Surveying the tariff landscape

The European Union (EU) is finding itself in the crosshairs of a trade dispute with the United States. RBC Global Asset Management Chief Economist Eric Lascelles points out that although no individual European country is among its three largest trading partners, collectively the EU is the largest consumer of U.S. products and, at the same time, maintains a trade surplus with the U.S.—meaning the region exports even more than it imports.

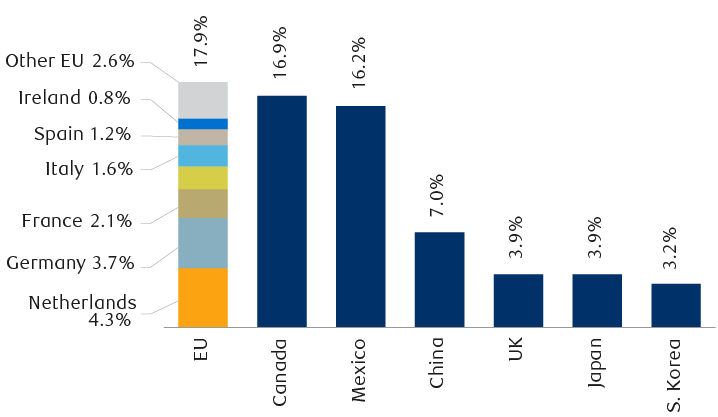

Trump tariff targets are top U.S. export destinations

U.S. goods exports (% of total exports)

The column chart shows the percentages of U.S. goods exports directed to the countries that consume the most U.S. goods. The European Union (EU) consumes 17.9% of U.S. goods exports; Canada, 16.9%; Mexico, 16.2%; China, 7.0%; the United Kingdom, 3.9%; Japan, 3.9%; South Korea, 3.2%. Within the European Union, the Netherlands consumes 4.3%; Germany, 3.7%; France, 2.1%; Italy, 1.6%; Spain, 1.2%; Ireland, 0.8%; and other EU countries combined, 2.6%.

As of December 2024; 12-month moving total of share of U.S. goods exports by destination.

Source - RBC Global Asset Management, U.S. Census Bureau, Macrobond

Reciprocal tariffs

U.S. President Donald Trump’s most recent idea for rectifying what he views as an unfavourable balance of trade is to impose reciprocal tariffs, whereby a country matches the tariffs that trade partners charge. Such tariffs would potentially have a much larger negative impact on the European economy than the targeted tariffs on steel and aluminium the U.S. recently announced.

Trump has tasked U.S. trade officials with examining all trade partners’ tariffs (as well as non-tariff barriers such as regulations, government subsidies, and sales taxes) with an eye toward charging countries similarly. In the case of the EU, potentially contentious regulations include limits on genetically modified organisms and hormone-treated meat, while a wide range of subsidies help support its agricultural sector.

U.S. trade officials will also focus on whether the value-added tax (VAT) system should be viewed as an additional tariff on U.S. exports.

The VAT is an approach to taxing consumption that is used by some 175 countries around the world. It is applied on all goods at the point of consumption, regardless of whether they are produced domestically or imported, a fact that underpins arguments against classifying it as a tariff. Nonetheless, opponents have long argued that the VAT unfairly impacts U.S. exports.

At an average rate of roughly 20%, the VAT is an important source of funds for the EU, accounting for approximately one-fifth of tax revenues. Hence, it is unlikely to be decreased, in our view.

U.S. officials are due to present their findings by April 1. If the U.S. were to impose reciprocal tariffs that include VAT rates, the EU could be hit by tariffs as high as 25%. Such an outcome would be negative for the European economy, though the impact would depend on how long such tariffs remain in force.

Targeted tariffs

The Trump administration has imposed 25% tariffs on steel and aluminium imports into the U.S. starting March 12, 2025. Lascelles thinks the maximum economic impact of targeted tariffs is likely to be relatively small, but he sees a high risk that these tariffs could persist indefinitely. This is because the U.S. administration sees tariffs as a means to fund tax cuts, at least partially, as well as to protect American businesses from foreign competition.

The EU’s options: fast and flexible?

The European Union’s trade policy is the remit of the European Commission (EC), which negotiates and ratifies international trade agreements. Individual member states do not enter into bilateral trade agreements.

Until 2023, the EU had no centralised mechanism to respond quickly to economic policies it viewed as coercive. Any ad hoc retaliation required unanimous agreement, and included waiting for a World Trade Organization ruling or lengthy negotiations among member states.

To formalise and speed up its response process in trade negotiations, the EU in 2023 put in place an Anti-Coercion Instrument (ACI) that requires only a “qualified majority” or the approval of 15 out of 27 member states, representing 65% of the bloc’s population.

The ACI also provides a wider range of countermeasures than were previously available; beyond tariffs, the EU can impose investment restrictions and procurement bans, among other economic tools. Though the process of responding to trade policy changes can still take up to eight weeks, the ACI enables the EU to impose countermeasures faster and with greater flexibility.

If the U.S. were to impose tariffs, the EU would likely offer concessions as a first response. It could increase U.S. liquified natural gas imports, and/or boost military spending as the governments of the three largest EU economies (Germany, France, and Italy) currently spend less than 2% of national GDP on defence. It could also offer to lower trade barriers; for instance, the EU levies a 10% tariff on motor vehicles produced in the U.S., while EU vehicles are subject to a 2.5% U.S. tariff.

But the EU would also eventually retaliate, in our view. The EC has stated it would respond “firmly” to U.S. tariffs, but the ones it might impose would likely be less punitive than those imposed by the U.S. Many European policymakers have argued for negotiations instead of retaliation. European Central Bank President Christine Lagarde has called for talks and Friedrich Merz, likely to be the next chancellor of Germany, suggested before the U.S. presidential inauguration that the EU should continue free trade discussions.

A strategy of de-escalation served Europe well in 2018. Faced with similar tariff threats, the EU increased its U.S. liquified natural gas purchases and responded to tariffs on European exports worth more than $6 billion with tariffs on U.S. goods for half that amount, targeting whiskey, blue jeans, and motorcycles.

This approach helped to defuse trade tensions with the first Trump administration. A similarly measured response by the EU could reduce the risks of trade war escalation, in our view.

A serious threat to regional recovery

Europe’s tentative economic recovery is likely to be tested by tariff threats. Given the Trump administration’s goal of increasing tariff revenues to help fund domestic tax cuts, these threats should be taken seriously, in our view, and we would look to position portfolios for increasing trade tensions and high volatility.

For European stocks, earnings risk may be mitigated by the fact that many companies have manufacturing facilities in the U.S. We would continue to focus on global leaders that benefit from—and drive—structural global trends, particularly in semiconductor manufacturing equipment, electrical and mechanical engineering, industrial gases, and health care.