Global warming and population growth continue to threaten the world’s increasingly limited freshwater supply. Water scarcity is one of the most complex and costly issues, but there is no shortage of solutions as firms within the water industry have seen momentum.

“Water, water, everywhere, nor any drop to drink.” The words of the titular character from Samuel Taylor Coleridge’s 18th-century poem “The Rime of the Ancient Mariner,” expressed in frustration, certainly have relevance today. Variations of that adage illustrate the dangerous paradox of water. Water is everywhere, yet most of it is inaccessible.

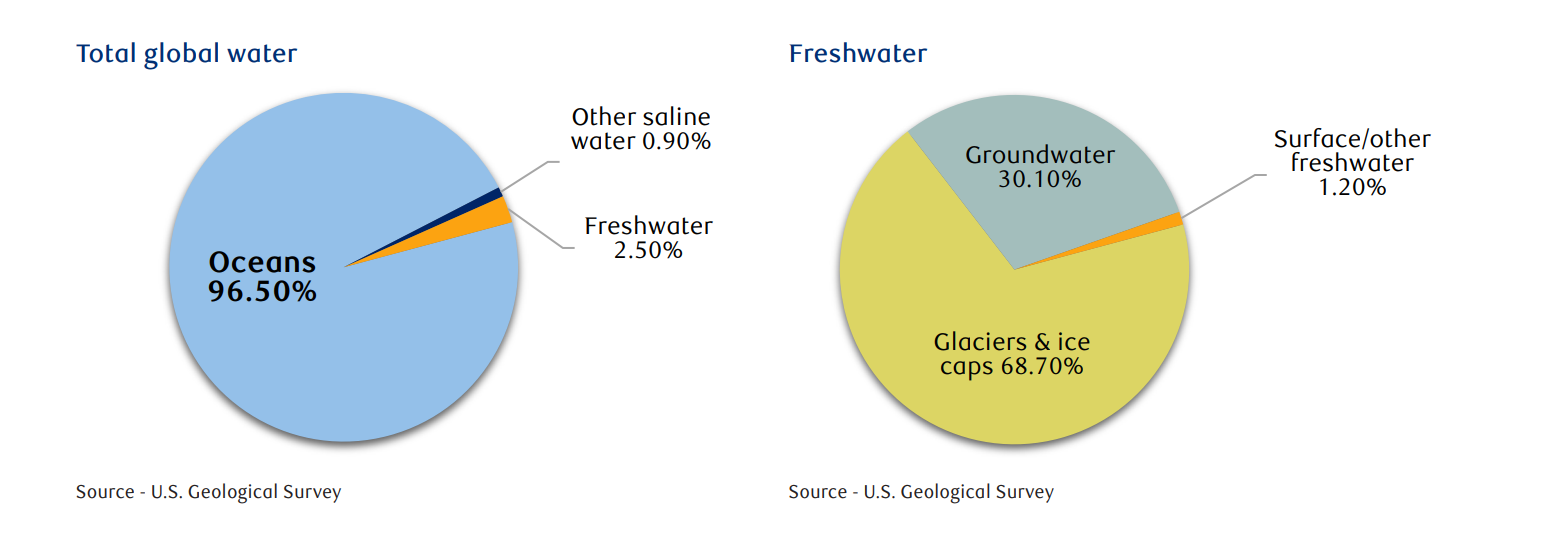

Water covers roughly 70% of the Earth’s surface, but only 3% is freshwater, 1% drinkable.

Water scarcity currently impacts more than 40% of the global population. By 2050, the World Resources Institute expects an additional one billion people to live with extremely high water stress, and some regions could see GDP growth rates decline by 6%. Water is vital to economic growth, impacting various essential functions of society, including growing crops and raising livestock, producing electricity, and maintaining human health. Population growth, economic development, and climate change will continue worsening water scarcity without improving water management.

Although the outlook for water scarcity may seem bleak, it does not necessarily lead to a water crisis. The water theme continues to broaden with new innovations, seen in places such as Singapore and Las Vegas, proving that societies can thrive even in water-scarce conditions, with technology such as desalination (removing salt and other impurities from seawater to produce fresh water) and wastewater treatments.

