We upgraded European equities to Market Weight from Underweight in March. Our bear case scenario was predicated on weakening economic and earnings growth momentum, but this no longer seems to be the case. The economy is showing signs of troughing.

European equities present attractive opportunities, in our view, though misconceptions, anchored in the past, often prevent investors from seeking them out. We discuss the evolution of the European equity market since the global financial crisis and evaluate how to position portfolios advantageously.

A changing face

European equity markets are often thought of as being dominated by “old economy” companies. This was indeed the case 15 years ago when low-growth sectors, such as Financials, Telecommunication Services (now called Communication Services), Utilities, Energy, and Materials, made up a significant portion of the MSCI Europe ex UK Index, which comprises large-cap and midcap companies across 14 European developed markets. With lackluster earnings growth stemming from poor pricing power and a highly competitive environment, the stocks of many companies in these sectors have been languishing ever since.

But the profile of the European equity market has seen a notable transformation. Those old economy sectors are now no more than a third of the index. Higher-growth-oriented sectors, such as Technology, Health Care, Industrials, and Consumer Discretionary, now represent some 57 percent of the index, a sharp increase from 37 percent in 2011.

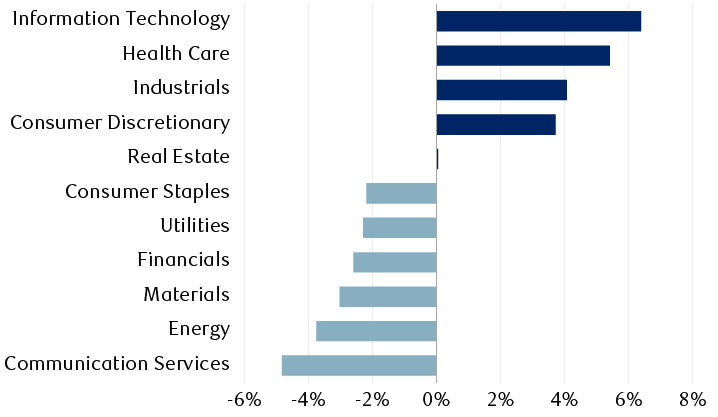

Low-growth sectors have been scaled back, while higher-growth sectors have gained

Changes in the sector composition of the MSCI Europe ex UK Index between January 2011 and March 2024

The bar chart shows the change in sector composition of the MSCI Europe ex UK Index from January 1, 2011 to March 1, 2024. The low-growth sectors Communications Services, Energy, Materials, and Financials decreased the most, while higher-growth sectors Information Technology, Health Care, Industrials, and Consumer Discretionary increased. The changes are: Information Technology, +6.4%; Health Care, +5.4%; Industrials, +4.1%; Consumer Discretionary, +3.7%; Real Estate, +0.1%; Consumer Staples, -2.2%; Utilities, -2.3%; Financials, -2.6%; Materials, -3.0%; Energy -3.8%; Communication Services, -4.8%.

Note: The former Telecommunication Services sector was expanded and renamed Communication Services in 2018.

Source - Bloomberg, MSCI

Notable changes are also afoot within industries. For instance, some of the formerly clunky and bloated conglomerates in heavy industries have slimmed down, spinning off underperforming operations to enhance capital efficiency, and are focusing on more modern, dynamic businesses and technologies. The Consumer Discretionary sector has also been transformed. It enjoys greater exposure to high-margin luxury goods, having benefited from demand arising from the growing middle class in emerging markets.

The evolution of the index’s composition has had several notable consequences. For one, approximately 55 percent of the revenue of index constituents is now generated outside Europe, lessening dependency on what has been an often lacklustre domestic macroeconomic backdrop, while providing exposure to economies with higher growth rates.

Moreover, European companies’ profitability, return on equity (ROE), earnings stability, and cash flow profiles have all improved. The ROE—a measure of profitability—of index companies reached 13 percent at the end of 2023, up from a meager 9.8 percent in 2011.

