- Asia’s equity outlook is likely to be shaped by U.S. president-elect Donald Trump’s proposed tariffs, China’s stimulus measures, and economic growth brought by Japan’s structural changes.

- Asian credit markets face trade and geopolitical pressures in 2025, but stable fundamentals and targeted stimulus support a cautiously optimistic outlook for investment-grade bonds.

Asia Pacific equities

We believe the key focus for China in 2025 will be the announcement and implementation of policy stimulus. Following a policy shift in September 2024, officials have started introducing measures to stabilize the economy and support the equity market. With the new U.S. government taking office in January 2025 and thereafter introducing its policies, we expect China to respond with additional stimulus measures.

The potential for 60% U.S. tariffs on Chinese goods and additional trade restrictions could generate volatility in Chinese equities. RBC Global Asset Management estimates that such tariffs could reduce China’s aggregate Real GDP by 1.6% two years after implementation. However, we believe if China’s fiscal stimulus is substantial—market expectations currently suggest at least 1.4% of total GDP—it could largely offset the negative impact from tariffs and declining exports.

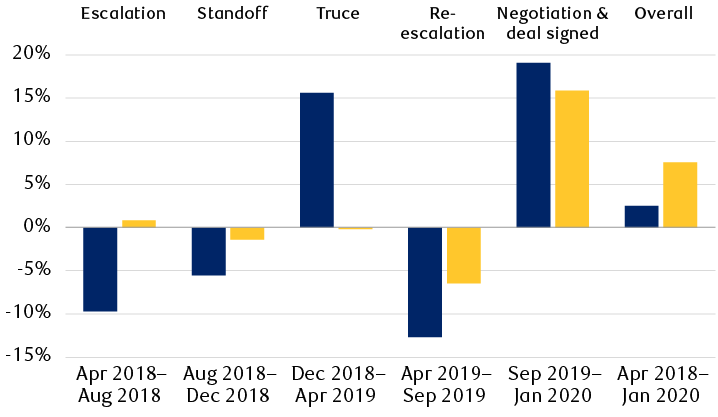

Performance of China and Japan equities during the five phases of U.S.-China trade tension

Percentage return

The column chart compares the performance of the MSCI China and Japan indexes in local currency during the period of trade tension between the United States and China, from April 2018 through January 2020, broken down into five phases. During the escalation phase (April to August 2018), MSCI China fell by roughly 10% and MSCI Japan rose roughly 1%. During the standoff phase (August to December 2018), MSCI China fell roughly 5% and MSCI Japan fell roughly 1.4%. During the truce phase (December 2018 to April 2019), MSCI China rose roughly 15% and MSCI Japan was roughly flat. During the re-escalation phase (April to September 2019), MSCI China fell roughly 13% and MSCI Japan fell roughly 6.5%. During the negotiation and deal signed phase (September 2019 to January 2020), MSCI China rose roughly 19% and MSCI Japan rose roughly 16%. Over the entire period, MSCI China rose roughly 2.5% and MSCI Japan rose roughly 7.5%.

Source - RBC Wealth Management, Bloomberg

A major concern for China’s growth is local government debt and the ongoing property market slowdown. We believe the government is determined to stabilize the property market, which is essential for shoring up domestic demand and supporting the equity market’s valuation. We remain cautiously optimistic about Chinese equities as many economic headwinds appear to be priced into the market already. We see more upside potential than downside risk in 2025.

Our constructive view on Japan equities is underpinned by our belief that a sustainable 2% inflation target is in sight; the potential for inflows from friend-shoring and on-shoring investments; the likelihood corporate Japan will raise shareholder returns; potential elevated domestic demand on the back of high savings and wage hikes; and forthcoming retail inflows from the revamped Nippon Individual Savings Account scheme.

Risks to our view include the possibility of the Japan Government Pension Investment Fund tilting its allocation in favor of domestic bonds over domestic stocks, the Bank of Japan (BoJ) reducing its equity ETF holdings and, lastly, a volatile yen weighing on corporate earnings.

Japan’s political climate has become more unpredictable as the ruling coalition government lost its majority in the lower house election. We believe the new government, likely still led by the Liberal Democratic Party, will see Prime Minister Shigeru Ishiba’s fiscal agenda become less hawkish.

The consensus of economists is for the BoJ to continue to raise interest rates into late 2025. We think the incoming Trump administration increases the prospect of a somewhat stronger U.S. economy, which we view as positive for Japanese equities overall. However, we would be selective among exporters due to risks associated with U.S. tariffs and stricter U.S. regulations vis-à-vis China, an important Japanese export market.

Asia Pacific fixed income

Heading into 2025, Asian credit markets face a complex macroeconomic landscape, influenced by potential geopolitical tensions and U.S. protectionist policies under the incoming Trump administration. Market concerns over the U.S. imposing tariffs on the region are expected to pressure Asian credit. We have a preference for Asian investment-grade bonds, despite tight credit spreads, given expectations of higher U.S. Treasury bond yields and a steeper U.S. Treasury curve. Asian financial institutions, especially major banks, appear well-positioned to manage currency volatility and may benefit from an inflationary backdrop, in our view. Overall, firm demand for high total yields, moderate supply, and stable fundamentals underpin our cautiously optimistic outlook for Asian credit.

Asia ex Japan USD investment-grade credit spread tightened from January to October 2024

Bloomberg Asia ex Japan USD Credit Corporate IG Index relative to U.S. Treasury curve

The chart illustrates the credit spread (in basis points) of the Asia Ex Japan USD Credit Corporate IG bond index over the period from start of 2024 to the end of October 2024. It shows the spread steadily get tighter since the start of 2024 and widening briefly for the months of Aug and September, before sharply tightening again into the end of October 2024 leading into Donald Trump’s election victory.

Source - Bloomberg

China enters 2025 with familiar pressures, bearing the brunt of President-elect Donald Trump’s tariff agenda—where he threatens to impose a 60% tariff on Chinese imports. However, we expect this threat to be used as a bargaining chip to extract concessions from China, and the tariffs imposed to be lower. Domestically, China introduced a fiscal package in November 2024 aimed at addressing local government debt risks. This follows an earlier round of monetary stimulus in September 2024 aimed at reviving the property sector and boosting consumption. Additional measures are likely to be announced in the next months, in our view. Despite low consumer sentiment, bright spots are evident in sectors like food service and air travel, which are showing resilience. Investment-grade bonds remain our preferred choice within China’s credit market.

In Japan, the Bank of Japan’s (BoJ) actions continue to be closely guided by yen movement. The lead-up to Trump’s election victory and the market’s expectations of ensuing higher U.S. Treasury bond yields have led to a weaker yen. A near-term hike by the BoJ could be possible if the currency continues to weaken excessively, boosting import prices for consumers and businesses and dampening domestic demand. We have a preference for Japanese investment-grade credit, which should act as a defensive buffer against a potential rise in Japanese government bond yields and imposition of the 10%–20% tariffs proposed by the incoming Trump administration.