The Bank of Canada (BoC) lowered its policy rate by 25 basis points on June 5, joining the Swiss National Bank and Sweden’s Riksbank as the first G10 central banks to cut interest rates this year. The BoC gave limited guidance on future rate cuts, but RBC Capital Markets and Bloomberg consensus expect the overnight rate will be lowered to four percent by year-end from five percent at the start of the year. These same sources expect further rate reductions in 2025.

That path would see the BoC diverging from its U.S. counterpart, with the timeline for Federal Reserve rate cuts having been pushed back by elevated inflation readings and generally firm economic data. This divergence is justified, in our view, by a softer growth backdrop in Canada and more benign inflation trends. Canada’s economy is clearly feeling the effects of higher rates, while in the U.S., there is ongoing debate over the neutral interest rate and whether monetary policy is sufficiently restrictive.

Divergence is nothing new

Policy rates in the two countries have diverged substantially in the past. In the mid-1990s, stubbornly high unemployment and fiscal consolidation in Canada necessitated greater monetary policy support from the BoC. The Fed lowered its policy rate by relatively more following the dot-com bubble when the U.S. experienced a mild recession while Canada avoided a downturn. A less extreme but more sustained divergence occurred following the global financial crisis, which caused a deeper recession in the U.S. that was followed by a period of household deleveraging and fiscal restraint.

The market seems to imply we are in for another extended period of policy divergence. The spread between 10-year U.S. Treasury (UST) and Government of Canada (GoC) yields is at its widest level in at least several decades. It’s even wider than the 2-year spread, which is influenced more by near-term monetary policy. We attribute this persistence to two key “gaps” between Canada and the U.S.: household debt and productivity.

As the U.S. deleveraged, Canada racked up debt

Unlike the U.S., Canada didn’t go through a deleveraging cycle post the global financial crisis. Rather, Canadian households continued to accumulate debt, pushing the country’s debt-to-disposable income ratio to a record high and close to the U.S.’s 2008 peak on a comparable basis. Today, the average Canadian household has about 20 percent more debt than its U.S. counterpart, adjusted for income.

Canadian households are more highly indebted than their U.S. counterparts

Ratio of household debt to disposable income

The line chart shows the ratio of household debt to disposable income for the U.S. and Canada, and Canada's ratio adjusted to U.S. definitions. The U.S. debt-to-income ratio peaked at roughly 170% at the end of 2007 and declined through 2016 before stabilizing at approximately 135%. The Canadian ratio continued to increase through 2016 but has stabilized around 180% since. The Canadian ratio adjusted for U.S. definitions follows a similar trajectory but is shifted lower, with a 2022 peak slightly below the U.S.’s peak level at the end of 2007.

Note: Canadian adjustment to U.S. definitions based on Statistics Canada’s methodology.

Source - RBC Economics, RBC Wealth Management

On top of a higher debt load, Canada’s economy has seen faster pass-through of rate hikes due to the prevalence of 5-year fixed and variable rate mortgages, as opposed to 30-year fixed rates that are common in the U.S. While the U.S.’s debt servicing burden has barely budged amid policy tightening, Canada’s household debt service ratio has increased to a record high. And only half of Canadian mortgage holders have had to refinance at higher rates so far, according to the BoC.

While Canada’s debt-to-income ratio has flattened out in recent years, we think deleveraging will be a slow process as the economy attempts to “grow into” high levels of household debt. That suggests Canada’s greater rate sensitivity is likely to persist for the foreseeable future. Just as the Fed kept monetary policy more stimulative for several years amid the deleveraging following the global financial crisis, we believe the BoC might have to keep interest rates lower relative to the Fed for an extended period as Canada deals with its own debt overhang.

Canada’s productivity gap should mean lower rates

A widening gap in productivity growth between the two countries also argues for lower rates in Canada. Faster productivity growth in the U.S. is nothing new, but the recent divergence is particularly striking. While U.S. productivity growth has averaged 1.5 percent over the past four years, Canadian productivity has been flat.

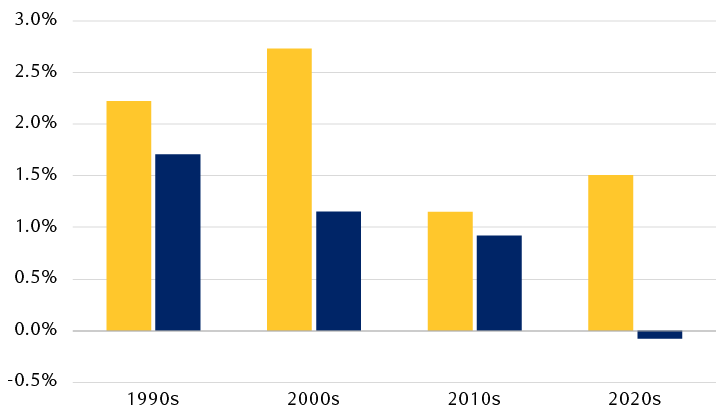

Canadian productivity growth significantly lags that of the U.S.

Average annual productivity growth

The bar chart shows average annual productivity growth in Canada and the U.S. by decade from the 1990s through the 2020s (as of 2024). U.S. productivity growth has consistently exceeded Canada's, particularly in the 2000s (U.S. 2.7% vs. Canada 1.2%) and the 2020s (U.S. 1.5% vs. Canada -0.1%).

Source - RBC Wealth Management, Bloomberg

Productivity growth is a key factor in central banks’ estimates of the neutral policy rate. If labour is less productive, investment demand will be lower and cheaper borrowing costs will be needed to stimulate new capital spending. In fact, Canada’s lagging productivity growth is a symptom of a growing gap in business investment per worker relative to the U.S.

Those two factors—higher household debt and slower productivity growth in Canada—are not the only potential drivers of policy divergence. While Canada has hardly been a model of fiscal restraint in recent years, the U.S. government’s largesse is on another level. Relatively more Treasury issuance to finance swollen deficits, which show no signs of abating, could contribute to higher UST yields relative to GoCs.

Canadian investors should think about diversification

If we are in fact entering a period of BoC-Fed policy divergence, what does that mean for investors? While UST-GoC spreads are already relatively wide, RBC Capital Markets expects further widening as the BoC continues to cut rates ahead of the Fed. That should cause some relative outperformance in Canadian fixed income in the near term. But once that plays out, prospects for future returns will likely be weaker in Canada. We expect a similar albeit more muted trend in other geographies where divergence relative to the Fed should be less acute.

Investors outside of the U.S. who don’t already have some global, and particularly U.S., fixed income exposure in their portfolios should evaluate strategies to diversify away from their home market, in our opinion. That said, even modestly lower bond yields in Canada and other non-U.S. developed markets should remain attractive relative to much of the post-global financial crisis era.

Policy divergence will also have currency implications. RBC Capital Markets forecasts the Canadian dollar will depreciate by about three cents against the U.S. dollar over the next year amid a growing interest rate gap. The Canadian dollar is already below RBC Capital Markets’ estimate of its fair value, and could stay there for some time if the BoC keeps rates lower than the Fed.

It’s not unusual to see currencies deviate from fair value for an extended period. Still, to avoid the risk that the Canadian dollar begins appreciating toward fair value, which would weigh on unhedged returns in foreign bonds, we think Canadian investors who don’t have U.S. dollar funds to invest should look at hedged solutions for their U.S. exposure.