The last five years have felt like a blur—from global lockdowns to economic restarts, extraordinary government stimulus in major infrastructure projects and green initiatives, 40-year highs in inflation, rising interest rates, decades-high mortgage rates, growing geopolitical uncertainties, and the rise of artificial intelligence (AI), along with a myriad of other notable events. These unprecedented waypoints have helped to decouple large- and small-cap return profiles—much the same as during the tech bubble boom in the early 2000s—helping to shape an unusual and powerful tailwind for large-cap stocks, which posted meaningfully above-average returns in four of the last five years. This dynamic has now built large-cap versus small-cap cumulative returns over recent years into a yawning gap.

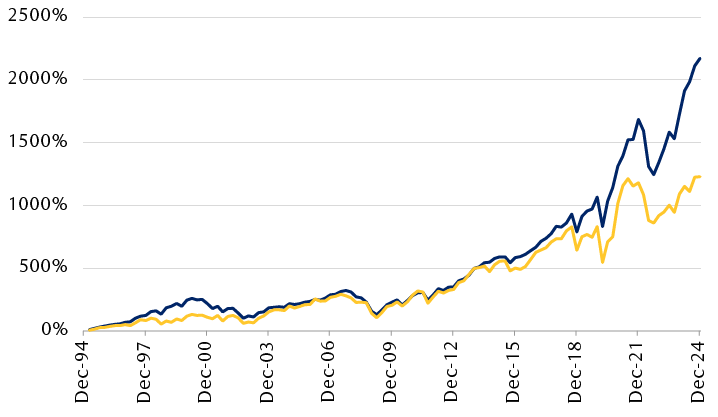

Long-term cumulative returns for large-cap and small-cap indexes

The line chart shows the cumulative quarterly returns relative to December 1994 levels of large-cap and small-cap equity indexes, through December 2024. Large-cap returns began to rise faster than small-cap returns around 2015, when cumulative returns for both indexes were roughly 500%, and the divergence has increased since then. The cumulative return of the large-cap index reached nearly 2200% in 2024, while the small-cap index return was roughly 1200%.

Large caps and small caps represented by the Russell 1000 and Russell 2000 indexes, respectively.

Source - RBC Wealth Management, Bloomberg

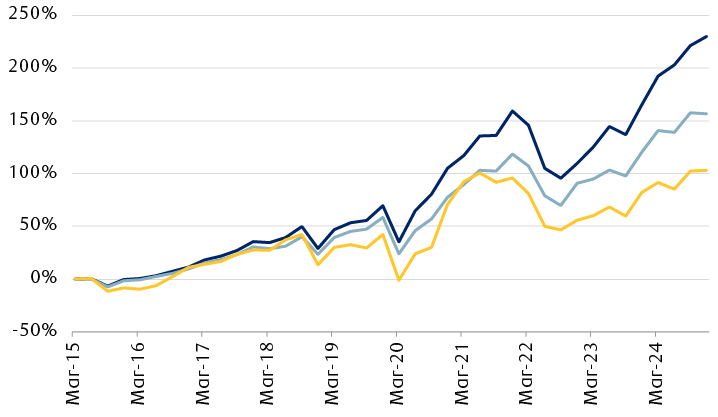

Taken at face value, this illustration is a bit misleading as we have seen near all-time highs in market concentration across a very narrow subset of names driven by the AI boom—these are chiefly known as the “Magnificent 7,” which include: Apple, Microsoft, Alphabet, Amazon, NVIDIA, Meta Platforms, and Tesla. Even when excluding the Magnificent 7 from the large-cap index returns, large-cap stocks have still outperformed their small-cap counterparts over recent years.

Medium-term cumulative returns for large-cap, large-cap ex Magnificent 7, and small-cap indexes

The line chart shows cumulative returns for large-cap and small-cap equity indexes, and for the large-cap index without the Magnificent 7 stocks (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms, and Tesla) from March 2015 through December 2024. Large-cap returns have steadily outpaced small-cap returns over this time period. Large-cap cumulative returns in December 2024 were roughly 230%, and small-cap returns were roughly 100%. Large-cap returns without the Magnificent 7 were roughly 150%.

Large caps and small caps represented by the Russell 1000 and Russell 2000 indexes, respectively; large caps ex Magnificent 7 represented by the Bloomberg US Large Cap ex Magnificent 7 Index.

