Fiscal and monetary policy are clearly important inputs for investors. Government spending accounts for roughly 20 percent of U.S. economic activity and even a quick glance at recent market moves shows the importance of the Federal Reserve. In fact, it’s hard to imagine any macroeconomic forecast that fails to account for the government’s net spending or the central bank’s interest rate target.

But the government’s influence extends well beyond these variables. Administrative measures, banking regulations, and anti-trust activity are examples of policy decisions that—while not strictly economic—can move the needle on investment outcomes.

Heading into this year’s election cycle, we see a realistic chance that a pair of non-economic policy moves—specifically increased restrictions on trade and immigration—could bring about important changes to the investing backdrop. Combined with a recent U.S. Supreme Court decision on administrative law, we see the potential for a meaningful shift in the economic environment heading in to 2025.

It’s important to establish at the outset that this is not a partisan issue—there is broad agreement in both parties and across the electorate that changes are necessary in immigration and trade. Partisan differences are largely one of degree, not kind. Nor are we taking a view on the advisability of these policy moves. Governments act for a wide range of reasons beyond influencing stock and bond prices. We are simply interested in the potential impact on asset prices as policy changes move across the economy.

New perspectives, new policies

In a recent Gallup poll, immigration was identified as the single largest problem facing the United States, ahead of the economy and inflation. A follow-up poll showed that 55 percent of the country wants lower levels of immigration, with 77 percent of the population describing the situation at the U.S.-Mexico border as a major problem or crisis. While partisan affiliation does impact the responses, the numbers also reflect broad popular support for a restrictive shift in immigration policy, and both parties have proposals designed to reduce crossings at the southern border.

The picture looks very similar for trade. Just over two-thirds of Americans believe that trade policy should be used to protect domestic jobs, according to a survey by the Chicago Council on Global Affairs. The same study indicated that a plurality supported reducing trade and increasing domestic self-sufficiency.

These views have been reflected in policy proposals.

In 2017, then-President Donald Trump imposed restrictions on nearly $300 billion of Chinese imports, restrictions that were kept in place and later extended by President Joe Biden. Trump, the Republican nominee, has voiced support for increasing and extending these tariffs, with a proposed 10 percent charge on all imports and a 60 percent charge on Chinese imports. He has floated the idea of doubling the universal tariff to 20 percent and potentially adding a 100 percent surcharge on imports from nations that “leave the dollar,” although it is currently unclear if those are firm policy proposals.

Democratic candidate Vice President Kamala Harris has shown skepticism on broadly applied tariffs but has in the past supported trade restrictions based on environmental considerations and labor standards. The current administration has also supported expanded domestic content requirements for Federal spending, a policy that favors U.S. producers over international suppliers.

Supplying the market

Economically, both trade and immigration speak to supply.

With U.S. unemployment just above four percent, we think impactful immigration restrictions will almost inevitably lead to higher services prices, as domestic producers struggle to find workers. It may even force some operators to close, suspend operations, or reduce hours, much as we saw during the early stages of the pandemic recovery. A downward shift in labor supply could also lead to upward pressure on wages. The exact impact will depend on the efficacy of the chosen policy mix—which is difficult to predict given the paucity of reliable data and policy specifics—and the potential depth of any slowdown in the domestic economy.

Increased trade restrictions will look very similar, but with more of an emphasis on goods instead of services. Higher costs from tariffs will likely be passed on to consumers, and there is limited near-term ability for domestic producers to establish or ramp up production—it takes time to build a factory and create a domestic supply chain. Worker shortages would also tend to leave U.S. companies less able to step into any void created by reduced imports.

In short, the policies that are well-supported by the electorate and politicians are likely, we believe, to create obstacles to the supply of goods and services in the United States.

Economic implications of a 10 percent global and 60 percent Chinese tariff

| Country | Real GDP | Consumer price inflation | ||

|---|---|---|---|---|

| Full tariffs | Partial tariffs | Full tariffs | Partial tariffs | |

| U.S. | -1.5 | -0.2 | 0.8 | 0.2 |

| China | -1.6 | -0.3 | 0 | -0.1 |

| Canada | -2.5 | -0.3 | 0.8 | -0.1 |

| Mexico | -2.3 | -0.3 | -0.4 | -0.1 |

| Eurozone | -1 | -0.2 | -0.4 | 0 |

| UK | -0.7 | -0.1 | -0.4 | 0 |

| Japan | -0.7 | -0.1 | -0.6 | -0.1 |

| India | -0.3 | 0 | -0.9 | -0.2 |

| South Korea | -1.6 | -0.2 | -0.7 | -0.2 |

| World | -1.1 | -0.2 | -0.3 | -0.1 |

Note: As at 8/5/2024. Deviation (in percentage) in level of GDP and CPI from normal trend after two years.

Source - RBC Global Asset Management Inc. Chief Economist Eric Lascelles

Demand uncertain

Supply, of course, is only one side of the equation. Demand is the other factor; on that front, we see potentially mixed signals.

One inflationary input is the movement of higher wages through the economy. Wage-dependent households tend to convert a high degree of their income into consumption relative to savings. A shrinking labor force, therefore, could push up household consumption and, by extension, inflation. The early stages of the pandemic recovery indicated the power of lower-income households to drive consumer prices higher.

