Tactical strategy

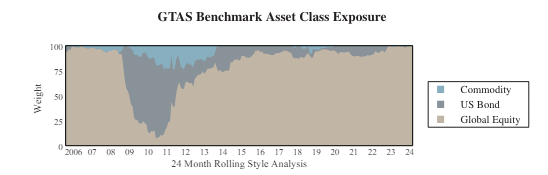

Global tactical allocation strategy, GTAS has operated since 2003. GTAS seeks to provide global exposure through allocation of assets across countries, sectors and asset classes. We tactically reposition according to macroeconomic conditions, market fundamentals, government policy changes and our estimates of potential risk factors. Our tactical portfolio composition changes over time as conditions fluctuate and to reflect its sometimes-varying asset class configurations, GTAS uses a blended benchmark consisting of 70% global equities, 20% US domestic bonds and 10% commodities. Actual holdings will vary relative to that benchmark and may depend on the timing of cash inflows and outflows.

A returns-based style analysis provides an overview of the changing portfolio allocations but may not precisely reflect the portfolio holding at a specific moment.

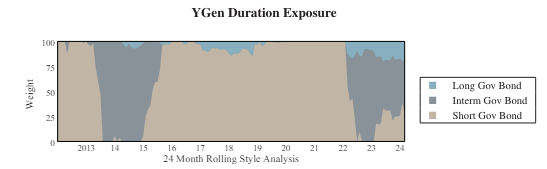

Multi-Asset Income Strategy

Our multi-asset income strategy seeks to provide exposure to a variety of income-generating investments across asset classes. We tactically reposition according to economic conditions and market fundamentals. This strategy seeks to be a diversification complement to a traditional investment grade corporate, or municipal bond portfolio. Its benchmark is an intermediate bond index composite. The strategy aims to create a portfolio with a low correlation to conventional bonds while generating a similar income. In this sense it seeks to create a diversification complement to a bond portfolio and does not replace bonds in an overall allocation.

A returns-based style analysis provides an overview of the changing portfolio allocations, but may not precisely reflect the portfolio holding at a specific moment.

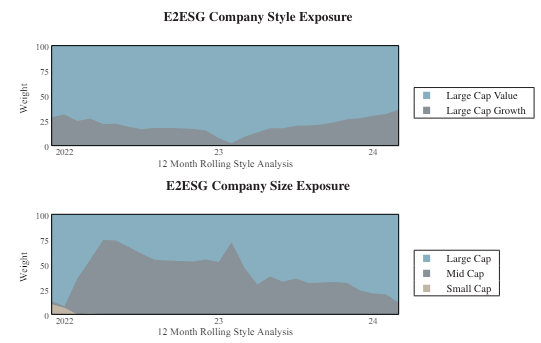

ESG Strategy

Our ESG Strategy, E2ESG, draws from a universe of US large-cap and mid-cap stocks with relatively high MSCI ESG scores. This strategy targets sector and industry weights that are close to the Russell 1000 index, however, E2ESG seeks to provide returns in line with a broad US equity index while investing in companies with superior environmental, social, and governance performance. This strategy is frequently altered to accommodate individual values which we determine through preliminary screening calls.

A returns-based style analysis provides an overview of the changing portfolio allocations but may not precisely reflect the portfolio holding at a specific moment.