Source - RBC Wealth Management, Bloomberg

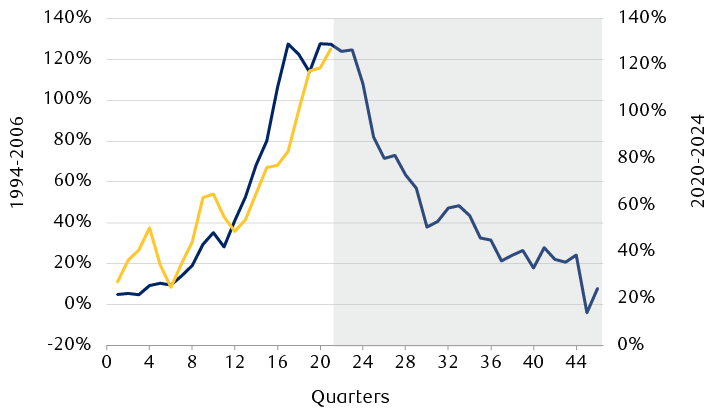

History doesn’t repeat … but it does rhyme

Large-cap cumulative return spreads of more than double that of small-cap counterparts is eerily reminiscent of the immense outperformance we saw for large caps during the tech bubble runup. Large-cap performance relative to small caps this cycle has mirrored the advance in performance. Unlike the tech bubble burst during the early 2000s—driven in large part from a lack of earnings power which helped drive the collapse of the trade—large-cap earnings today have continued to deliver and we see no signs of investor appetites for AI or other related investment abating anytime soon. That doesn’t mean that this time won’t see cumulative return spreads reset in a similar way to last time over the next several years, but they are likely to be spurred on by other less obvious drivers in addition to elevated investor expectations.

Cumulative return spreads during the tech bubble and AI boom

Large-cap minus small-cap cumulative returns (%)

The line chart compares the quarterly difference (spread) between the cumulative returns of large-cap and small-cap equity indexes during two historical periods: the tech bubble (1994-2006) and the AI boom (2020-2024). The returns spread during the tech bubble period increased from 4.9% in the first quarter to over 120% after 16 quarters before plateauing and then falling back to around parity after 44 quarters. Spreads during the AI boom have followed a similar upward path, increasing from around 27% to more than 120% after 20 quarters.

Large caps and small caps represented by the Russell 1000 and Russell 2000 indexes, respectively.

Source - RBC Wealth Management, Bloomberg

So, what are they?

Mergers and acquisitions (M&A) along with initial public offerings (IPO) have historically been key drivers for overall small-cap index performance outside of earnings.

Large-cap company balance sheets hit an all-time record last quarter coming in at nearly $2.5 trillion with Financials sector companies holding nearly 50 percent of the total and Technology, Consumer Discretionary, Communication Services, Health Care, and Industrials names making up the bulk of the remainder. Despite large-cap company balance sheets being flush with cash, last year was the worst on record for small-cap M&A going back several decades. According to Bloomberg data, 2024 closed out the year with just 52 deals in the small-cap space for a cumulative total of $113.7 billion; this was worse than during the 2008 financial crisis where just 61 deals were closed. Since the U.S. Federal Reserve started raising rates at the beginning of 2022 we’ve seen rate-sensitive sectors like Financials, Communication Services, and Real Estate have substantially fewer deals overall, corroborating the close tie between monetary policy and overall corporate risk-taking, irrespective of cash on hand.

As for small-cap IPO activity—which also points to investor risk appetites—2024 marked the return to a “new normal”; the year averaged just 31 deals and a scant $7 billion per quarter in value. Albeit up from 2023’s anemic $7.7 billion in total for the year (the smallest amount raised in over three decades), pre-COVID-era small-cap listings were typically in the 60–100 count and $15 billion–$20 billion total ranges per year.

The turning of the tide

2024 marked an about-face in monetary policy as the Fed started a fresh round of easing after a few years of tighter policy decisions—intending to stamp out inflation driven by abundant cash and more than a decade of easy money policies—and these changes helped spur the beginnings of “green shoots” in the small-cap IPO space during the year. 2025 could continue that trend and serve as a turning point as large caps look to spend cash hoards and as more deal-friendly administrators take the wheel. New appointments under the Trump administration for the Federal Trade Commission and the Department of Justice seem likely to be in place, quickly providing needed tailwinds to both deal activity (M&A) and IPOs for 2025 and beyond.

2025 and beyond

In our view, tailwinds to small-cap stocks closing the gap to large include extremely elevated consensus earnings expectations for large caps (particularly amongst AI-related names), election risks fading, more M&A-friendly regulators set in place, easier Fed policy to reignite corporate risk-taking, and record cash hoards being put to good use. After years of underperformance relative to large-cap counterparts, we believe small caps seem poised to return to form.