“80% of the studies show that stock price performance of companies is positively influenced by good sustainability practices.”

- University of Oxford study(2015)1

Incorporating qualitative environmental, social and governance (ESG) factors into investment analyses alongside traditional quantitative factors can help:

- Identify risks and opportunities of investments that we believe will, at some point, impact performance (for example, potential impact to the business of climate change, union and employee relationships, or lack of adequate oversight from the board of directors)

- Identify high quality management teams that manage businesses with these types of considerations in mind

- Align your portfolio with your thoughts and values

*Due diligence processes do not assure a profit or protect against loss. Like any type of investing, ESG investing involves risks, including possible loss of principal.

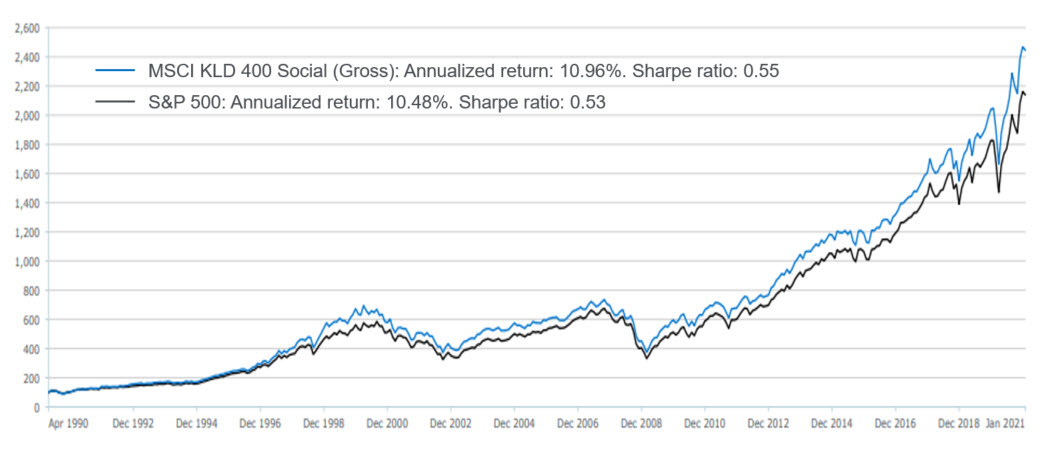

MSCI KLD 400 Social Index has outperformed the S&P 500 on an actual and risk-adjusted basis2

May 1990 - January 2021 (Single Computation)

*Past performance does not guarantee future results.