home and belongings

• Disability- Replaces your income if you are disabled or can no longer work at your job.

• Long-Term Care - Helps cover the cost of care if you have a chronic medical condition.

As I have integrated myself into the financial services industry, I have observed that in addition to the five foundational steps to follow is the importance of beginning as soon as possible. It is understandable that when a young person is beginning to invest, the technicalities of saving and investing can cause decision fatigue and inevitably delay the start to investing later in life. However, the best thing to do is to begin.

Save early. Save often.

Use the power of compound interest. It's important to start saving early, since compound interest can make a dramatic difference over time.

Compound interest is not only calculated on the initial principal of your retirement savings account, but also on the accumulated interest of prior periods.

You save from age 25 to 40

In this illustration, you're an early investor! By investing $150,000 you will reach a balance of $1 million by age 65*

Your friend saves from age 35 to 65

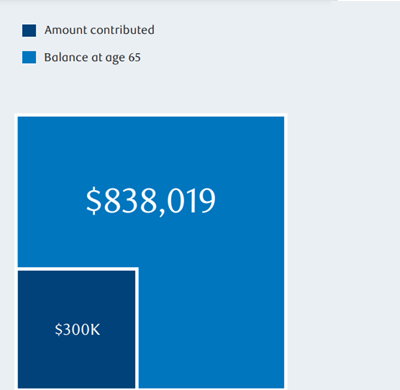

Even while investing twice as much as her friend ($300,000) this late investor will retire with approximately $840,000.**

The graphic above illustrates the importance of beginning early. What this shows is that a person who decides to invest $150,000 from the ages 25-40 will reach the milestone of $1,000,000 by age 65. Whereas, if they have a friend that waits to invest from ages 35-65 and doubles the amount of investment to $300,000, they will retire with $840,000. This illustrates the power of starting early. Even with double the amount of the initial investment, you are not receiving the compounding interest that accumulates over time.

It’s never too late to build a foundation and to implement a financial plan, but the earlier you begin the better. If you are seeking financial literacy, have general financial questions, or have questions about the five steps to create a financial foundation, please email me. I am happy to help! My email is catharine.weber@rbc.com