Market overview: A new reality

We think a U.S. recession is the most probable outcome in the coming quarters. In the past, the combination of high interest rates and restrictive bank lending standards—what is in place today—has been a recipe for recession. Soft landings, on the other hand, have historically featured rising interest rates but no overt tightening of lending standards. The presence of similar conditions, i.e., high rates and restrictive lending, is already taking a toll in Canada, the UK, and the eurozone.

However, it could be that the big, decisive shifts in fiscal and monetary policy over the past few years continue to have lingering effects on the course of the U.S. economy, and that instead of a decline in GDP, growth is merely on the slow side in 2024.

Regardless of the outcome, the economic headwinds which have been gathering will likely run their course and probably fully dissipate later in the year.

That could be enough to keep S&P 500 earnings growing, and we believe any growth in earnings would leave room for share prices to advance between now and the end of 2024, even if the path for getting there is debatable.

We recommend a Market Weight position in global equities, but we believe investors should consider limiting individual stock selections to high-quality businesses, i.e., those with resilient balance sheets, sustainable dividends, and business models that are not intensely sensitive to the economic cycle.

In our opinion, portfolios that have held their value to a better-than-average degree will be best-equipped to take advantage of the opportunities that are bound to present themselves when a stronger pace of economic growth reasserts itself.

The stock market will need to adjust to the new competition from bonds for investment dollars. For the first time in more than a decade, bond yields have moved back up to levels that make fixed income a fully useable and attractive adjunct to equities in a balanced portfolio. Bonds provide, as they have traditionally done, a combination of reduced volatility, more predictable returns, and the comfort of a maturity value.

If at some point a more defensive structuring for a balanced portfolio is called for, having bonds as a reasonable alternative for an investor looking to take some risk out is a welcome development.

United States

Nimble positioning in equities; bonds could post strong returns

U.S. equities face an unusually high number of crosscurrents in 2024.

There is a wide range of potential economic outcomes possible, as described above.

The market seems positioned for a rosy scenario. Industry analysts’ S&P 500 consensus earnings forecast of $244 per share in 2024 represents 11.1 percent year-over-year growth. This forecast, combined with the market’s 19.3x above-average price-to-earnings ratio, leaves little wiggle room for economic disappointments.

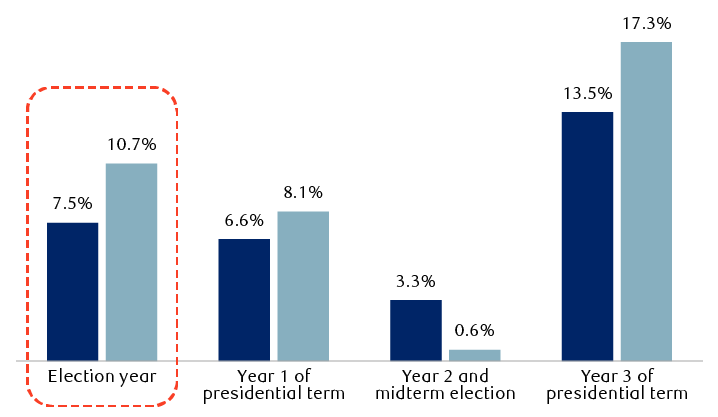

The U.S. presidential election will inevitably generate noise. Investors should remember that since 1928, the S&P 500 rose 7.5 percent on average during presidential election years and ended the year in positive territory almost 75 percent of the time. We believe Fed policy and the economic cycle play greater roles in shaping market returns than political party control in Washington.

Overall, we think S&P 500 returns for the next 12–18 months will largely depend on whether a U.S. recession materializes. But even if one does and the stock market corrects, the market typically establishes a new uptrend partway through the recession period.

The U.S. stock market has historically traded in a four-year pattern associated with elections

S&P 500 performance during presidential election cycles since 1928

The column chart shows average and median S&P 500 performance during the four-year U.S. election cycle from 1928 through 2022. The respective average and median returns are as follows: 7.5% average and 10.7% median return in the election year; 6.6% and 8.1% in year one of the presidential term; 3.3% and 0.6% in year two of the presidential term (this is also the midterm election year); 13.5% and 17.3% in year three of the presidential term.

Source - RBC Wealth Management, Bloomberg; based on annual data through 2022

To start the year, we recommend maintaining U.S. equities at the Market Weight level to take advantage of the distinct possibility of the S&P 500 reaching new all-time highs in the coming few months. This allocation is also intended to balance the risk of a recession against the possibility that one may be averted.

We anticipate market performance will broaden out beyond the “Magnificent 7” technology-oriented stocks that led by a wide margin for much of 2023.

