The following is an executive summary of the recent Global Insight special report published as part of RBC Wealth Management’s “Innovations” series.

We survey the growing number of biotechnology innovations that could revolutionise the battle against two major age-related challenges—cancer and Alzheimer’s—and explore how drugs designed for obesity may end up treating a much wider range of health issues. We also look at ways to position portfolios for the ageing theme.

The contour of a cancer cure?

Cancer is the second-leading cause of death among the elderly. Recent scientific advancements have accelerated the development of cancer vaccines, an increasingly viable approach in cancer treatment.

Cancer vaccines

Most traditional antiviral vaccines work by introducing specific components of an infectious organism—referred to as antigens—into the immune system. The aim is to induce an immune response and establish a “memory” so that the body easily recognises an infectious agent as being foreign.

Cancer, however, represents a unique challenge, as it originates from a body’s own cells, making it difficult for the immune system to recognise the cancer as foreign. The realisation years ago that many cancer cells are covered with unique antigens, known as “neoantigens,” was a breakthrough.

Cancer vaccines introduce neoantigens directly into the body, training the immune system to recognise them as foreign and target any cancer cells that carry them.

Personalised cancer vaccines

Advances in this technology have spearheaded the idea of personalised cancer vaccines tailored to a patient’s specific mutations. After a biopsy, the tumour is profiled, and mutations likely to generate proteins that can be recognised by the immune system are identified. A vaccine can then quickly be developed that targets the neoantigens produced by these mutations.

But if the process is quick, it is also very expensive. Scientists are looking to develop off-the-shelf vaccines that can work in large populations by targeting common tumours.

Cancer vaccines are different from traditional vaccines as they aim to cure, rather than prevent, a disease. Cancer vaccines may well one day lessen the reliance on more invasive treatments like chemotherapy.

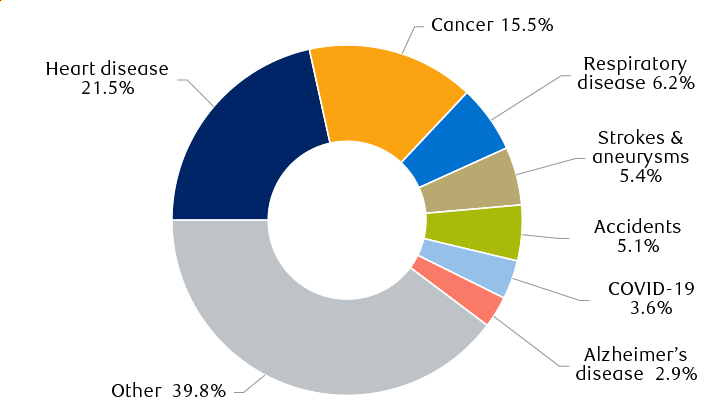

Cardiovascular diseases, cancer, and Alzheimer’s in the lead

Leading causes of death for Canadians aged 85 and older (2023)

The pie chart shows the leading causes of death for Canadians aged 85 and older in 2023. Diseases of the heart were the leading cause of death, accounting for 21.5% of total deaths, followed by cancer (15.5%), respiratory diseases (6.2%), strokes and aneurysms (5.4%), accidents (5.1%), COVID-19 (3.6%), and Alzheimer's disease (2.9%).

Note: Leading causes of death among the elderly population are similar in most developed countries.

Source - RBC Wealth Management, Statistics Canada

Encouraging progress for Alzheimer’s

By the age of 85, the probability of a person developing this devastating disease is currently one in three, according to the U.S. National Institute on Aging.

Progress in finding treatments has been slow, partly because the root cause of the disease has been difficult to identify.

Many scientists believe that Alzheimer’s is most likely caused by an abnormal buildup of beta-amyloid proteins in the brain, forming plaques that trigger the formation of tangled clumps of another protein, tau. Researchers believe these developments lead to neuron dysfunction and eventual death.

Scientists thus focused on targeting amyloid proteins and developed lecanemab and donanemab, two drugs that work by flooding the bloodstream with antibodies that bind to the beta-amyloid plaques, prompting immune cells to clear them away. There are ongoing concerns with the therapies, however, regarding their effectiveness, practicality, cost, and even safety,

Today, there is a growing number in the scientific community contending that plaques and tangles are not the cause of Alzheimer’s but rather the body’s response to an underlying viral infection. If such a link can be established with certainty, then eliminating a virus through vaccination or antiviral drugs could offer a path to disease prevention or treatment.

While current treatments for Alzheimer’s may offer limited comfort to those already afflicted with the disease, they are an important step forward.

GLP-1: The wonder drugs?

Originally developed for type 2 diabetes, glucagon-like peptide 1, or GLP-1, drugs gained widespread recognition in 2021 for their effectiveness in treating obesity.

GLP-1 drugs are synthetic versions of a natural gut hormone that helps control the levels of sugar in the blood by triggering insulin release and slowing digestion.

GLP-1 drugs are also being studied as potential treatments for an unprecedentedly wide range of other medical conditions that goes far beyond pharma companies’ usual search for new markets for their drugs.

In fact, in March 2024, semaglutide, a GLP-1 drug sold as Ozempic for diabetes and Wegovy for weight loss, was approved in the U.S. for cardiovascular disease in overweight patients. Trials are also ongoing to assess whether GLP-1 drugs could be used to treat chronic kidney and liver disease, among others.

One reason for optimism is that GLP-1 drugs seem to support cellular health. When cells with GLP-1 receptors become dysfunctional, treatment with GLP-1 drugs seems to help them recover. These drugs may thus be able to reduce inflammation throughout the body. Since inflammation is thought to be a key trigger of many diseases, the potential benefits of GLP-1 drugs could extend beyond current uses.

Biotech and beyond

Biotech is the obvious sector through which to invest in the theme of combatting ageing. Biotech companies are often perceived by investors as the research pipeline of Big Pharma. With ample cash on their balance sheets and over $350 billion in annual pharmaceutical sales at risk over the next decade due to patent expirations, pharmaceutical companies’ merger and acquisition activity may well pick up.

Other industries may also experience shifts in demand as the population ages and play into the theme as well:

Medtech also seeks to address age-related health issues. For example, robotic surgery is making treatments safer and minimally invasive, and could become the norm within 10 to 15 years, according to Nature Medicine.

Insurance and wealth management companies may well find they have an attentive audience as individuals will need to consider how not to outlive their savings.

Homebuilders may see higher demand from multi-generational households in some regions, and a growing need for single-occupancy homes in others.

The prospects for healthy ageing appear more promising today than 20 years ago, driven by a surge in biotech innovations. At the same time, industrial sectors such as homebuilders are developing solutions to make the later stages of life more comfortable and secure. We believe these sectors present compelling long-term opportunities for investors as the aged population grows.

For more on this topic, see the special report.