Greetings from the Rock Cut Investment Group!

May continued to see stocks rebound. The S&P 500 had its best month since 2023 and most indexes have now recovered most of their losses for the year. The S&P 500 ended the month up +5.09% and the Nasdaq gained +7.42% (Wall Street Journal). Tariffs, tax legislation (“The Big Beautiful Bill”), and a U.S. credit downgrade were the main topics in May.

President Trump’s tariffs were struck down by the courts only to be reinstated (for now). The tax legislation has been approved by the house and now goes to the Senate for approval. There is a lot of legislation built into this bill – including making the current tax cuts permanent, work requirements for certain Medicaid recipients, and defense and immigration spending, to name a few. The goal is to have this passed by the Fourth of July.

Given the upcoming deadlines in tariff negotiations and tax legislation, we believe June could probably be a volatile month.

A few comments on the economy and pending tax legislation (First Trust 5/19/25):

- Non-defense government spending has increased from less than 15% in 2000 to more than 20% today.

- The M2 money supply (cash and near liquid investments) has tripled since 2007. Does this sound inflationary?

- The U.S. has run annual budget deficits of 6.5% of GDP the past 2 years and is on pace to do it again in 2025 – yes, that’s 2 separate administrations, even with DOGE.

- In the past 20 years, real GDP has grown 2% per year and government spending has soared from $3 trillion to $7 trillion with near 0% interest rates for 9 of the past 17 years.

Global Insight Weekly:

RBC’s views on asset classes, the economy, and timely issues that impact investment strategy.

- Recession Scorecard: Slow going – Three years ago, recession indicators seemed to suggest the U.S. had a long way to run. However, the signals have become decidedly more mixed.

- Treasury market finds relief – We look at what the recent drop in Treasury yields means for the market’s Fed rate cut expectations.

Click Here for the full report.

From the “Personal” File:

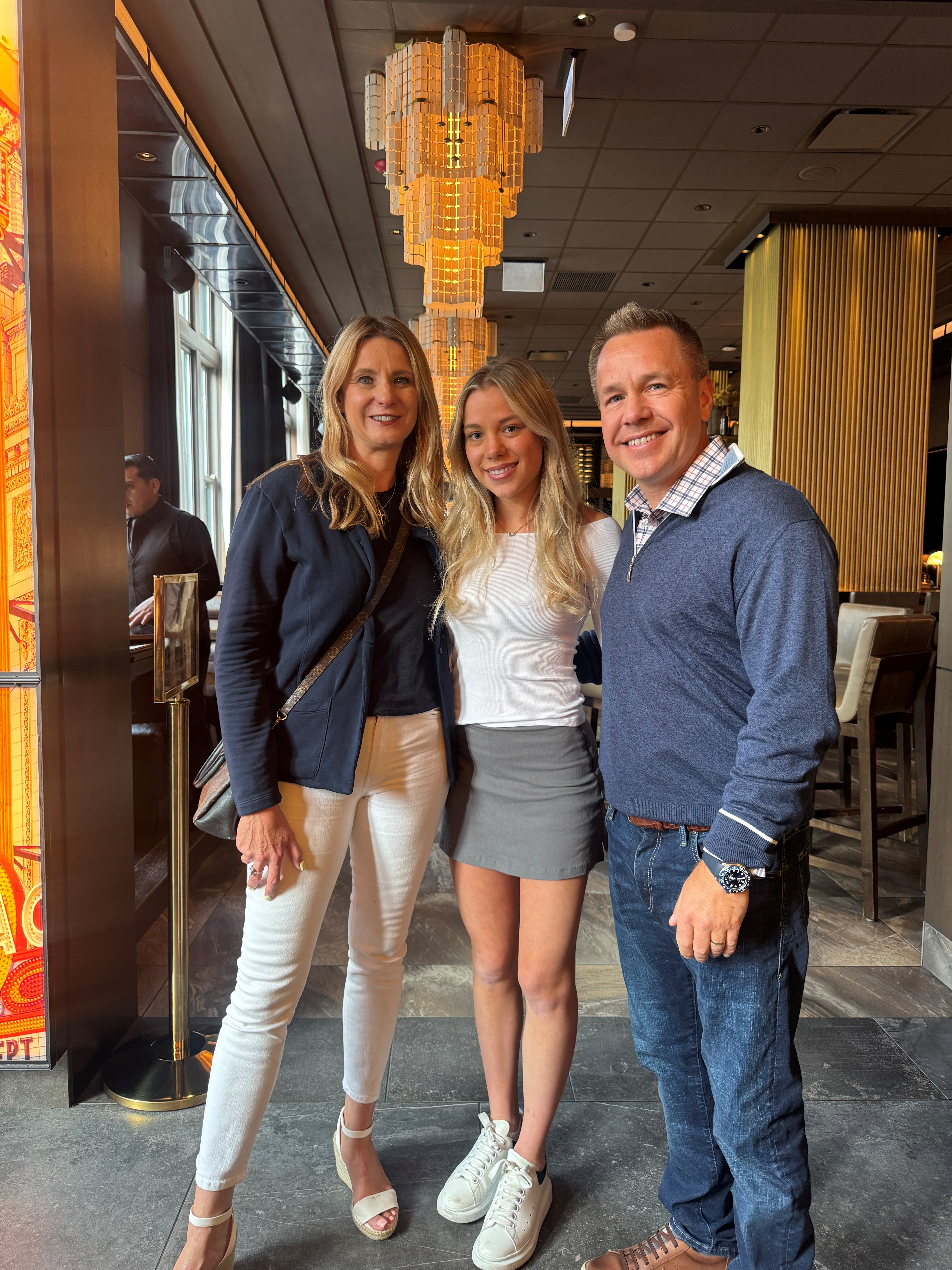

The Montalbano family celebrated the college graduation of their oldest child, Madeline, from the University of Iowa. Coincidentally, Madeline’s graduation was exactly 28 years to-the-day as Matt’s college graduation – also from the University of Iowa. Madeline will begin her career working in Chicago in investment banking.

Virgie and Brandon spent some time visiting Ireland to celebrate their 25th wedding anniversary.