Given the flurry of tariff and other policy developments, many investors seem to have their eyes glued on Washington—understandably so. But we think it’s also important to pay attention to what we believe matters most to the U.S. stock market over the medium and long term—corporate profit trends.

The ongoing Q4 2024 earnings season is in good shape thus far, from our vantage point, including earnings and revenue beat rates and magnitude of beats. However, there have been some highlights and lowlights.

With 78 percent of the S&P 500 market capitalization having reported results as of Feb. 13, the Q4 2024 earnings-per-share (EPS) growth estimate has jumped to 12.6 percent from 7.3 percent since Jan. 10, just before the earnings season began, according to Bloomberg.

The Bloomberg full-year consensus EPS forecasts are for $246 per share (9.4% y/y growth) in 2024 and $271 per share (10.4% y/y growth rounded) in 2025.

The $271 per share 2025 estimate is lower than the $273 per share forecast right before the earnings season began. This does not trouble us as the full year forecast typically retreats at this stage of the year, and heading into the results season we had thought that the 2025 estimate was too lofty. It now looks more realistic, assuming annual GDP growth holds up near the 2.2 percent consensus forecast for this year or exceeds it.

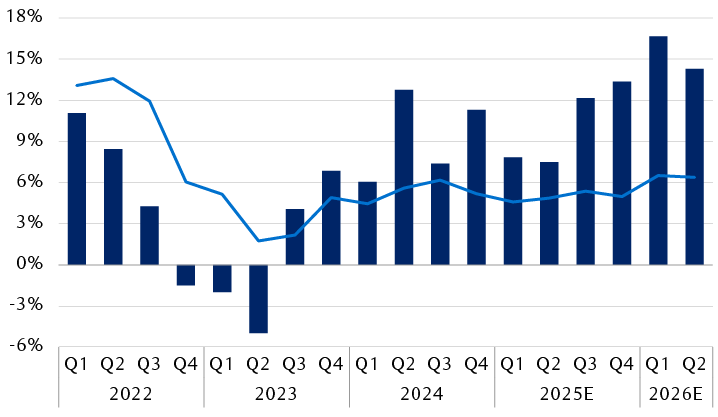

Consensus earnings growth forecasts seem lofty from Q3 2025 onward

S&P 500 year-over-year growth

Source - RBC Wealth Management, Bloomberg Intelligence; data as of 2/13/25; Q1 2022-Q3 2024 are actual results, Q4 2024 onward are Bloomberg consensus estimates (E)

Lowlights: Magnificent 7 (well, five actually)

Earnings reports from five of the so-called Magnificent 7 stocks—Alphabet, Amazon.com, Apple, Microsoft, and Tesla—have been lowlights, in our view. Meta Platforms was the exception, and the other Magnificent 7 stock, advanced chipmaker NVIDIA, is scheduled to release results on Feb. 26.

Despite the fact that earnings growth exceeded the consensus forecast for many of them, the quality of the results didn’t live up to those of previous quarters. There were blemishes in terms of revenue growth of key units and/or somewhat lower-than-expected forward projections from management teams.

The results and/or guidance also didn’t rise to the very high investor expectations that had been baked into share prices and valuations. There was little room for error, and all five stocks sold off after they reported.

Each Magnificent 7 firm is very involved in the global artificial intelligence (AI) ecosystem. We think scrutiny on the billions upon billions in AI capital spending that has already occurred by these companies—with more in the pipeline—will be in focus in coming quarters. So too will competition and developments coming from China’s AI firms.

We expect the pressure will build for America’s AI leaders to “show investors the money” so to speak—in other words, to start showing tangible prospects for the return on invested capital in their AI buildouts, especially given that their price-to-earnings valuations still look elevated.

Magnificent 7 earnings trends going forward will likely help shape market performance in the near term, especially given this group represents about 32 percent of the S&P 500’s market capitalization (aka market value). With such a large footprint, when the Magnificent 7 stocks do well, they tend to boost S&P 500 returns like in 2023 and 2024. In contrast, when their shares consolidate or sell off, they can constrain or hinder the S&P 500’s progress, like recently.

Highlights: The rest of the market, especially Financials

We think Q4 2024 earnings results from the rest of the market have, on balance, been pretty good so far.

The S&P 500 excluding Magnificent 7—the overwhelming majority of stocks in the index—is pacing at 7.5 percent year-over-year earnings growth thus far, which is ahead of 3.7 percent in the previous quarter. Results from the Financials sector, and bank stocks in particular, have been standouts, in our view.

We have yet to hear from major retailers and many other Consumer Discretionary sector stocks. We will be monitoring these reports closely given signs of stress among lower-income households due to sticky inflation and signals that recent spending by this category has been fueled by elevated credit card usage.

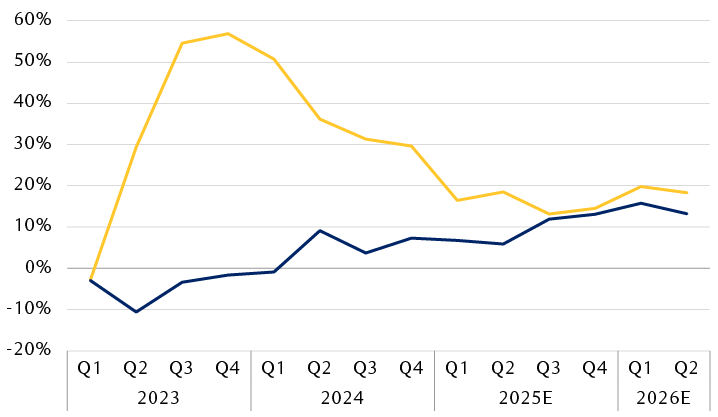

Is convergence really ahead?

The big question is whether forecasts for earnings convergence—the coming together of earnings growth rates for the Magnificent 7 and the remainder of the companies in the S&P 500—will finally materialize.

The consensus forecast is for Magnificent 7 earnings growth to continue to decline this year mainly due to challenging year-over-year comparisons. This would not be a negative development, so long as major hiccups don’t occur and things play out as forecast.

In contrast, earnings growth for non-Magnificent 7 stocks is expected to pick up more later this year.

Earnings growth rates are expected to converge later this year

S&P 500 year-over-year earnings growth and consensus estimates (%)

* Magnificent 7 stocks are Apple, Microsoft, Alphabet, Amazon.com, NVIDIA, Tesla, and Meta Platforms.

Source - RBC Wealth Management, Bloomberg Intelligence; data as of 2/13/25; Q1 2023 – Q3 2024 are actual results, Q4 2024 onward are Bloomberg consensus estimates (E)

Whether or not the current convergence forecast plays out will depend on economic developments, in our view. If economists’ 2025 consensus GDP growth forecast deteriorates meaningfully from the current 2.2 percent level, we think the likelihood of this convergence would diminish.

But if sturdy GDP growth and earnings convergence play out as forecast or exceed expectations, we would anticipate the non-Magnificent 7 area of the S&P 500 to deliver worthwhile share price returns as a group this year.