Top 10 companies by weight in the MSCI Europe ex UK Index in 2011 and 2024

| January 1, 2011 | March 1, 2024 | ||||

|---|---|---|---|---|---|

| Company | Sector | Weight | Company | Sector | Weight |

| Nestlé | Consumer Staples | 4.4% | Novo Nordisk | Health Care | 4.8% |

| Novartis | Health Care | 2.7% | ASML | Information Technology | 4.7% |

| Total | Energy | 2.4% | Nestlé | Consumer Staples | 3.3% |

| Siemens | Industrials | 2.2% | LVMH | Consumer Discretionary | 3.0% |

| Roche | Health Care | 2.2% | Novartis | Health Care | 2.5% |

| Telefónica | Telecommunication Services | 2.0% | SAP | Information Technology | 2.4% |

| Banco Santander | Financials | 1.9% | Roche | Health Care | 2.2% |

| BASF | Materials | 1.6% | Siemens | Industrials | 1.8% |

| Sanofi | Health Care | 1.4% | TotalEnergies | Energy | 1.7% |

| Daimler | Consumer Discretionary | 1.3% | Schneider Electric | Industrials | 1.5% |

Note: Some company and sector names have changed since 2011. Total is now TotalEnergies; Daimler is now Mercedez-Benz. The former Telecommunication Services sector was expanded and renamed Communication Services in 2018.

Source - MSCI, Bloomberg

Finding its footing

For the remaining 45 percent of revenue generated within Europe, prospects have improved somewhat, in our view. The region narrowly sidestepped a recession in the second half of 2023 despite stomaching three shocks in a row: the pandemic, the sudden energy price surge following Russia’s invasion of Ukraine, and a harsh monetary tightening cycle. In fact, economic activity seems to have troughed.

Economic indicators such as the HCOB Eurozone Composite Purchasing Managers’ Index have been improving since last October. The European Central Bank’s (ECB) recent Bank Lending Survey points to lending conditions becoming much less restrictive. Real wage growth is improving amid falling inflation, and with markets widely expecting the ECB to cut rates in June, we anticipate the region’s economy to continue to stabilize in coming months.

We acknowledge that the European economy does not have growth potential as high as that of the U.S., being more highly regulated and with an aging population. But consensus GDP growth forecasts are no longer being downgraded and are stable at 0.5 percent and 1.4 percent for 2024 and 2025, respectively.

We see downside risk to these forecasts if labor markets were to deteriorate. Conversely, they could prove conservative if the Chinese economy were to improve, as Europe is a large exporter to that market. Moreover, if bank lending picks up as business confidence improves, this could feed into stronger investment growth, another source of upside risk to consensus GDP growth forecasts.

A sheen of opportunity

Overall, as Europe’s economy is stabilizing, so too are corporate earnings forecasts. After declining for most of the past six months, consensus expectations now call for low-to-mid single-digit growth.

Valuations are not stretched, in our assessment. The MSCI Europe ex UK Index is currently trading on a 12-month forward price-to-earnings (P/E) ratio of 15x, in line with its 10-year average. We note, however, that over the past 12–18 months seven European quality growth leaders with global footprints including Novo Nordisk, the obesity and diabetes drug manufacturer, and ASML, the producer of extreme ultraviolet lithography systems for semiconductor manufacturing, have largely driven stock market performance and seen a notable expansion in valuations. Stripping out these companies leaves the rest of the stock market on a lower valuation.

On a relative basis, European equities trade on a sharp discount to U.S. shares. Adjusting for sector weighting differences, the valuation discount is particularly stark. The Continent’s P/E ratio relative to that of the U.S. excluding the Tech sector is at its lowest level since the EU sovereign debt crisis in 2011.

Importantly, a record number of European companies, particularly those with a strong balance sheet and a healthy level of cash, are increasingly buying back their own stock to boost earnings per share growth and improve their valuations. We also note that during recent earnings announcements more and more management teams have been mentioning plans to return capital to shareholders.

Building balance

Given that the tentatively improving macroeconomic backdrop is set against a relatively low-growth environment, we continue to argue for a balanced approach to stock picking. We favor pairing high-quality secular growers, or global leaders listed in Europe, with selective exposure to more cyclically sensitive names, particularly in the Industrials sector.

Long-term, we prefer the Technology sector (particularly mission critical software and semiconductor manufacturing equipment), Health Care, and Industrials names with exposure to the capital expenditure supercycles related to the themes of decarbonization, deglobalization (e.g., reshoring), and higher defense spending. The luxury goods segment, within Consumer Discretionary, also benefits from powerful drivers, in our view. By contrast, we have a more cautious view of the Utilities and Consumer Staples sectors.