Investors should consider limiting individual stock selections to companies they would be content to own through a recession—those with strong management teams, robust cash flow generation, and healthy balance sheets. We would tilt portfolio holdings toward reasonably valued stocks of high-quality companies. The valuations of small-capitalization stocks in particular seem to already price in a recession.

As for fixed income, we expect a strong bounce-back year to play out over the course of 2024. When bond yields are high, the income earned is often enough to offset most price fluctuations. In fact, for the 10-year Treasury to deliver a negative return in 2024, the yield would have to rise to 5.3 percent. This is relatively unlikely, in our view, as we expect the Fed to embark on a series of modest rate cuts beginning this summer as the economy loses steam.

The bond market’s repricing of rate cut expectations will likely be most dramatic at the short end of yield curves. Thus, investors should proactively rotate out of cash and/or cash equivalent products and into longer-dated securities, in order to lock in yields for longer—and before they fade away, in our opinion.

Canada

Interest rate risks becoming more two-sided

Restrictive monetary policy continues to work its way through the Canadian economy, weakening it. Meanwhile, inflation risks seem to be easing and additional rate hikes from the Bank of Canada (BoC) are likely on hold, in our view.

For equities, the trajectory of interest rates and the ultimate impact on the consumer will have clear implications for the Canadian banks, in our view. Bank valuations reflect the uncertain environment, and the group trades close to trough levels.

We expect Energy sector stock performance to be largely influenced by commodity prices and note the Canadian energy companies’ fortified balance sheets and reasonable capital expenditure needs.

As for fixed income, historically, adding duration following the last BoC rate hike has led to higher total returns relative to short-duration strategies. We suggest extending maturities through laddering, exposing portfolios to a higher degree of rate sensitivity while minimizing return volatility, which should lead to a smoother path of returns.

United Kingdom

Opportunities despite the subdued economy

Economic data is likely to slip further as the full impact of much higher interest rates increasingly filters through the economy. We think the Bank of England will likely keep the Bank Rate elevated for much of 2024 as core inflation remains sticky and above five percent. We see a risk of stagflation in the UK.

Despite these challenging prospects, we continue to recommend a Market Weight position in UK equities. Their defensive qualities and attractive valuations should be assets given the more volatile backdrop we are expecting in 2024. The Energy sector currently enjoys a favourable risk-reward profile, in our view.

For fixed income, we would add further to Gilts and increase duration. Credit spreads could widen as credit fundamentals worsen. There are pockets of opportunities in non-cyclical issuers and in senior-ranking bank bonds.

Europe

Remain cautious but on the lookout for the next economic upturn

Europe will also likely grapple with anemic economic growth in 2024. The pandemic and the war in Ukraine have compounded the bloc’s long-standing structural issues, such as a lack of competitiveness, which conspire to undermine the effectiveness of the EU single market. European Commission task force recommendations to remedy the situation are due in March 2024.

We continue to recommend an Underweight position in European equities as weakening macro and earnings momentum remain headwinds for the region’s ability to outperform. However, we are watchful for any green shoots and signs that the euro area’s relative economic growth momentum may be improving. This would be a key catalyst to increase allocations given inexpensive valuations.

In fixed income, we would add to sovereign bond positions and duration as the economic outlook looks set to deteriorate further, thus benefiting longer-duration and sovereign positions.

Asia Pacific

Overweight Japan equities; prefer Asian investment-grade credit

We suggest an Overweight stance in Japanese equities, where the outlook appears bright thanks to the launch of a revamped tax-exempt investment scheme for residents, corporate pension reforms, onshoring trends, and efforts at improving corporate governance. Relative economic and political stability combines with low valuations to further enhance this market’s attractiveness.

Given that China’s economic recovery and investor sentiment remain fragile, Chinese equities may continue to trade within a limited range. We would focus on opportunities in industries where China has competitive advantages or which can benefit from policy tailwinds, such as advanced manufacturing and health care.

In Asian fixed income, we continue to prefer investment-grade credit for 2024. The lower U.S. Treasury yields that we expect into 2024 should provide an overall tailwind for Asian credit. We prefer to keep duration short for Asian investment-grade credit due to spread valuations. We like the attractive coupon carry for this resilient segment, but also seek to limit the potential performance impact should valuations reverse.

For more details on these views, as well as forecasts for commodities and currencies, please have a look at our complete Global Insight 2024 Outlook or the individual articles: Investing for a new reality (feature article), as well as the regional focus commentaries on the U.S., Canada, the UK, Europe, and Asia.