Most investors, in our experience, have an intuitive understanding of their individual risk tolerance and a robust filter to ignore news stories that are outside their universe. They have little trouble, for example, skipping over discussions regarding the volatility surface of swaptions or the most recent moves in a double-knockout USD/JPY option combo.

When it comes to investment time horizon, though, we find the situation reversed, with investors overly focused on issues that we think are irrelevant to their portfolio goals when measured over the appropriate time span. Too few investors, in our view, read the financial press with a focus on how their individual investment time horizon differs from that of active institutional traders and the typical reporter.

In it for the long haul

Most investors, in our experience, say they have a long-term perspective. That view, we think, makes sense. Individuals tend to save for major life events such as children’s college tuition or retirement that are frequently years in the future. Many even take an intergenerational approach, looking to provide for grandchildren or more distant heirs.

That mindset is very different from active institutional traders, who we find tend to think in terms of quarterly earnings reports and annual bonus payments. Moreover, most institutional traders cannot really determine their own holding period. They tend to rely significantly on borrowed money—in some cases, positions are funded with as much as 90 percent debt. This forces traders to take a short-term outlook; if they cannot meet the margin call from their lenders, it doesn’t matter if their long-term view was correct—they still end up losing money.

The financial press, unsurprisingly in our view, tends to reflect the short-term perspective of more active traders. Partly because it makes for better copy—an article headlined “Quarterly portfolio rebalance comes off without a hitch” is not likely to draw a lot of clicks. But it also helps with reporters’ need to explain daily market moves; short-term predictions let reporters and the press get a jump on the news cycle.

Ignore the obvious?

This difference in time horizon has significant implications for how investors should approach their consumption of financial data.

Take, for instance, all the discussion about the timing of Fed rate cuts. Rather than getting sucked into a discussion of will they, won’t they, or when they move, we think investors should start by asking if the outcome really matters to them. For many, if not most, individual investors, we think the answer is likely no.

Let’s start with bond prices. If the Fed delayed rate cuts by a year, the impact on 5-year Treasury rates would be approximately 20 basis points, assuming the central bank then implemented the policy path embedded in interest rate futures pricing from the start of March. That’s less than the yield change from Feb. 7 to Feb. 13 of this year. So, all of the analysis, all of the discussion, and all of the forecasting on the Fed boils down to the equivalent of some random week in February. If we didn’t lose sleep over the latter, why is there such an intense focus on the former?

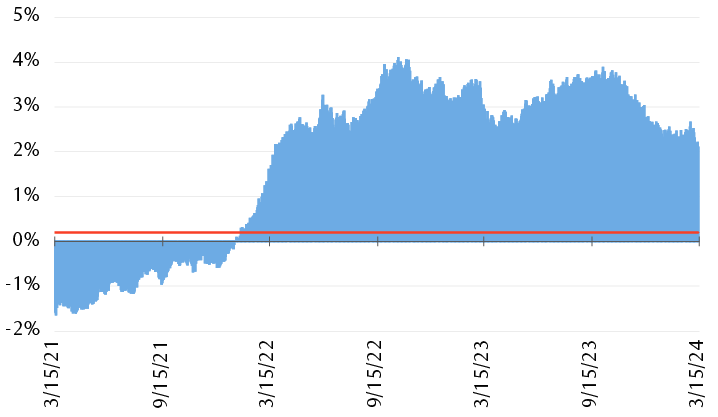

Rate cut timing is barely discernible against longer-term rate shifts

Change in 5-year U.S. Treasury yield

The chart compares the estimated impact on the 5-year U.S. Treasury yield of a one-year deferral of Federal Reserve interest rate cuts with actual two-year yield changes since March 15, 2021. The magnitude of the estimated impact, at 0.2%, is much smaller than the actual yield changes, which range from roughly -1.5% to 4%.

Note: Projected impact is based on fed fund futures-implied rates as of 3/1/24.

Source - RBC Wealth Management, Bloomberg

Equity price moves are also sensitive to interest rates, and Fed policy could have a meaningful impact on where stocks go in the short term. But it’s important to put interest rate policy into context. If rates are staying high, but corporate earnings and economic growth are solid, then we think there is little reason to expect a sustained loss of value to stock prices. In its recent rate hike campaign, the Fed took interests rates up by 5.25 percent, and equity markets are at or near record highs; do we really think a small delay in rate cuts is a meaningful threat over a multiyear time horizon?

We think it’s very clear why short-term traders care about the timing and number of cuts—they’re playing with borrowed money and need to make sure that margin calls don’t push them into forced sales. But for a cash investor—or one with the moderate leverage typical in individual accounts—the likely impacts of May versus June versus September for the first cut are blips in performance that will likely be long forgotten when retirement rolls around.

Best case or worst case?

The informational bias toward short-term results can even turn perceived outcomes from negative to positive. Most regular readers of the financial press, for instance, probably worry about a potential market selloff caused by the Fed’s failure to cut when expected. That may be a bad outcome for a hedge fund, but the economics look very different for a retirement saver.

A selloff means 401k or other routine contributions will buy more assets, so any Fed-induced pullback likely means more money when it matters. Higher interest rates also mean better reinvestment rates on upcoming portfolio cash flows; coupons and dividends will earn more, boosting realized yields. Finally, lower security prices allow investors to optimize their tax profile, swapping losing positions into new securities to delay or even eliminate taxes, subject to IRS restrictions.

The bottom line is that we believe there’s only one account valuation that really matters—the valuation on the day the investment is liquidated. Intermediate readings are potentially important markers, but focusing on those data points is letting the tail wag the dog.

The Fed matters, but so do you

This is not to say that monetary policy is irrelevant or that macroeconomic conditions don’t matter. The ideal blend of equities and fixed income will vary with prospects for a recession, and for investors with shorter time horizons—such as those in retirement or with a high emphasis on money market investments—rate cut timing may be important to their portfolios. Individuals may also have significant exposure to interest rate policy through their employment or personal business.

Our point isn’t that everyone should ignore the Fed. Instead, our view is that the degree and type of attention paid to particular inputs varies with the individual. Just as a moderate risk investor is probably not going to be looking too deeply into exotic option pricing, a long-term investor can likely look past the first rate cut debate.

Not dead yet

John Maynard Keynes famously observed that “in the long run, we’re all dead,” while Burton Malkiel and other economists have told us that short-term asset price moves are random. Knowing where you sit on the spectrum from quantum uncertainty to the inevitable future is a first step toward knowing what to focus on when thinking about markets.