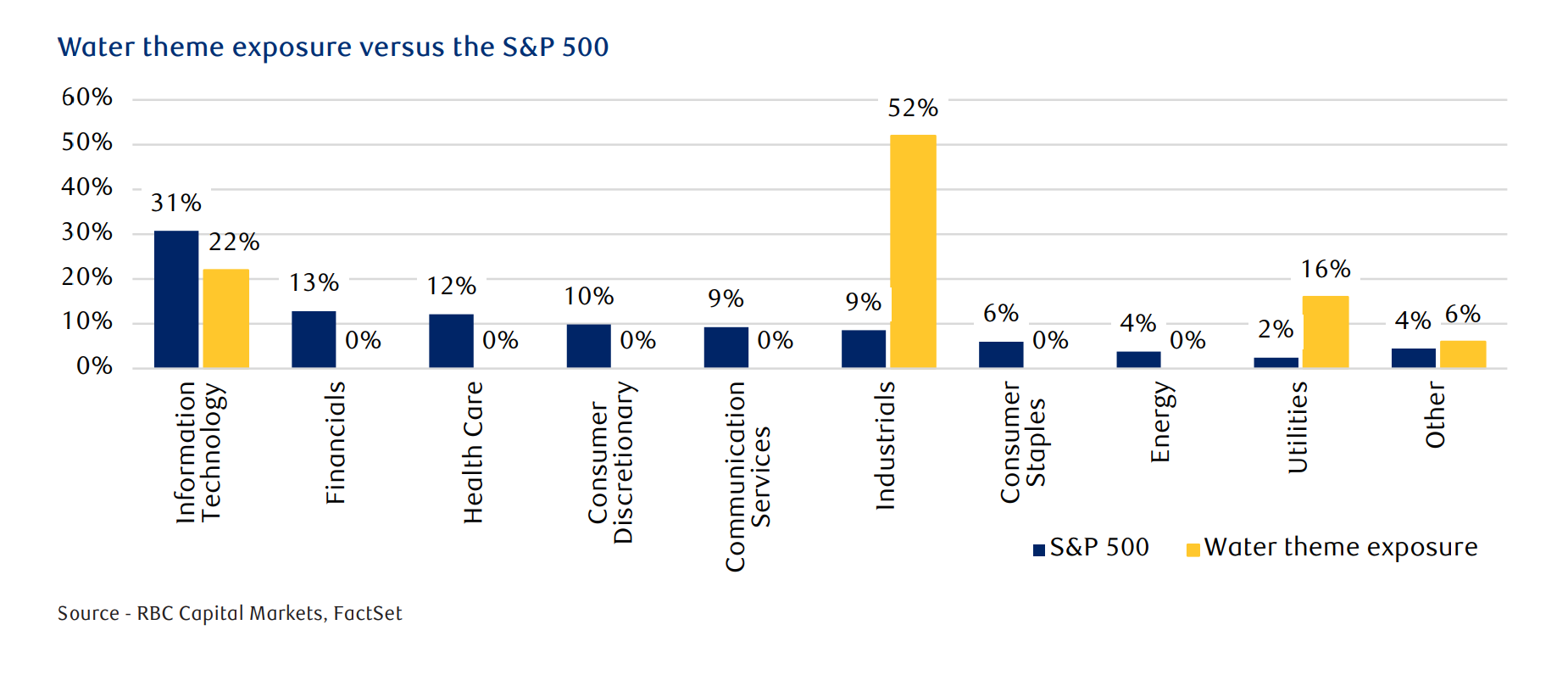

The water theme is a vast and fragmented landscape, rather than a single sector, which varies across numerous sub-sectors and has an approximate market size of more than $655 billion. Constituents in this theme include companies whose products and services provide access to water, increase water efficiency, and contribute to the sustainable management of water resources.

The water theme has three main sector players: Industrials, Information Technology, and Utilities.

Industrials and Utilities

There is a large abundance of Industrials and Utilities names within the water theme. A large array of water management firms within industrials provides solutions and water utilities in areas such as wastewater, electric energy, irrigation, drainage, water filtration, and desalination. Within Industrials, you will find firms that operate within industries such as machinery, construction & engineering, building products, trading & distribution, and commercial services. These sectors are the quarterbacks in improving the quality and availability of water.

Technology

Technology is a growing space within the water theme as a solution to resilient infrastructure and water efficiency. Water metering technology has been around for some time but has seen significant advancements in recent years with the expansion of meter capabilities seen in ‘smart water meters.’ This technology has increased the precision and efficiency of water usage, reducing water over-consumption.

As an investment opportunity, according to the Sustainable Development Solutions Network, $735 billion will need to be invested by 2030 to meet the UN’s goals for water and sanitation. However, some countries face a funding gap of nearly 60% to do so. This major gap provides an economic opportunity for investment for both private and public sectors.

Water scarcity also poses a risk from an investment standpoint, in our view, as it may lead to revenue and supply chain disruptions and additional costs for firms that have a high intensity of water usage. According to RBC Capital Markets indicators, the water theme is well-positioned and has experienced resilient earnings revisions momentum and long-term growth.

Incorporating the water theme into an investment portfolio falls under the umbrella of responsible investing or intentionally incorporating environmental, social, and governance (ESG) data into an investment portfolio. Investors can reach out to their advisors to discover the risks and opportunities related to the water theme and how to incorporate these factors into their investments.

Looking for additional insights about responsible investing?

Download our Q2 2024 Insights into responsible investing newsletter