Building portfolios: strong investment philosophy

Portfolio construction is the cornerstone of a successful RBC WealthPlan. Through a broad array of investment strategies, considering all asset classes, Cash carefully tailors your portfolio to meet your unique goals and priorities. His dedicated approach is based on your lifestyle, legacy and impact objectives. Cash’s methodology is practical — and most importantly — risk- and tax-aware.

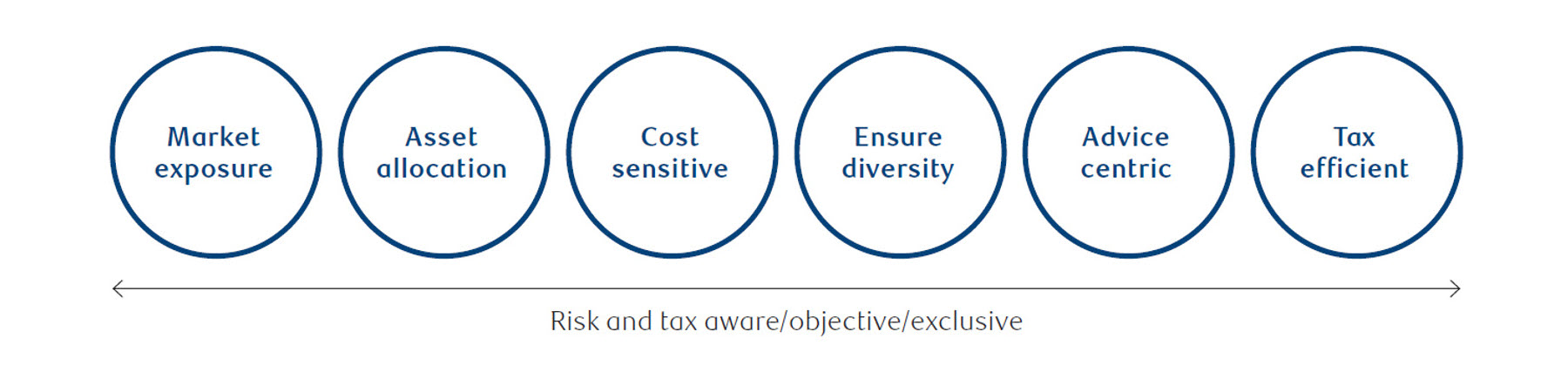

Portfolio selection process

Asset management: rules-based process

Our methodology is practical, and most importantly, risk- and tax-aware. We believe successful investing requires skill, discipline and focus. Our skilled investment professionals offer attractive opportunities to fit your unique situation, investment objectives, and growth and income needs.

Pillars of our methodology