Investing with a greater purpose

Our values are at the core of every choice we make. Making decisions with greater purpose helps the world become a better place for everyone, which is why so many people are choosing to align their financial goals with their personal values.

RBC Wealth Management is committed to a better future. Like many of our clients, we’re focused on community involvement, diversity and inclusion and environmental responsibility as a way to support both current and future generations. To help you create positive social and environmental impact, we offer a broad range of solutions designed to align your values with your financial goals.

A growing trend

As companies continue to innovate and strive for positive impacts, responsible investing opportunities continue to increase.

Responsible investing is an umbrella term encompassing the approaches used to deliberately incorporate environmental, social and governance (ESG) considerations to an investment portfolio. This encompasses a number of investing approaches, including ESG integration, ESG screening & exclusion, Thematic ESG investing, and Impact investing.

ESG Integration

Systematically incorporating material ESG factors into investment decision making to identify potential risk and opportunities and cultivate long-term, risk-adjusted returns.

ESG integration happens at the same time as traditional financial analysis. ESG integration is about understanding the material factors that are important to a company as it helps create a clearer picture in order to better understand the potential impacts to long term value. A few examples of ESG factors include:

| Environmental concerns - Including climate change, natural resources conservation, pollution and waste management, and water scarcity. |

| Social issues - such as corporate philanthropy, community and government relations, workplace health and safety, human rights and diversity. |

| Governance topics - Including accounting practices, board accountability and structure, disclosure practices, executive compensation, corporate ethics, regulatory compliance and transparency. |

ESG Screening & Exclusion

This is applying positive or negative screens to include or exclude assets from the investment universe. This is often referred to as investing in line with values or values alignment.

ESG exclusions and screening can include positive/negative screening, socially responsible investing (SRI), inclusions/exclusions, norms-based investing, best-in-class, and seeking leaders’ strategies.

Negative screening

Positive screening

Thematic ESG Investing

Identifies a social or environmental impact or theme that the portfolio wants to measure and report progress in alongside risk and return. With thematic investing, there is an intentional allocation of capital to a specific investment theme (e.g. climate change, gender equity, sustainability-related categories).

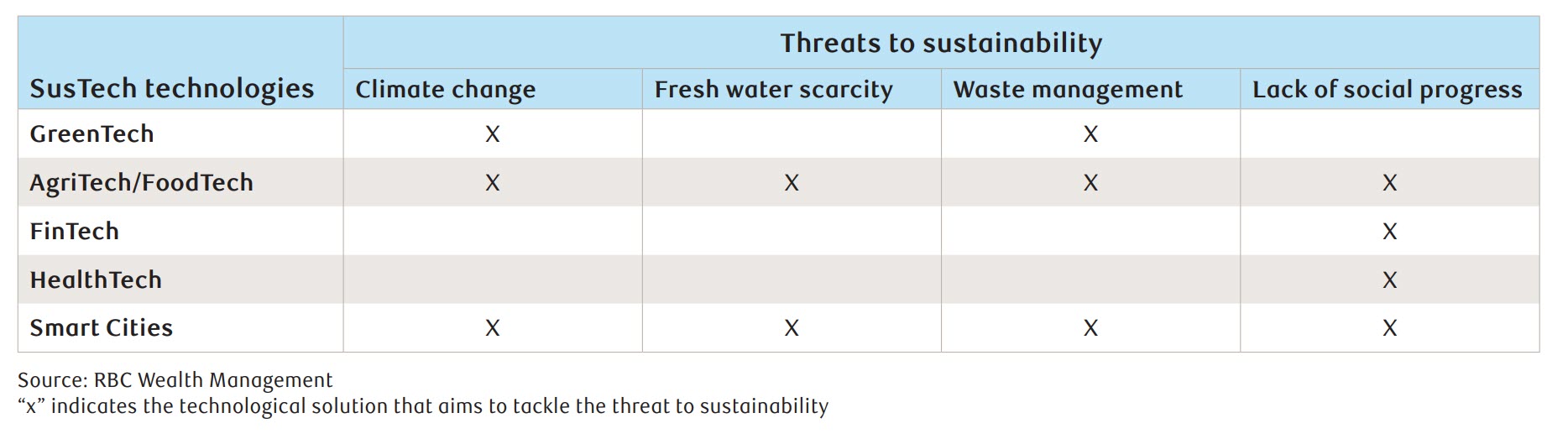

There is significant investment into technologies that alleviate the threats to sustainability. At RBC Wealth Management, we call the technologies that help tackle the threats to sustainability “SusTech”—Sustainability through Technology.

These include:

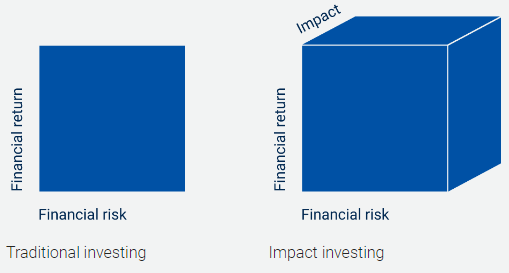

Impact Investing

Investing in assets that intend to generate a measurable positive social or environmental impact. Impact is the third dimension of performance, alongside traditional financial risk and return. An impact investor wants to earn a return on their investment, but they may also be willing to take a capital loss as long as some tangible result for the investment can be seen. In that way, it is essential to be able to measure the impact of this investment. An example includes investment in low-income housing loan assistance, where a tangible impact is measurable (i.e., number of households able to afford housing).

Impact - a third dimension of performance