Another potential inflationary vector is the extent to which U.S. government budgets are debt funded. If either tax cuts or spending increases are paid for by additional indebtedness, we believe that would likely increase underlying inflationary pressures. Recent history indicates a high probability that increased budget deficits would be largely or entirely funded through new borrowing.

Policy moves in broader context

On the other side, there are potential offsets in the actual and likely policy shifts. To begin with, lower immigration would reduce what economists refer to as household formation and the rest of us think of as demand for a place to live. With shelter costs representing over one-third of the consumer price index basket, any tendency toward lower rent could help ameliorate inflation.

The overall regulatory environment has also become more friendly toward corporations with the recent over-turning of the so-called Chevron doctrine, a 40-year-old rule that Federal judges defer to regulatory agency’s “reasonable” interpretation of any ambiguous statutory language. With Chevron now overturned, regulators will no longer receive this deference. One consequence, we believe, is that new regulations will take longer to implement and will tend to be less restrictive. As a result, it may be easier for companies to increase output quickly, allowing for increased supply and higher profits.

Finally, it’s important to consider that the government’s presence in the economy is less than half that of the private sector. Multiple indicators, including the recently released Fed Beige Book, are consistent with a broadly slowing pace of economic growth. Slowdowns of this sort are generally disinflationary, and could mitigate some of the impact of any policy-driven inflation. We are skeptical, however, that it would be sufficient to absorb the total impact, given the long lead times for worker training and supply chain realignment.

Errors may not be easy to fix

When Fed Chair Jerome Powell makes a mistake in a press conference—as he arguably did with his excessively dovish comments in December 2023—it’s easy to fix. A few more speeches and a meeting later, he had largely erased that dovish view from market estimates. The central bank’s dominance over the short end of the yield curve means that it’s not particularly consequential to make a mistake—the Fed can always correct it later.

That’s not necessarily true in trade and immigration. Both policy areas are impacted by other entities—either potential migrants or sovereign nations—that have their own goals and objectives, and it’s difficult for the U.S. to predict with clarity how these actors will respond to any given policy change. That uncertainty amplifies the consequences of making a mistake.

Take trade with China, for instance. The Chinese response to tariffs may prove more impactful than anticipated. Even if the U.S. wanted to turn back the clock to the status quo ante, reversing course could be difficult politically. It would likely require Congressional approval, which may not be forthcoming. And even if the U.S. reversed course, there is no guarantee that China would likewise back down.

Theoretical tariff considerations for GDP

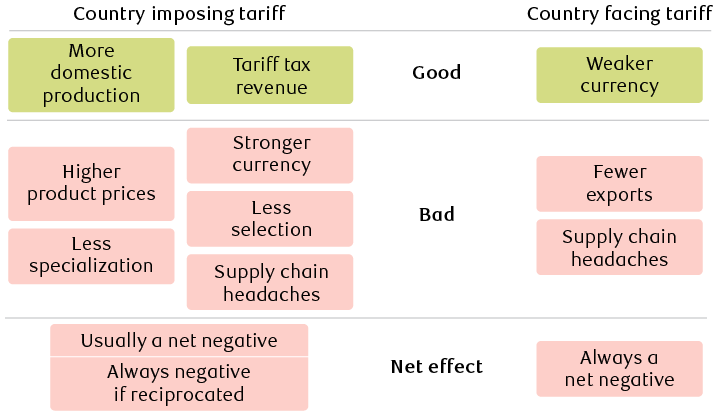

The graphic shows potential positive and negative effects of tariffs for a country that imposes a tariff, and for the country on which the tariff is imposed. For the country imposing the tariff, potential positive effects include more domestic production and the revenue from tariffs; potential negative effects include higher product prices, less specialization, a stronger currency, less selection, and supply chain headaches. For the country facing the tariff, a potential positive effect is a weaker currency; potential negative effects include fewer exports and supply chain headaches. The net effect of a tariff is usually negative for the imposing country, and always negative if the tariff is reciprocated; for the country facing the tariff, the net effect is always negative.

Source - RBC Global Asset Management Inc. Chief Economist Eric Lascelles

Asset prices and policy moves

If meaningful trade and immigration restrictions come to pass, we think the likeliest beneficiaries are going to be large corporations relative to smaller entities. Bigger companies are better suited to finding and hiring scarce workers, and their scale provides them significant advantages in international trade. They can secure scarce imports while leveraging their global footprint to avoid restrictions in the first place. Finally, larger companies tend to face the highest regulatory scrutiny, so the shifting legal landscape could help offset any higher input costs. The net result is that what is likely a profit headwind for large companies could prove a serious and potentially existential threat for smaller firms.

The other likely market impact is a tendency toward higher interest rates. The increased uncertainty on key supply-side inputs and the potential for higher inflation are likely to at least make the Fed think twice about aggressively cutting interest rates and could make investors leery of committing capital to longer maturity bonds. This would likely be a growth headwind across the entire domestic economy.

Overall, we think the key for investors is to consider the entire policy framework—and not just the government’s explicitly economic choices—when evaluating their investment profile. At this time, that broader perspective makes us slightly cautious on potential inflationary flare-ups, with consequences for bond maturity and equity size selection.